Valic Rmd Form

What is the Valic Rmd Form

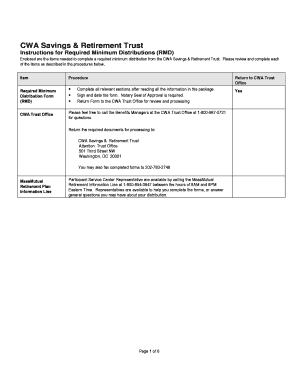

The Valic RMD form, specifically designed for required minimum distributions, is essential for individuals with retirement accounts, such as 403(b) plans. This form ensures compliance with IRS regulations that mandate minimum withdrawals from retirement accounts starting at age seventy-two. Completing the Valic RMD form accurately is crucial to avoid potential tax penalties associated with non-compliance.

How to use the Valic Rmd Form

Using the Valic RMD form involves several straightforward steps. First, gather necessary information, including account details and personal identification. Next, fill out the form with required information, ensuring accuracy to prevent delays. Once completed, submit the form according to the specified submission methods. This process can be streamlined using digital tools to ensure secure and efficient handling of the document.

Steps to complete the Valic Rmd Form

Completing the Valic RMD form requires careful attention to detail. Follow these steps:

- Gather personal information, including Social Security number and account details.

- Indicate the amount to withdraw, ensuring it meets the IRS minimum requirement.

- Provide any additional information requested on the form.

- Review the form for accuracy before submission.

- Choose your preferred method of receiving the distribution, such as direct deposit or check.

Legal use of the Valic Rmd Form

The legal validity of the Valic RMD form is reinforced by compliance with federal regulations. When filled out correctly and submitted through authorized channels, the form serves as a legally binding document. It is important to ensure that all signatures are obtained as required, and that the form is submitted within the designated time frame to avoid penalties.

Required Documents

To complete the Valic RMD form, certain documents are necessary. These typically include:

- Proof of identity, such as a government-issued ID.

- Account statements from your Valic retirement account.

- Any previous tax documents that may be relevant to your distribution.

Form Submission Methods

The Valic RMD form can be submitted through various methods to ensure convenience and compliance. Options include:

- Online submission via secure digital platforms.

- Mailing the completed form to the designated Valic address.

- In-person submission at a local Valic office, if available.

IRS Guidelines

IRS guidelines dictate the requirements for required minimum distributions, including the timing and amount. According to IRS regulations, individuals must begin taking distributions by April first of the year following the year they turn seventy-two. Adhering to these guidelines is essential to avoid significant tax penalties, which can be as high as fifty percent of the required distribution amount.

Quick guide on how to complete valic rmd form

Effortlessly complete Valic Rmd Form on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents rapidly without delays. Manage Valic Rmd Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Valic Rmd Form with ease

- Locate Valic Rmd Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to deliver your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about missing or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Valic Rmd Form to ensure clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the valic rmd form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Valic RMD form and why do I need it?

The Valic RMD form is a required document for distributing your retirement savings once you signNow a certain age. It's essential to complete this form to ensure compliance with IRS regulations and to avoid signNow tax penalties. airSlate SignNow makes it easy to fill out and eSign the Valic RMD form securely.

-

How can I complete the Valic RMD form using airSlate SignNow?

To complete the Valic RMD form using airSlate SignNow, simply upload your document, fill in the required fields, and then eSign it digitally. The platform provides a user-friendly interface that simplifies the process, ensuring you complete the Valic RMD form quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for the Valic RMD form?

airSlate SignNow offers competitive pricing plans, including options for individual users and businesses. While there may be a fee associated with accessing premium features, basic functionality for completing the Valic RMD form is often included in the subscription plans. For specific pricing details, you can visit our website or contact our sales team.

-

What features does airSlate SignNow offer for managing the Valic RMD form?

airSlate SignNow provides features like customizable templates, advanced data encryption, and audit trails, which can enhance the process of managing the Valic RMD form. These tools help ensure that your documents are secure while streamlining the eSigning process to save you time and effort.

-

Can I integrate airSlate SignNow with other software for the Valic RMD form?

Yes, airSlate SignNow supports integrations with various platforms such as Google Drive, Salesforce, and Dropbox. These integrations can be particularly beneficial for managing documents like the Valic RMD form, allowing for seamless workflows and easier document retrieval.

-

What are the benefits of using airSlate SignNow for the Valic RMD form?

Using airSlate SignNow for the Valic RMD form offers several benefits, including increased efficiency, reduced paperwork, and enhanced compliance with regulatory standards. The ability to eSign documents from anywhere also adds convenience, making the process hassle-free for users who are often on the go.

-

How do I get support for issues related to the Valic RMD form?

AirSlate SignNow provides comprehensive customer support to assist users with any issues related to the Valic RMD form. You can access help through our extensive FAQ section, live chat, or by signNowing out to our support team via email. We are dedicated to ensuring your experience is smooth and successful.

Get more for Valic Rmd Form

- Mohammad hossain marksheet dhs 3243 form

- Clinical editing appeal form

- Bcbsm anesthesia assistant combined signature pdf form

- Blue cross medicare supplement plans a c f high deductible f g and n application form

- Changes for medicare supplement plans c and f blue form

- A z guide traverse city pit spitters traverse city pit spitters form

- Patient registration form rxhope

- Minnesota submission form

Find out other Valic Rmd Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement