Form 8863 Instructions

What is the Form 8863 Instructions

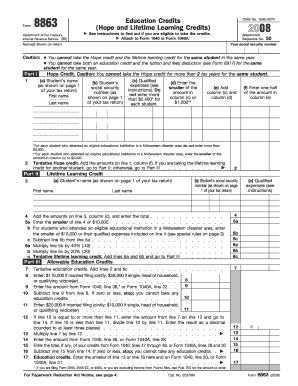

The Form 8863 instructions provide detailed guidance for taxpayers claiming education credits on their federal tax returns. This form is specifically used to claim the American Opportunity Credit and the Lifetime Learning Credit, which help offset the costs of higher education. Understanding the instructions is crucial for ensuring accurate completion and maximizing potential tax benefits. The form outlines eligibility requirements, necessary documentation, and the process for claiming these credits effectively.

Steps to complete the Form 8863 Instructions

Completing the Form 8863 requires several key steps to ensure accuracy and compliance with IRS regulations. Start by gathering all relevant information about your educational expenses, including tuition and fees paid during the tax year. Next, follow these steps:

- Fill out your personal information, including your name, Social Security number, and filing status.

- Indicate the educational institution's name and address, along with the student's information if different from the taxpayer.

- Calculate the amount of qualified expenses and enter them in the appropriate sections of the form.

- Determine the credits you are eligible for based on the provided guidelines and fill in the corresponding amounts.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 8863 Instructions

The legal use of the Form 8863 instructions is essential for ensuring compliance with IRS regulations when claiming education credits. Taxpayers must adhere to the guidelines set forth in the instructions to validate their claims. This includes providing accurate information about qualified educational expenses and ensuring that the educational institution meets IRS criteria. Misrepresentation or errors can lead to penalties, so it is important to follow the instructions closely and maintain proper documentation.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8863 are aligned with the overall tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can grant additional time to file. It is important to submit the Form 8863 by the deadline to ensure eligibility for the education credits in question.

Required Documents

To complete the Form 8863 accurately, several documents are required. These include:

- Form 1098-T from the educational institution, which reports tuition payments.

- Receipts or records of other qualified expenses, such as books and supplies.

- Personal identification information, including Social Security numbers for all students claimed.

Having these documents ready will facilitate a smoother filing process and help ensure that all information reported is accurate.

Eligibility Criteria

Eligibility for the education credits claimed on Form 8863 is based on several factors. To qualify for the American Opportunity Credit, the student must be enrolled at least half-time in a degree or certificate program and must not have completed four years of post-secondary education. For the Lifetime Learning Credit, the student can be enrolled in any course of higher education, but the credit is limited to qualified expenses incurred for one student per tax year. Income limitations also apply, which can affect the amount of credit available.

Quick guide on how to complete form 8863 instructions

Effortlessly Prepare Form 8863 Instructions on Any Device

Digital document management has become increasingly favored by enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the resources required to generate, modify, and eSign your documents swiftly without any holdups. Manage Form 8863 Instructions on any gadget using the airSlate SignNow Android or iOS applications and simplify your document-based tasks today.

The Easiest Way to Alter and eSign Form 8863 Instructions with Minimal Effort

- Locate Form 8863 Instructions and then click Get Form to begin.

- Utilize the features we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, be it through email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 8863 Instructions to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8863 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 8863 instructions 2022?

The form 8863 instructions 2022 provide guidance on how to claim education credits for eligible students. Understanding these instructions is crucial for maximizing your tax benefits. Using airSlate SignNow can simplify the process of completing and submitting this form.

-

How can airSlate SignNow assist with form 8863 instructions 2022?

airSlate SignNow offers an easy-to-use platform that allows you to electronically sign and send documents related to form 8863 instructions 2022. This streamlines the process, ensuring that your forms are filed accurately and on time. Additionally, our platform provides templates to help you get started easily.

-

Are there any costs associated with using airSlate SignNow for form 8863 instructions 2022?

airSlate SignNow provides several pricing plans to cater to different budgets, making it a cost-effective solution for managing form 8863 instructions 2022. You can start with a free trial to explore the features before committing to a paid plan. This flexibility ensures you only pay for what you need.

-

What features does airSlate SignNow offer for managing form 8863 instructions 2022?

airSlate SignNow offers features such as document templates, customizable workflows, and secure electronic signatures to facilitate the management of form 8863 instructions 2022. These features help you save time and reduce errors. Additionally, the platform is user-friendly, ensuring that anyone can navigate it with ease.

-

How can I ensure my form 8863 instructions 2022 are secure with airSlate SignNow?

Security is a top priority at airSlate SignNow. When working with form 8863 instructions 2022, your documents are protected with advanced encryption and secure storage. Our platform complies with industry standards to ensure your sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other tools for form 8863 instructions 2022?

Yes, airSlate SignNow offers seamless integrations with various productivity tools that can enhance your workflow for form 8863 instructions 2022. Whether you're using CRM systems, cloud storage, or accounting software, these integrations help streamline document management and improve efficiency.

-

What are the benefits of using airSlate SignNow for form 8863 instructions 2022?

Using airSlate SignNow for form 8863 instructions 2022 helps you save time and reduce stress associated with filing taxes. Our platform simplifies the process of completing forms and obtaining necessary signatures, ensuring compliance and accuracy. Furthermore, it empowers your team to collaborate effectively on document preparation.

Get more for Form 8863 Instructions

- Florida application for registration foreign florida llc form

- Georgia withdrawal form

- Gwinnett county sign permit form

- Mailing address individualfiduciary income tax form

- Form trademark application state of hawaii

- Ag balance sheet your county bank form

- State of illinois invention developer bond to the people of the state form

- Statement of reissuable get form

Find out other Form 8863 Instructions

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation