Extended Declaration for Non Individual Entities Hdfc Form

What is the Extended Declaration for Non Individual Entities HDFC

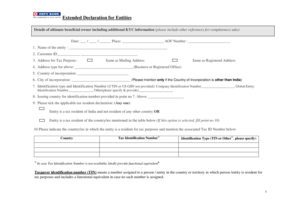

The Extended Declaration for Non Individual Entities HDFC is a specific form required by HDFC Bank for entities that do not qualify as individual taxpayers. This form is part of the compliance with the Foreign Account Tax Compliance Act (FATCA), which mandates financial institutions to report information about financial accounts held by foreign entities. The declaration ensures that the bank collects accurate information regarding the entity's tax status and compliance with U.S. tax laws.

How to Use the Extended Declaration for Non Individual Entities HDFC

To use the Extended Declaration for Non Individual Entities HDFC, entities must fill out the form accurately, providing all required information. This includes details about the entity's structure, tax identification number, and other relevant financial information. Once completed, the form can be submitted to HDFC Bank through designated submission methods, ensuring that all provided information is current and correct to avoid compliance issues.

Steps to Complete the Extended Declaration for Non Individual Entities HDFC

Completing the Extended Declaration for Non Individual Entities HDFC involves several key steps:

- Gather necessary documents, including the entity's tax identification number and financial statements.

- Fill out the form with accurate information regarding the entity's status and compliance.

- Review the completed form for any errors or omissions.

- Submit the form to HDFC Bank through the preferred submission method.

Legal Use of the Extended Declaration for Non Individual Entities HDFC

The Extended Declaration for Non Individual Entities HDFC serves a legal purpose by ensuring compliance with U.S. tax regulations. By accurately completing and submitting this form, entities confirm their tax status and avoid potential penalties associated with non-compliance. It is essential for entities to understand their obligations under FATCA to maintain their banking relationship with HDFC Bank.

Required Documents for the Extended Declaration for Non Individual Entities HDFC

When completing the Extended Declaration for Non Individual Entities HDFC, certain documents are required to support the information provided in the form. These may include:

- Tax identification number of the entity.

- Proof of entity registration, such as articles of incorporation.

- Recent financial statements or bank statements.

Form Submission Methods for the Extended Declaration for Non Individual Entities HDFC

The Extended Declaration for Non Individual Entities HDFC can be submitted through various methods, including:

- Online submission via HDFC Bank's secure portal.

- Mailing the completed form to the designated HDFC Bank address.

- In-person submission at a local HDFC Bank branch.

Quick guide on how to complete extended declaration for non individual entities hdfc 209131907

Complete Extended Declaration For Non Individual Entities Hdfc seamlessly on any device

Managing documents online has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can find the necessary form and securely save it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Extended Declaration For Non Individual Entities Hdfc on any device with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The simplest way to modify and eSign Extended Declaration For Non Individual Entities Hdfc effortlessly

- Locate Extended Declaration For Non Individual Entities Hdfc and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device of your choice. Modify and eSign Extended Declaration For Non Individual Entities Hdfc and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the extended declaration for non individual entities hdfc 209131907

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FATCA form for HDFC Bank?

The FATCA form for HDFC Bank is a document required for compliance with the Foreign Account Tax Compliance Act. This form helps banks report information about foreign accounts to the IRS. Ensuring you have the correct FATCA form HDFC Bank is essential for maintaining your account's standing.

-

How do I fill out the FATCA form for HDFC Bank?

Filling out the FATCA form for HDFC Bank involves providing your personal information, tax identification numbers, and confirming your tax residency status. Ensure that all information is accurate to avoid potential delays. Utilizing services like airSlate SignNow can simplify this process with eSignature capabilities.

-

Where can I obtain the FATCA form for HDFC Bank?

The FATCA form for HDFC Bank can typically be downloaded directly from the bank's official website or requested at a local branch. Make sure you are getting the most recent version of the form to ensure compliance. For easy management of these documents, airSlate SignNow can help streamline your workflow.

-

What are the benefits of using airSlate SignNow for submitting the FATCA form HDFC Bank?

Using airSlate SignNow for your FATCA form HDFC Bank submission enhances convenience and speed. With its user-friendly interface, you can eSign and securely send your documents online. This eliminates unnecessary paperwork and reduces the risk of errors.

-

Is there a fee for submitting the FATCA form for HDFC Bank?

Typically, there are no fees associated with submitting the FATCA form for HDFC Bank itself. However, some services may charge fees for assistance with form preparation or digital submission. Using airSlate SignNow can offer a cost-effective solution for eSigning and sending your forms.

-

Can I integrate airSlate SignNow with HDFC Bank for the FATCA form?

Yes, airSlate SignNow can be integrated with various banking processes, including submitting the FATCA form for HDFC Bank. This integration allows for seamless document management and signing. It simplifies the compliance process, making it efficient and straightforward.

-

What features does airSlate SignNow offer for handling the FATCA form HDFC Bank?

airSlate SignNow provides features like customizable templates, secure eSigning, and document tracking, which are perfect for managing the FATCA form HDFC Bank. These tools help ensure that you can quickly fill out, sign, and submit your forms without hassle. This functionality enhances your overall experience and compliance.

Get more for Extended Declaration For Non Individual Entities Hdfc

- State of new jerseydepartment of children and families form

- Assistive technologyenvironmental modification evaluation nj form

- New jersey general eligibility requirements worksheet form

- Ilovepdf api reference for developers form

- Revised total coliform rule level 2 assessment form state of

- Nj opra fillable form

- This form shall be used for all new or existing isra cases seeking an approval of an application for an alternate compliance

- Register ready new jersey office of emergency management form

Find out other Extended Declaration For Non Individual Entities Hdfc

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple