Form W 204

What is the Form W-204

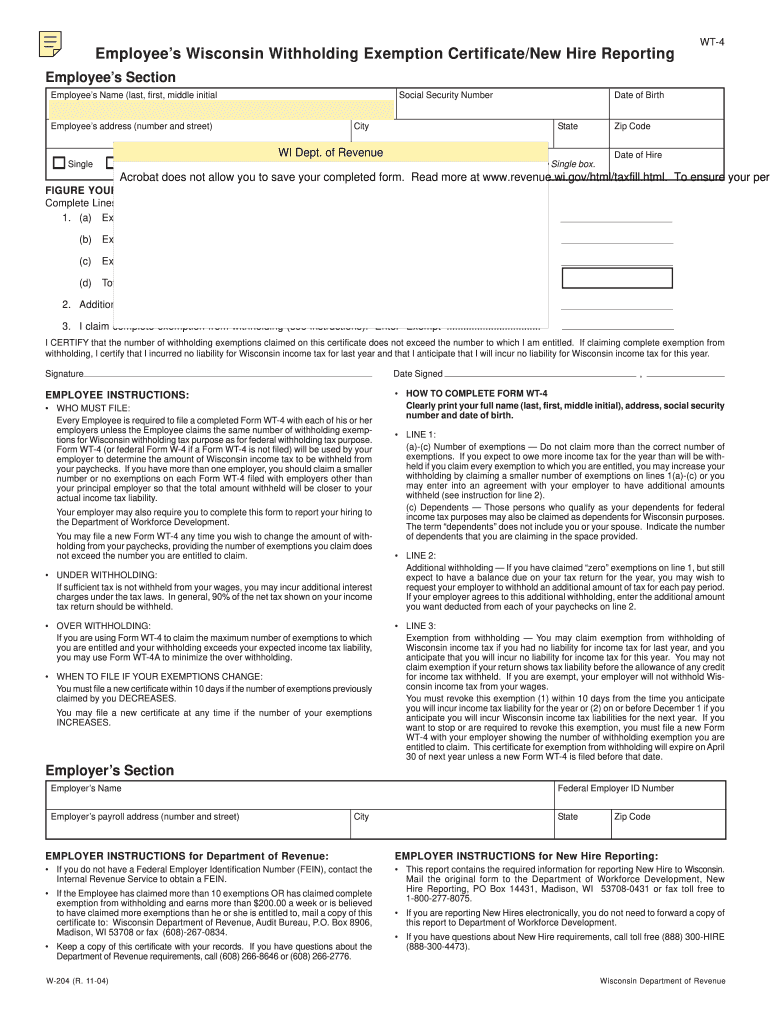

The Form W-204 is a specific tax form used in the United States for reporting certain types of income. It is primarily utilized by businesses and individuals who need to report payments made to independent contractors or other non-employees. This form helps ensure compliance with federal tax regulations and assists in the accurate reporting of income for tax purposes.

How to use the Form W-204

Using the Form W-204 involves several steps to ensure that all necessary information is accurately reported. Start by gathering all relevant details about the payments made to the contractor or non-employee. This includes their name, address, and taxpayer identification number. Once you have this information, fill out the form with the payment amounts and any applicable deductions. After completing the form, it should be submitted to the appropriate tax authority as part of your annual tax filings.

Steps to complete the Form W-204

Completing the Form W-204 requires careful attention to detail. Follow these steps:

- Gather necessary information about the payee, including their legal name and taxpayer identification number.

- Enter the total amount paid to the contractor or non-employee during the tax year.

- Include any required deductions or exemptions that apply to the payments.

- Review the completed form for accuracy to avoid any potential issues with the IRS.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Form W-204

The legal use of the Form W-204 is governed by IRS regulations. It is essential for businesses to ensure that the form is filled out correctly and submitted on time to avoid penalties. The form serves as a record of payments made, which can be crucial in case of audits or disputes regarding income reporting. Compliance with federal tax laws is necessary to maintain the legitimacy of the document.

IRS Guidelines

The IRS provides specific guidelines for the use of the Form W-204. These guidelines outline who must file the form, the information required, and the deadlines for submission. It is important for filers to familiarize themselves with these guidelines to ensure compliance and avoid potential penalties. The IRS website offers detailed instructions and resources for completing the form correctly.

Form Submission Methods

The Form W-204 can be submitted through various methods, allowing flexibility for businesses and individuals. Options include:

- Online submission through the IRS e-filing system, which is often the fastest method.

- Mailing a physical copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, although this option may require an appointment.

Quick guide on how to complete form w 204

Complete Form W 204 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, edit, and eSign your documents quickly and efficiently. Manage Form W 204 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form W 204 without stress

- Find Form W 204 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to submit your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form W 204 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 204

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 204 used for?

Form W 204 is used by businesses to report specific tax information. It’s essential for accurately documenting employee information and ensuring compliance with IRS regulations. Understanding how to fill out Form W 204 properly can help streamline your payroll processes.

-

How does airSlate SignNow help with Form W 204?

airSlate SignNow enables businesses to electronically sign and send Form W 204 quickly and securely. The platform ensures that all signatures are legally binding, making compliance with tax regulations seamless. Using airSlate SignNow simplifies the process of managing Form W 204 documentation.

-

Is there a cost associated with using airSlate SignNow for Form W 204?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including eSigning Form W 204. The plans are designed to be cost-effective, providing tools that enhance productivity. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for processing Form W 204?

Absolutely! airSlate SignNow offers integrations with various software applications that can enhance your workflow when handling Form W 204. This includes popular CRMs and document management systems, ensuring that you can manage your documentation efficiently.

-

What are the key features of airSlate SignNow for managing Form W 204?

Key features of airSlate SignNow include easy document upload, customizable templates, and mobile signing capabilities, all of which enhance the management of Form W 204. Additionally, the platform provides audit trails and storage solutions to ensure secure handling of your documents.

-

How secure is airSlate SignNow when handling Form W 204?

airSlate SignNow employs advanced security protocols, including encryption and secure cloud storage, to protect your Form W 204 documents. This ensures that your sensitive information is handled safely and complies with privacy regulations. You can confidently use airSlate SignNow for all your eSigning needs.

-

What are the benefits of using airSlate SignNow over traditional methods for Form W 204?

Using airSlate SignNow to manage your Form W 204 offers numerous benefits over traditional paper-based methods. It enhances efficiency by reducing the time spent on paperwork and allows for quick turnaround times. Moreover, eSigning improves accuracy and helps eliminate the risks associated with lost or misplaced documents.

Get more for Form W 204

Find out other Form W 204

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template