Wolfs 109 Form

What is the Wolfs 109 Form

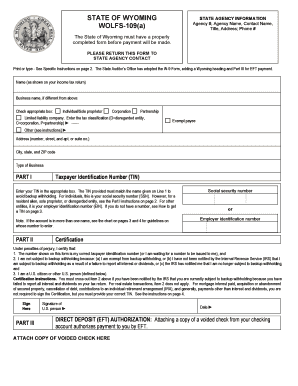

The Wolfs 109 Form is a tax-related document used primarily in the United States. It is designed to report specific financial information to the Internal Revenue Service (IRS). This form is crucial for individuals and businesses to ensure compliance with federal tax regulations. Understanding the purpose and requirements of the Wolfs 109 Form can help taxpayers avoid potential penalties and ensure accurate reporting of their financial activities.

How to use the Wolfs 109 Form

Using the Wolfs 109 Form involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents and information relevant to the reporting period. This may include income statements, expense records, and any other pertinent financial data. Next, carefully fill out the form, ensuring that all sections are completed accurately. Once the form is filled out, review it for any errors before submitting it to the IRS. Utilizing electronic signature solutions can streamline this process, making it easier to sign and submit the form securely.

Steps to complete the Wolfs 109 Form

Completing the Wolfs 109 Form requires attention to detail. Here are the general steps to follow:

- Collect all relevant financial documents.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for accuracy, including names, numbers, and dates.

- Sign the form electronically if using an eSignature solution.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the Wolfs 109 Form

The Wolfs 109 Form must be used in accordance with IRS regulations to be considered legally binding. This means that all information provided must be truthful and accurate. Failure to comply with these regulations can result in penalties, including fines or additional scrutiny from the IRS. It is essential to understand the legal implications of submitting this form and to ensure that all data is reported correctly to maintain compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Wolfs 109 Form are critical for compliance. Typically, the form must be submitted by a specific date each year, which is usually aligned with the tax filing deadline. It is important to stay informed about any changes to these dates, as failing to file on time can result in penalties. Taxpayers should mark their calendars and prepare their documents in advance to avoid last-minute issues.

Form Submission Methods (Online / Mail / In-Person)

The Wolfs 109 Form can be submitted through various methods, depending on the preference of the taxpayer. Options include:

- Online Submission: Many taxpayers choose to file electronically through the IRS e-file system or authorized software.

- Mail: The form can be printed and mailed to the appropriate IRS address, ensuring it is sent with sufficient time to meet deadlines.

- In-Person: Some individuals may opt to submit the form in person at designated IRS offices, although this is less common.

Quick guide on how to complete wolfs 109 form

Complete Wolfs 109 Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Handle Wolfs 109 Form on any platform using the airSlate SignNow Android or iOS apps and simplify any document-related process today.

How to edit and electronically sign Wolfs 109 Form with ease

- Obtain Wolfs 109 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Wolfs 109 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wolfs 109 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wolfs 109 Form?

The Wolfs 109 Form is a document used for specific tax reporting purposes. It is crucial for businesses to understand how to complete this form accurately to ensure compliance with IRS regulations. Using airSlate SignNow, you can easily prepare, send, and eSign the Wolfs 109 Form with confidence.

-

How can airSlate SignNow help with the Wolfs 109 Form?

airSlate SignNow streamlines the process of completing the Wolfs 109 Form by offering an intuitive interface for filling out and signing documents. With this solution, you can quickly collaborate with team members or clients and ensure that the form is accurately completed. Plus, eSigning the Wolfs 109 Form saves time compared to traditional methods.

-

What are the pricing options for airSlate SignNow when using the Wolfs 109 Form?

airSlate SignNow offers various pricing plans that cater to different business needs when handling documents like the Wolfs 109 Form. These plans are designed to provide flexibility while ensuring you have access to all the essential features for document management. You can choose a plan that suits your budget, allowing you to handle the Wolfs 109 Form efficiently.

-

Is airSlate SignNow secure for signing the Wolfs 109 Form?

Yes, airSlate SignNow prioritizes security and ensures that all documents, including the Wolfs 109 Form, are protected with advanced encryption methods. This means that your sensitive information is safe during the signing process. Additionally, airSlate SignNow complies with industry standards, providing peace of mind when dealing with important tax forms.

-

Can I customize the Wolfs 109 Form within airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the Wolfs 109 Form as needed, ensuring it meets your specific requirements. You can add fields, modify layouts, and tailor the content to fit your business needs. This level of customization makes it easier to gather the necessary information accurately through airSlate SignNow.

-

Does airSlate SignNow integrate with other tools to manage the Wolfs 109 Form?

Yes, airSlate SignNow integrates seamlessly with a variety of software and applications, making it easy to manage the Wolfs 109 Form alongside your other business tools. This integration can enhance your workflow by automating document processes and reducing manual data entry. You can access your documents from multiple platforms while ensuring the Wolfs 109 Form is handled efficiently.

-

What are the benefits of using airSlate SignNow for the Wolfs 109 Form?

Using airSlate SignNow for the Wolfs 109 Form simplifies the entire process from creation to completion. It offers a cost-effective solution that enhances productivity, reduces paper clutter, and expedites the signing process. With airSlate SignNow, you can ensure that your Wolfs 109 Form is completed quickly and accurately, improving your operational efficiency.

Get more for Wolfs 109 Form

- Seniors forms and publications alberta seniors and housing

- Chris semenuk form

- Motive fuel and fuel oil application for approval form

- Medical assessmentreferral form home oxygen concentrator program hocp home oxygen concentrator program hocp

- Msp application for enrolment ministry of health health gov bc form

- Ocf 4 death and funeral benefits application effective march 1 form

- Articles of revival of a society service alberta servicealberta gov ab form

- The claimant must complete this section to authorize the release of the information requested in section 2 to the insurer

Find out other Wolfs 109 Form

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple