Year 1040x Form

What is the Year 1040x Form

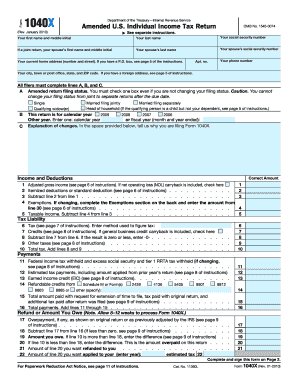

The Year 1040x Form is an amended tax return form used by individuals in the United States to correct errors or make changes to their previously filed Form 1040. This form allows taxpayers to adjust their income, deductions, or credits, ensuring that their tax liability is accurately reported. It is essential for individuals who discover discrepancies after filing their original return, whether due to mathematical errors, overlooked deductions, or changes in tax law that affect their situation.

How to use the Year 1040x Form

Using the Year 1040x Form involves several key steps. First, gather all necessary documentation, including your original tax return and any relevant financial records. Next, complete the form by providing accurate information regarding the changes you wish to make. Be sure to clearly explain the reasons for the amendments in the designated section. After completing the form, review it thoroughly for accuracy before submitting it to the IRS. If you are amending multiple years, a separate 1040x must be filed for each tax year.

Steps to complete the Year 1040x Form

Completing the Year 1040x Form involves a systematic approach:

- Start by obtaining the correct version of the form for the tax year you are amending.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending at the top of the form.

- In Part I, provide the original amounts from your filed Form 1040.

- In Part II, enter the corrected amounts and explain the changes in Part III.

- Sign and date the form before submitting it to the IRS.

Legal use of the Year 1040x Form

The Year 1040x Form is legally recognized as a valid method for correcting tax returns in the United States. To ensure its legal standing, it must be completed accurately and submitted within the designated time frame. The IRS allows taxpayers to amend returns for up to three years from the original filing date or within two years of paying the tax owed, whichever is later. Proper use of the form helps maintain compliance with tax regulations and can prevent potential penalties.

Filing Deadlines / Important Dates

When filing the Year 1040x Form, it is crucial to be aware of the deadlines. Taxpayers have up to three years from the original filing date to submit an amendment. If you are claiming a refund, ensure that you file the form within this time frame to receive any potential overpayment. Additionally, if you owe taxes as a result of the amendment, it is advisable to pay any owed amounts as soon as possible to avoid interest and penalties.

Examples of using the Year 1040x Form

There are various scenarios where the Year 1040x Form may be necessary. For example, if a taxpayer initially filed their return without claiming a significant deduction, such as student loan interest, they can use the 1040x to amend their return and potentially receive a refund. Another instance might involve correcting income reported from a W-2 or 1099 form that was inaccurately reported. Each of these situations illustrates the importance of the 1040x in ensuring accurate tax reporting.

Quick guide on how to complete year 1040x form

Effortlessly Prepare Year 1040x Form on Any Device

Managing documents online has gained immense popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Handle Year 1040x Form on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

How to Edit and Electronically Sign Year 1040x Form with Ease

- Obtain Year 1040x Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or mask sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Year 1040x Form to ensure excellent communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the year 1040x form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Year 1040x Form and who needs it?

The Year 1040x Form is a tax form used by individuals in the United States to amend their previously filed tax returns. If you've made an error on your original Form 1040, or if you need to make changes regarding your filing status or income, the Year 1040x Form is essential for correcting those inaccuracies.

-

How can airSlate SignNow help with the Year 1040x Form?

airSlate SignNow simplifies the process of preparing and signing the Year 1040x Form by providing a user-friendly platform for eSigning documents. With our solution, you can easily send, sign, and store your amended tax forms securely, ensuring compliance and ease of access.

-

Is there a cost associated with using airSlate SignNow for the Year 1040x Form?

Yes, airSlate SignNow offers a cost-effective solution for businesses and individuals who need to eSign documents, including the Year 1040x Form. Our pricing plans are designed to accommodate various user needs, ensuring that everyone can access our services at a reasonable cost.

-

What features does airSlate SignNow provide for handling the Year 1040x Form?

airSlate SignNow offers numerous features to assist with the Year 1040x Form, including customizable templates, advanced security measures, and a seamless signing experience. Users can track the status of their forms and receive notifications, ensuring a smooth process from start to finish.

-

Can I integrate airSlate SignNow with other software for the Year 1040x Form?

Yes, airSlate SignNow provides integrations with popular software solutions such as CRM systems, document management platforms, and email applications. This allows for streamlined workflows when dealing with the Year 1040x Form and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for the Year 1040x Form?

Using airSlate SignNow for the Year 1040x Form offers numerous benefits, including increased efficiency, reduced document turnaround time, and improved security for sensitive tax information. The platform is designed to help you complete your amendments with ease and confidence.

-

How secure is airSlate SignNow when dealing with the Year 1040x Form?

airSlate SignNow takes data security seriously. When handling the Year 1040x Form, all documents are encrypted and stored in a secure environment to protect your personal and financial information. We comply with industry standards to ensure your data remains safe.

Get more for Year 1040x Form

- Free north dakota name change forms how to change your

- Chapter 301 08 wills eforms

- Free new mexico name change forms how to change

- New mexico uniform owner resident relations act rld

- Change of name adult second judicial district court nm form

- 1 judicial district court form

- Section 47 8 33 breach of agreement by resident and justia law form

- Nomination for appointment of attorneys ucs 74l nycourts form

Find out other Year 1040x Form

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement