Mw5 Form Mn

What is the Mw5 Form Mn

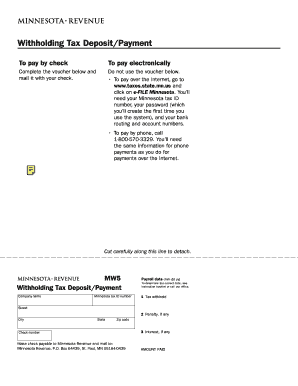

The Mw5 form, also known as the Mw5 payment voucher, is a document used primarily in Minnesota for various payment-related purposes. It serves as a means for individuals and businesses to submit payments for taxes, fees, or other financial obligations to the state. The form is designed to streamline the payment process, ensuring that all necessary information is collected efficiently. Understanding the Mw5 form is essential for anyone looking to fulfill their financial responsibilities in Minnesota.

How to use the Mw5 Form Mn

Using the Mw5 form involves a few straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from the Minnesota Department of Revenue website or other official sources. Next, fill out the form with accurate information, including your name, address, and the amount being paid. After completing the form, review it for any errors before submission. The Mw5 form can be submitted electronically or via mail, depending on your preference and the requirements set by the state.

Steps to complete the Mw5 Form Mn

Completing the Mw5 form requires careful attention to detail. Follow these steps to ensure accuracy:

- Obtain the latest version of the Mw5 form.

- Fill in your personal information, including your name and address.

- Indicate the payment amount and the purpose of the payment.

- Double-check all entries for accuracy.

- Sign and date the form, if required.

- Submit the form either online or by mailing it to the appropriate state department.

Legal use of the Mw5 Form Mn

The Mw5 form is legally recognized in Minnesota, provided it is completed and submitted according to state regulations. It is crucial to ensure that all information is accurate and that the form is submitted by any applicable deadlines to avoid penalties. The legal validity of the Mw5 form is reinforced by compliance with state laws governing financial transactions and record-keeping.

Key elements of the Mw5 Form Mn

Several key elements must be included in the Mw5 form to ensure it is processed correctly. These include:

- Your full name and contact information.

- The specific payment amount.

- The purpose of the payment, clearly indicated.

- Your signature, if required.

- The date of submission.

Including these elements helps facilitate a smooth transaction and ensures that your payment is accurately recorded by the state.

Form Submission Methods

The Mw5 form can be submitted through various methods, depending on your preference and the guidelines set by the Minnesota Department of Revenue. Options typically include:

- Online submission through the official state website.

- Mailing the completed form to the designated address.

- In-person submission at local revenue offices.

Choosing the right submission method can enhance efficiency and ensure timely processing of your payment.

Quick guide on how to complete mw5 form mn

Complete Mw5 Form Mn effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Mw5 Form Mn on any platform with airSlate SignNow Android or iOS applications and streamline any document-based tasks today.

The simplest way to edit and electronically sign Mw5 Form Mn with ease

- Locate Mw5 Form Mn and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant portions of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Mw5 Form Mn and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw5 form mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mw5 form mn and how can I use it?

The mw5 form mn is a regulatory document used in Minnesota for specific business processes. Using airSlate SignNow, you can easily fill out and eSign the mw5 form mn electronically, streamlining your workflow. Our platform’s user-friendly interface ensures that completing the mw5 form mn is quick and efficient.

-

Is there a cost associated with using the mw5 form mn on airSlate SignNow?

Using airSlate SignNow to manage the mw5 form mn is very cost-effective. We offer flexible pricing plans that can accommodate businesses of all sizes, allowing you to choose a package that best suits your needs. Plus, with our subscription, you can enjoy unlimited access to eSigning and document management features, including the mw5 form mn.

-

What features does airSlate SignNow offer for the mw5 form mn?

airSlate SignNow offers a suite of features perfect for managing the mw5 form mn, including real-time collaboration, templates, and secure cloud storage. You can easily track the status of your mw5 form mn, ensuring that all parties are updated on the progress. This efficiency makes handling documents faster and more reliable.

-

How can airSlate SignNow benefit my business in processing the mw5 form mn?

By using airSlate SignNow for the mw5 form mn, your business can signNowly reduce paperwork and improve turnaround times for essential documents. Our solution enhances collaboration, making it easier for team members to work together on the mw5 form mn. Additionally, you can maintain compliance with legal requirements while enjoying a seamless eSigning process.

-

Can I integrate airSlate SignNow with other applications for the mw5 form mn?

Yes, airSlate SignNow provides integration capabilities with various applications that can help streamline the processing of the mw5 form mn. You can connect it with CRM systems, document management tools, and more to create a seamless workflow. This functionality allows you to manage the mw5 form mn efficiently alongside your existing systems.

-

Is it safe to eSign the mw5 form mn using airSlate SignNow?

Absolutely! airSlate SignNow uses advanced security measures, including encryption and multi-factor authentication, to ensure that your eSignatures on the mw5 form mn are secure. We take data privacy seriously, providing peace of mind while managing sensitive documents. Your information remains protected at all times.

-

What support does airSlate SignNow offer for users of the mw5 form mn?

Our dedicated customer support team is here to assist you with any questions related to the mw5 form mn and our platform. Whether you need help getting started or navigating features, we're available to provide guidance. You can signNow our support team via chat, email, or phone for prompt assistance.

Get more for Mw5 Form Mn

Find out other Mw5 Form Mn

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer