California W4 Form

What is the California W4

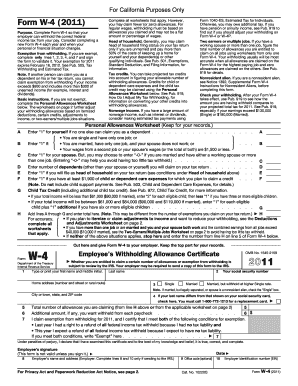

The California W4 form, officially known as the Employee's Withholding Allowance Certificate, is a crucial document for employees in California. It is used to determine the amount of state income tax that should be withheld from an employee's paycheck. By completing this form, employees can claim allowances based on their personal situation, such as marital status and number of dependents, which directly impacts their tax withholding. Understanding this form is essential for ensuring that the correct amount of taxes is withheld, helping to avoid underpayment or overpayment during tax season.

How to Obtain the California W4

Obtaining the California W4 form is straightforward. Employees can access the form through several channels:

- Visit the California Franchise Tax Board website to download a printable version of the form.

- Request a copy from your employer, as many companies provide the form during the onboarding process.

- Access the form through various tax preparation software that includes state-specific forms.

Having the correct version of the California W4 is essential for accurate tax withholding.

Steps to Complete the California W4

Completing the California W4 form involves several key steps:

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Claim allowances based on your personal and financial situation. Each allowance reduces the amount of tax withheld.

- Sign and date the form to validate your information.

It is important to review the form carefully before submission to ensure all information is accurate and complete.

Legal Use of the California W4

The California W4 form is legally binding when completed and submitted correctly. It serves as a declaration of your tax withholding preferences and must be kept up-to-date, especially after significant life changes such as marriage or the birth of a child. Employers are required to honor the information provided on the form, making it essential for employees to ensure its accuracy. Misrepresentation on the form can lead to penalties, including under-withholding and the associated tax liabilities.

Key Elements of the California W4

Several key elements are crucial for understanding the California W4 form:

- Personal Information: This section includes your name, address, and Social Security number.

- Filing Status: Indicates whether you are single, married, or head of household.

- Allowances: The number of allowances claimed affects the withholding amount; more allowances mean less tax withheld.

- Signature: Your signature is necessary to validate the form.

Understanding these elements helps ensure that employees make informed decisions about their tax withholding.

Form Submission Methods

Employees can submit the completed California W4 form through various methods:

- In-Person: Deliver the form directly to your employer's human resources or payroll department.

- Online: Some employers offer electronic submission through their payroll systems.

- Mail: If required, you can send a physical copy to your employer, though this method is less common.

Choosing the appropriate submission method ensures that your form is processed efficiently and accurately.

Quick guide on how to complete california w4

Effortlessly Prepare California W4 on Any Device

Managing documents online has gained signNow popularity among both businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your paperwork quickly and without hassles. Manage California W4 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Edit and Electronically Sign California W4 with Ease

- Find California W4 and click Get Form to begin.

- Utilize the available tools to fill out your document.

- Emphasize key sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign California W4 to ensure excellent communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w4 form california, and why is it important?

The w4 form california is a tax form used by employees to determine the amount of federal income tax to withhold from their paychecks. It's crucial because accurate withholding ensures you pay the right amount of taxes throughout the year. Completing the w4 form california correctly can help avoid tax penalties and maximize your take-home pay.

-

How can airSlate SignNow help me with the w4 form california?

airSlate SignNow simplifies the process of completing and eSigning the w4 form california by providing an intuitive platform for document management. You can easily fill out your w4 form california online, ensure accuracy, and securely send it to your employer, all in one place. This saves time and reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for the w4 form california?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is reasonable considering the efficiency and security you gain when handling your w4 form california. There are also free trials available that let you explore the features before committing.

-

What features does airSlate SignNow offer for managing the w4 form california?

airSlate SignNow features a user-friendly editor that allows you to easily fill out and modify your w4 form california. It also supports document storage, tracking, and automated reminders for signatures, making the entire process seamless. These features help ensure that your w4 form california is completed and submitted on time.

-

Can I integrate airSlate SignNow with other applications for handling the w4 form california?

Absolutely! airSlate SignNow provides integration capabilities with various popular applications such as Google Drive, Salesforce, and more. This allows you to streamline workflows related to your w4 form california, automating information transfer and enhancing productivity.

-

Is it secure to eSign the w4 form california using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. All eSignatures on the w4 form california are legally binding and protected with encryption. You can have peace of mind knowing that your sensitive information is secure while you manage your tax documents.

-

How does airSlate SignNow improve the efficiency of submitting the w4 form california?

By enabling users to fill out and eSign the w4 form california digitally, airSlate SignNow eliminates the paperwork hassle. You can complete your form anytime, anywhere, and submit it immediately. This results in quicker processing times and reduced administrative overhead for both employees and employers.

Get more for California W4

Find out other California W4

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe