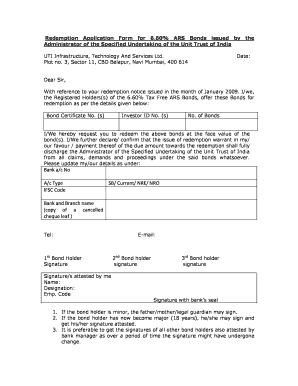

Ars Bond Form

What is the Ars Bond

The Ars Bond is a financial instrument issued by state or local governments, typically used to fund public projects. These bonds are a way for municipalities to raise capital while providing investors with a fixed income. When you purchase an Ars Bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond's face value upon maturity. Understanding the nature and purpose of these bonds is crucial for anyone interested in investing in municipal securities.

How to use the Ars Bond

Using an Ars Bond involves several steps, including purchasing the bond, holding it until maturity, and redeeming it for its face value. Investors can buy these bonds through brokers or directly from the issuing authority. Once acquired, the bondholder receives interest payments, which can be reinvested or used as income. Upon maturity, the bondholder must complete the bond redemption form to receive the principal amount back. This process ensures that investors can effectively manage their investments and maximize returns.

Steps to complete the Ars Bond

Completing the Ars Bond involves a series of straightforward steps:

- Gather necessary documentation, including identification and proof of purchase.

- Access the bond redemption form, which can typically be found online or obtained from the issuing authority.

- Fill out the form accurately, providing all required information such as your name, contact details, and bond specifics.

- Submit the completed form according to the instructions provided, either online or via mail.

Following these steps ensures a smooth redemption process and helps avoid potential delays.

Legal use of the Ars Bond

The legal use of the Ars Bond is governed by specific regulations that ensure compliance with state and federal laws. These bonds must adhere to the guidelines set forth by the Internal Revenue Service (IRS) and other regulatory bodies. Investors should be aware of the legal framework surrounding these bonds, as it affects their rights and obligations. Proper legal understanding helps in mitigating risks associated with bond investments and ensures that investors are protected under the law.

Required Documents

When dealing with Ars Bonds, certain documents are essential for both purchasing and redeeming the bonds. The following documents are typically required:

- Proof of identity, such as a government-issued ID.

- Purchase confirmation or transaction receipt.

- Completed bond redemption form.

- Any additional documentation requested by the issuing authority.

Having these documents ready can streamline the process and facilitate a successful transaction.

Who Issues the Form

The bond redemption form for Ars Bonds is usually issued by the municipality or governmental entity that created the bond. This form is critical for investors wishing to redeem their bonds and is designed to capture all necessary information to process the redemption efficiently. It is important for bondholders to ensure they are using the correct form issued by the relevant authority to avoid any complications during the redemption process.

Quick guide on how to complete uti ars bond price today

Complete uti ars bond price today effortlessly on any gadget

Online document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to develop, modify, and eSign your documents quickly without any issues. Manage uti ars bonds status check online on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign uti ars bond redemption status seamlessly

- Locate uti ars bonds status check and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Revise and eSign bond redemption form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to uti ars bonds

Create this form in 5 minutes!

How to create an eSignature for the uti ars bond price

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask uti ars bond redemption form

-

What is the process for a uti ars bonds status check?

To perform a uti ars bonds status check, simply visit our user-friendly platform and navigate to the dedicated section for bond status tracking. You will need to input the required bond details to retrieve the current status efficiently. Our system ensures quick access to all necessary information at your fingertips.

-

Are there any fees associated with performing a uti ars bonds status check?

Yes, while the initial access for a uti ars bonds status check might be free, there could be additional fees for detailed reports or specific document retrieval. We provide transparent pricing so you can easily understand any costs involved. Always check our pricing page for the most current information and offers.

-

What features does airSlate SignNow offer for handling bonds?

airSlate SignNow offers various features streamlined for conducting a uti ars bonds status check, including electronic signatures, document management, and real-time tracking. This suite of tools helps you maintain efficiency and accuracy when dealing with bond documentation. Our platform is designed to simplify bond-related processes effectively.

-

How can airSlate SignNow improve my workflow related to bond management?

Using airSlate SignNow enhances your workflow by automating the bond management process, including the uti ars bonds status check. Our solution eliminates manual data entry, reduces errors, and speeds up document processing times. This saves you time and allows you to focus on more strategic tasks.

-

Can I integrate airSlate SignNow with other applications I use?

Absolutely! airSlate SignNow offers seamless integration with numerous applications, allowing you to incorporate the uti ars bonds status check into your existing systems. Integrations with popular CRMs and productivity tools streamline your workflow. Check our integrations page to find out more.

-

How does airSlate SignNow ensure the security of my bond data?

Security is a top priority for airSlate SignNow. We implement advanced encryption and data protection measures to safeguard your information during a uti ars bonds status check. You can trust that your bond data is handled with the utmost care and complies with all industry standards.

-

What are the benefits of using airSlate SignNow for bond status tracking?

Using airSlate SignNow for bond status tracking, including a uti ars bonds status check, offers numerous benefits such as efficient document handling, real-time status updates, and reliable e-signature capabilities. Our platform enhances efficiency, saves costs, and simplifies the entire process. This ultimately leads to better decision-making regarding your bond investments.

Get more for uti ars bonds status check online

Find out other uti ars bond redemption status

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form