Irs Form 668 a PDF

What is the IRS Form 668 A PDF?

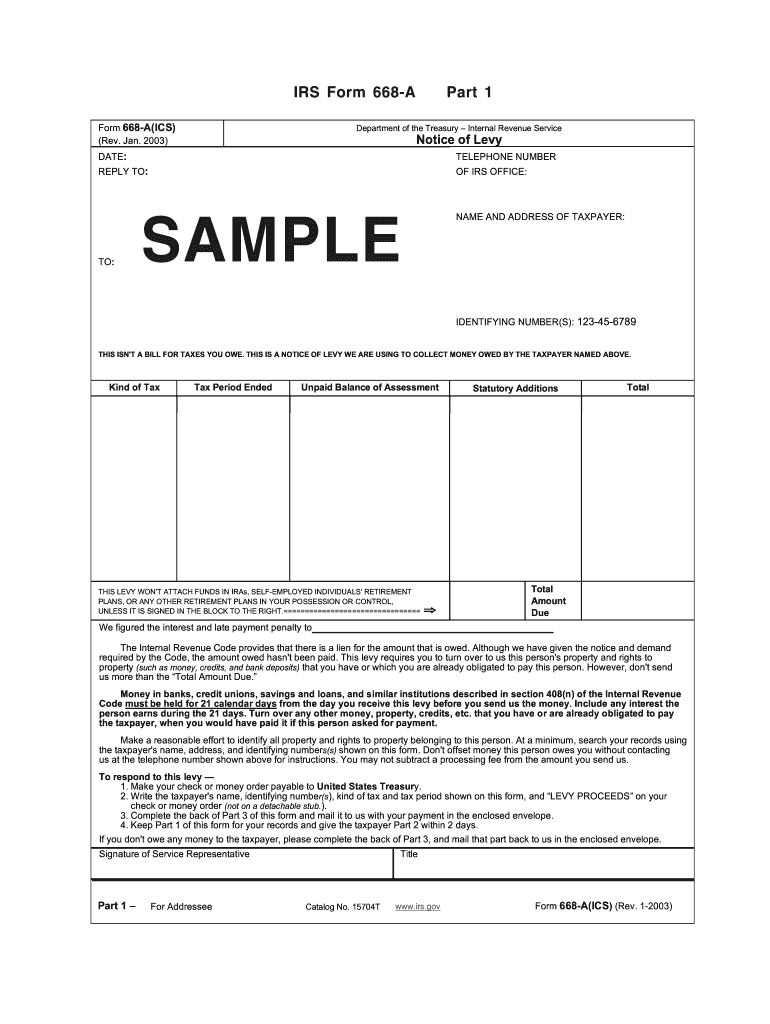

The IRS Form 668 A is a legal document used by the Internal Revenue Service to notify taxpayers of a federal tax lien. This form serves as an official notice that the IRS has a claim against a taxpayer's property due to unpaid taxes. The form is essential in the tax collection process and provides information about the taxpayer's obligations and the IRS's rights regarding the lien. The IRS Form 668 A PDF is the digital version of this document, allowing for easier access and completion. Understanding this form is crucial for anyone facing tax liabilities, as it outlines the implications of the lien on property and financial transactions.

How to Use the IRS Form 668 A PDF

Using the IRS Form 668 A PDF involves several steps to ensure that the document is completed accurately and submitted correctly. First, download the form from a reliable source, ensuring it is the most current version. Next, fill in the required information, including the taxpayer's name, address, and details regarding the tax liability. It is important to review the form for accuracy before submission. Once completed, the form can be printed and mailed to the appropriate IRS office or submitted electronically if applicable. Familiarity with the form's requirements helps to avoid delays in processing and potential penalties.

Steps to Complete the IRS Form 668 A PDF

Completing the IRS Form 668 A PDF requires careful attention to detail. Follow these steps for a smooth process:

- Download the form: Ensure you have the latest version of the IRS Form 668 A PDF.

- Fill in taxpayer information: Enter the taxpayer's full name, address, and taxpayer identification number.

- Provide tax details: Include the specific tax period and the amount owed to the IRS.

- Review the form: Double-check all entries for accuracy and completeness.

- Submit the form: Send the completed form to the IRS via mail or electronically, if applicable.

Legal Use of the IRS Form 668 A PDF

The IRS Form 668 A PDF has specific legal implications. It serves as a public notice of the IRS's claim against a taxpayer's property, which can affect the taxpayer's credit and ability to secure loans. This form is legally binding and must be treated with care. When properly executed, it ensures that the taxpayer is informed of their obligations and the consequences of non-compliance. Understanding the legal context of this form is essential for taxpayers to navigate their financial responsibilities effectively.

Key Elements of the IRS Form 668 A PDF

Several key elements define the IRS Form 668 A PDF. These include:

- Taxpayer Information: Essential details about the taxpayer, including name and address.

- Tax Liability Amount: The total amount owed to the IRS, which triggers the lien.

- Tax Period: The specific tax years associated with the unpaid taxes.

- IRS Contact Information: Details on how to reach the IRS for questions or clarifications.

Filing Deadlines / Important Dates

Filing deadlines related to the IRS Form 668 A PDF are crucial for taxpayers to understand. While the form itself does not have a specific filing deadline, it is typically issued when a taxpayer has unpaid taxes. Timely response to the form is essential to avoid further penalties or legal action. Taxpayers should be aware of the general tax filing deadlines and any specific notices they receive from the IRS regarding their tax obligations. Keeping track of these dates helps in managing tax liabilities effectively.

Quick guide on how to complete irs form 668 a pdf

Complete Irs Form 668 A Pdf seamlessly on any device

Online document administration has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 668 A Pdf on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Irs Form 668 A Pdf effortlessly

- Find Irs Form 668 A Pdf and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Irs Form 668 A Pdf to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 668 a pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 668 and why do I need it?

Form 668 is a notice of federal tax lien used by the IRS to protect its interest in your assets. If you're facing tax lien issues, understanding how to manage Form 668 can help you resolve your tax problems efficiently. Utilizing airSlate SignNow allows you to sign and send Form 668 documents easily, ensuring compliance and timely responses.

-

How can airSlate SignNow help with managing form 668?

airSlate SignNow streamlines the process of managing Form 668 by enabling users to electronically sign and send the document securely. The platform provides students and businesses with an easy-to-use interface that simplifies the completion and submission of Form 668. By digitizing Form 668, you can save time and reduce paperwork.

-

What features does airSlate SignNow offer for form 668 management?

airSlate SignNow offers robust features like document tracking, templates, and customizable workflows specifically designed for form 668 management. Users can create reusable templates for Form 668, making it easy to fill out the document each time. Additionally, the platform ensures that all sent documents comply with legal standards, providing peace of mind.

-

Is there a cost associated with using airSlate SignNow for form 668?

Yes, airSlate SignNow operates on a subscription-based model with various pricing tiers depending on features and usage. The cost-effectiveness of using airSlate SignNow for managing Form 668 can result in savings on printing and administrative tasks. Evaluating the subscription options will help you choose the best fit for your needs.

-

What are the benefits of using airSlate SignNow for form 668 signing?

The primary benefits of using airSlate SignNow for Form 668 include enhanced efficiency, reduced turnaround times, and improved compliance. By digitalizing the process, you receive instant notifications when the document is signed, and integrating into existing workflows becomes seamless. Overall, it simplifies the complexities often associated with Form 668.

-

Can I integrate airSlate SignNow with other applications for form 668?

Absolutely! airSlate SignNow offers integration capabilities with various applications such as Salesforce, Google Drive, and others, allowing for effective handling of Form 668 within your workflow. These integrations ensure that you can manage your Form 668 documentation in the software tools you already use, optimizing overall productivity.

-

How secure is my data when signing form 668 with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you sign Form 668 on the platform, your data is protected through advanced encryption protocols. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for Irs Form 668 A Pdf

Find out other Irs Form 668 A Pdf

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe