Usda Income Calculation Worksheet Form

What is the USDA Income Calculation Worksheet

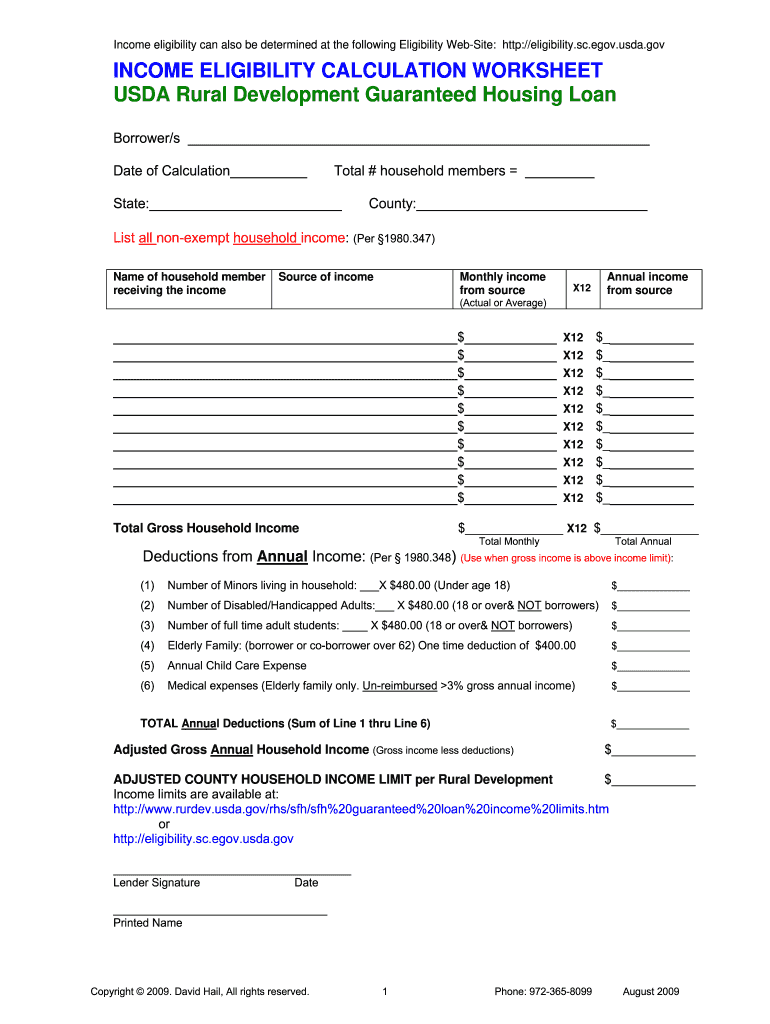

The USDA Income Calculation Worksheet is a crucial tool used to determine eligibility for various USDA rural development programs. This form helps assess the income of applicants to ensure they meet the necessary financial criteria for assistance. It includes sections for reporting various income sources, such as wages, self-employment earnings, and benefits. By accurately completing this worksheet, applicants can facilitate the review process for loans or grants aimed at supporting rural development initiatives.

How to Use the USDA Income Calculation Worksheet

Using the USDA Income Calculation Worksheet involves several steps to ensure accurate reporting of income. Begin by gathering all necessary documentation, including pay stubs, tax returns, and any other relevant financial records. Next, fill out the worksheet by entering your income details in the designated sections. Be sure to include all sources of income, as this will affect your eligibility. Once completed, review the worksheet for accuracy before submitting it as part of your application for USDA assistance.

Steps to Complete the USDA Income Calculation Worksheet

Completing the USDA Income Calculation Worksheet requires attention to detail. Start by entering your personal information at the top of the form. Then, follow these steps:

- List all household members and their respective income sources.

- Calculate gross income by adding all sources of income, including wages, benefits, and other earnings.

- Account for any deductions or adjustments as specified in the instructions.

- Double-check all calculations to ensure accuracy.

- Sign and date the worksheet to certify the information provided.

Key Elements of the USDA Income Calculation Worksheet

The USDA Income Calculation Worksheet consists of several key elements that are essential for determining eligibility. These include:

- Personal Information: Basic details about the applicant and household members.

- Income Sources: Sections to report various types of income, such as wages, self-employment, and government benefits.

- Deductions: Areas to note any applicable deductions that may lower the total income.

- Certification: A signature block confirming the accuracy of the information provided.

Eligibility Criteria

Eligibility for USDA programs based on the Income Calculation Worksheet is determined by specific criteria. Generally, applicants must meet income limits set by the USDA, which vary by location and household size. Additionally, applicants must demonstrate a need for assistance, which is evaluated through the information provided in the worksheet. Understanding these criteria is vital for ensuring that your application is successful.

Legal Use of the USDA Income Calculation Worksheet

The USDA Income Calculation Worksheet is legally binding when completed accurately and submitted as part of an application for USDA assistance. It is essential to provide truthful and complete information, as any discrepancies can lead to penalties or denial of assistance. The worksheet must be signed by the applicant, affirming that the information is correct to the best of their knowledge, thereby ensuring compliance with USDA regulations.

Quick guide on how to complete usda income calculation worksheet

Effortlessly Prepare Usda Income Calculation Worksheet on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly, without delays. Handle Usda Income Calculation Worksheet on any platform through the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

Effortlessly Modify and Electronically Sign Usda Income Calculation Worksheet

- Find Usda Income Calculation Worksheet and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or conceal sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional ink signature.

- Review the details carefully and then select the Done button to save your modifications.

- Decide how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Usda Income Calculation Worksheet to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the usda income calculation worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a USDA income calculation worksheet?

A USDA income calculation worksheet is a tool used to determine household income for eligibility in USDA loan programs. It outlines various income sources and helps ensure that borrowers meet the necessary income criteria. Using this worksheet is essential for calculating the right income figures for USDA loan applications.

-

How do I use the USDA income calculation worksheet with airSlate SignNow?

With airSlate SignNow, you can easily utilize the USDA income calculation worksheet by integrating it directly into your document workflow. Simply upload your worksheet, add the necessary fields, and share it with your clients for e-signature. This process streamlines your USDA loan documentation and improves efficiency.

-

Is the USDA income calculation worksheet included in airSlate SignNow's features?

Yes, the USDA income calculation worksheet is a part of airSlate SignNow's comprehensive digital document management solutions. Our platform allows you to create, customize, and share this worksheet effortlessly with your clients. This feature enhances your productivity and ensures you stay organized.

-

What are the benefits of using airSlate SignNow for the USDA income calculation worksheet?

Using airSlate SignNow for the USDA income calculation worksheet offers several benefits, including improved accuracy and faster completion times. Our solution automates the signing process, reduces paperwork, and enhances collaboration. You can focus more on client relations while we take care of the documentation.

-

Can airSlate SignNow integrate with other software for USDA income calculation worksheet management?

Yes, airSlate SignNow offers seamless integrations with various software platforms to enhance your USDA income calculation worksheet management. Our eSignature tool can connect with CRM and document management systems, allowing for a cohesive workflow. This integration simplifies the process and reduces the risk of errors.

-

What is the pricing structure for using airSlate SignNow with the USDA income calculation worksheet?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for using the USDA income calculation worksheet. Plans typically include a range of features suited for individuals and teams, allowing you to choose what fits your requirements best. Visit our pricing page for the most accurate information.

-

Is technical support available for using the USDA income calculation worksheet with airSlate SignNow?

Absolutely! airSlate SignNow provides dedicated technical support for users utilizing the USDA income calculation worksheet. Our support team is available to assist you with any questions or issues that may arise during the use of our platform, ensuring a smooth and efficient process.

Get more for Usda Income Calculation Worksheet

- Master short form complaint northern district of florida

- Florida short form individual acknowledgment fs 695

- In re 3m combat arms earplug products liability form

- Prea audit pre audit questionnaire juvenile facilities florida form

- Hancock acknowledgement for georgia instruments signed in california form

- Hc 001 petition for writ of habeas corpus form

- San diego county marriage license form

- Request for dismissal small claims form

Find out other Usda Income Calculation Worksheet

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document