Unicef Donation Receipt Download Form

What is the Unicef Donation Receipt Download

The Unicef donation receipt serves as proof of your charitable contributions to Unicef, which may be necessary for tax purposes. This document typically includes details such as the donor's name, the amount donated, and the date of the contribution. Downloading this receipt can help ensure that you have the proper documentation for claiming tax deductions. It is essential to keep this receipt safe for your records, especially during tax season.

How to Obtain the Unicef Donation Receipt Download

To obtain your Unicef donation receipt, you can visit the Unicef website or the specific donation portal where you made your contribution. After logging into your account, look for the section dedicated to donation history. Here, you should find options to download your receipts. If you made a donation via mail or through a third party, you may need to contact Unicef directly for assistance in obtaining your receipt.

Key Elements of the Unicef Donation Receipt Download

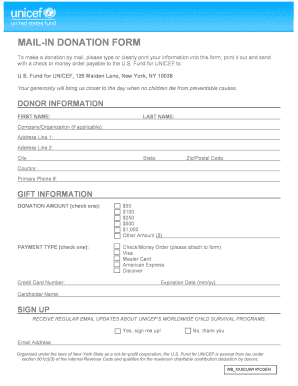

When downloading your Unicef donation receipt, ensure it includes the following key elements:

- Donor Information: Your full name and address.

- Donation Details: The amount donated and the date of the transaction.

- Charity Information: Unicef's name and tax identification number.

- Statement of Tax Deductibility: A note indicating that the donation is tax-deductible.

Steps to Complete the Unicef Donation Receipt Download

To successfully download your Unicef donation receipt, follow these steps:

- Visit the Unicef website and log into your account.

- Navigate to the donation history section.

- Select the specific donation for which you need the receipt.

- Click on the download option to save the receipt to your device.

Legal Use of the Unicef Donation Receipt Download

The Unicef donation receipt is a legally binding document that can be used for tax purposes. It provides evidence of your charitable contribution, which may be necessary when filing your taxes. To ensure compliance with IRS regulations, keep this receipt as part of your financial records. It is advisable to consult with a tax professional if you have questions regarding the use of this receipt for tax deductions.

IRS Guidelines

According to IRS guidelines, donations made to qualified charitable organizations like Unicef are tax-deductible. To claim these deductions, you must have proper documentation, such as the Unicef donation receipt. The IRS requires that donations over a certain amount be substantiated with a written acknowledgment from the charity. Ensure that your receipt meets these requirements to facilitate a smooth tax filing process.

Quick guide on how to complete unicef donation receipt download

Effortlessly prepare Unicef Donation Receipt Download on any device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Unicef Donation Receipt Download on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign Unicef Donation Receipt Download seamlessly

- Find Unicef Donation Receipt Download and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your updates.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, annoying form searches, or mistakes that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Unicef Donation Receipt Download and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the unicef donation receipt download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a UNICEF donation receipt?

A UNICEF donation receipt is a document that confirms your charitable contribution to UNICEF. It serves as proof of your donation for tax purposes and provides details such as the amount donated and the date of the transaction. Having a valid UNICEF donation receipt is crucial for claiming tax deductions on your contributions.

-

How can I obtain my UNICEF donation receipt through airSlate SignNow?

You can easily obtain your UNICEF donation receipt by utilizing airSlate SignNow’s document management features. After making your donation, you can request a receipt through the platform, and it can be electronically signed and sent to your email for your convenience. This process is quick and ensures you have an official record of your donation.

-

Are there any costs associated with obtaining a UNICEF donation receipt?

Obtaining a UNICEF donation receipt through airSlate SignNow typically does not incur additional costs if you are already subscribed to our services. Our platform allows for seamless transactions and documentation without hidden fees. Make sure to check our pricing plans for any specific features related to donation receipts.

-

What features does airSlate SignNow offer for managing UNICEF donation receipts?

airSlate SignNow offers various features to manage UNICEF donation receipts effectively. These include document templates, electronic signatures, and easy sharing options. Additionally, you can securely store all your receipts in one place, making it simple to access them whenever needed for tax filing.

-

Can I integrate airSlate SignNow with other applications for managing donations?

Yes, airSlate SignNow supports integration with a wide range of applications to help you manage donations and receipts more efficiently. This includes connecting with payment processors, CRM systems, and other financial software. This integration capability ensures that all donation-related documentations, like UNICEF donation receipts, are automatically organized and stored.

-

How do UNICEF donation receipts benefit me as a donor?

UNICEF donation receipts benefit you by providing official documentation needed for tax deductions. They help you keep track of your charitable contributions and promote transparency in your donations. Furthermore, receiving an organized UNICEF donation receipt through airSlate SignNow enhances your overall donation experience.

-

What should I do if I haven't received my UNICEF donation receipt?

If you haven't received your UNICEF donation receipt, you can check your email's spam folder or contact UNICEF's support directly. Alternatively, through airSlate SignNow, you can access your donation history and request a reissue of the receipt easily. Our support team is also available to assist you with any related issues.

Get more for Unicef Donation Receipt Download

Find out other Unicef Donation Receipt Download

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online