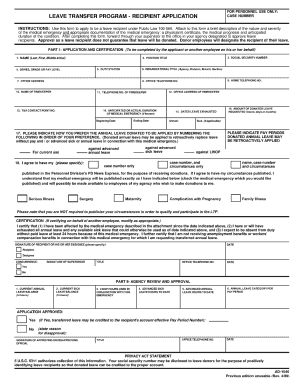

1046 Form

What is the 1046 Form

The IRS Form 1046 T is a tax document used primarily for reporting certain types of income and transactions. This form is essential for taxpayers who need to disclose specific financial information to the Internal Revenue Service. Understanding the purpose of the 1046 T form is crucial for maintaining compliance with federal tax regulations. It serves as a means for the IRS to gather necessary data about taxpayers’ financial activities, ensuring that all income is accurately reported and taxed.

How to use the 1046 Form

Using the IRS Form 1046 T involves several key steps to ensure accurate submission. First, gather all necessary financial documents, including income statements and transaction records. Next, fill out the form with precise information, ensuring that all entries reflect your financial activities accurately. It is important to double-check your entries to avoid errors that could lead to penalties. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the requirements set by the IRS.

Steps to complete the 1046 Form

Completing the IRS Form 1046 T requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant documents, such as W-2s, 1099s, and other income statements.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Provide details regarding your income and any applicable deductions.

- Review the form for accuracy, ensuring all information is complete and correct.

- Submit the form electronically through a secure platform or mail it to the designated IRS address.

Legal use of the 1046 Form

The IRS Form 1046 T is legally binding when filled out correctly and submitted in accordance with IRS guidelines. To ensure its legal validity, it is essential to comply with all eSignature laws and regulations. Utilizing a reliable electronic signature platform can enhance the security and authenticity of your submission. The form must be signed and dated appropriately, as failure to do so may result in delays or rejections by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1046 T are critical to avoid penalties. Generally, the form must be submitted by April 15 of the tax year following the income reporting period. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of any changes to tax deadlines announced by the IRS to ensure timely filing.

Required Documents

To complete the IRS Form 1046 T accurately, certain documents are required. These may include:

- W-2 forms from employers.

- 1099 forms for various types of income.

- Records of any additional income sources, such as freelance work or investments.

- Documentation for deductions or credits you plan to claim.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS regulations.

Quick guide on how to complete 1046 form

Effortlessly Prepare 1046 Form on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and store it securely online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and efficiently. Manage 1046 Form on any platform using airSlate SignNow's Android or iOS applications and simplify your document processes today.

How to Modify and Electronically Sign 1046 Form with Ease

- Locate 1046 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using the features specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information thoroughly and click on the Done button to save your alterations.

- Select how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign 1046 Form to ensure excellent communication at every phase of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1046 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 1046 T and how is it used?

IRS Form 1046 T is a tax form used by businesses and individuals to report certain types of transactions to the Internal Revenue Service. It is primarily utilized for tax compliance regarding electronic transactions. Understanding how to properly fill out and file IRS Form 1046 T is crucial for avoiding penalties and ensuring accurate reporting.

-

How can airSlate SignNow assist with signing IRS Form 1046 T?

With airSlate SignNow, you can easily upload, sign, and send IRS Form 1046 T digitally. Our platform streamlines the eSigning process, ensuring that your documents are signed securely and efficiently. This makes it easy for you to comply with tax regulations without the hassle of traditional paperwork.

-

What are the pricing options available for airSlate SignNow?

AirSlate SignNow offers a variety of pricing plans to accommodate businesses of all sizes. Each plan includes features that facilitate the signing of forms such as IRS form 1046 T, ensuring you have the tools you need within your budget. For detailed pricing, you can visit our website or contact our sales team.

-

Is airSlate SignNow suitable for filling out IRS Form 1046 T?

Yes, airSlate SignNow is well-suited for assisting in the completion and signing of IRS Form 1046 T. Our software provides templates and easy-to-use tools that guide you through the process, minimizing errors and expediting your filing. It ensures that you can focus on your business while managing vital tax documents.

-

What integrations does airSlate SignNow offer to help with IRS Form 1046 T?

AirSlate SignNow seamlessly integrates with various popular applications, allowing you to manage IRS Form 1046 T and other essential documents alongside your existing tools. With integrations for CRM, cloud storage, and productivity software, you can streamline your workflow and enhance efficiency. This helps to simplify documentation management across your organization.

-

How does airSlate SignNow enhance security for IRS Form 1046 T?

AirSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your sensitive IRS Form 1046 T data. Our platform ensures that only authorized individuals can access and sign your documents, providing peace of mind. We are compliant with stringent security standards to safeguard your information.

-

Can I store IRS Form 1046 T digitally with airSlate SignNow?

Yes, airSlate SignNow allows you to store IRS Form 1046 T and other important documents securely in the cloud. This digital storage solution simplifies access and retrieval, ensuring you can easily manage your tax forms whenever needed. You will also benefit from organized and searchable document storage.

Get more for 1046 Form

Find out other 1046 Form

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement