T4013 Form

What is the T4013

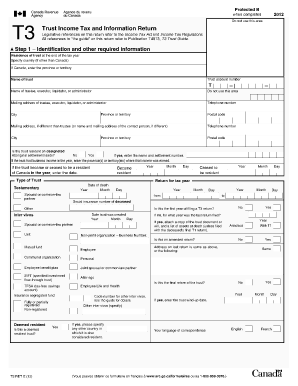

The T4013 form, also known as the T3 trust return form, is a crucial document used for reporting income earned by trusts in the United States. This form is specifically designed for trusts that are required to file an annual income tax return. The T4013 allows trustees to report the income, deductions, and credits of the trust, ensuring compliance with federal tax regulations. Understanding the purpose of the T4013 is essential for trustees and beneficiaries alike, as it directly impacts tax liabilities and distributions from the trust.

How to use the T4013

Utilizing the T4013 form involves several key steps to ensure accurate reporting. First, gather all necessary financial documents related to the trust, including income statements, expense records, and any applicable deductions. Next, complete the form by entering the trust's income, expenses, and any distributions made to beneficiaries. It is important to follow the guidelines provided by the IRS to avoid errors. Once completed, the T4013 must be submitted by the designated deadline to ensure compliance with tax regulations.

Steps to complete the T4013

Completing the T4013 form requires careful attention to detail. Here are the essential steps:

- Collect all relevant financial information, including income and expenses.

- Fill out the identification section with the trust's name, address, and tax identification number.

- Report all sources of income, including interest, dividends, and capital gains.

- Include any deductions that the trust is eligible for, such as administrative expenses.

- Calculate the total income and determine the tax liability.

- Review the form for accuracy and completeness before submission.

Legal use of the T4013

The legal use of the T4013 form is governed by federal tax laws that require trusts to report their income accurately. Proper completion and submission of the T4013 ensure that the trust complies with IRS regulations, thus avoiding potential penalties. Additionally, the form must be signed by the trustee, affirming that the information provided is true and correct. Understanding the legal implications of the T4013 is vital for trustees to uphold their fiduciary responsibilities.

Filing Deadlines / Important Dates

Filing deadlines for the T4013 form are critical for compliance. Typically, the T3 trust return must be filed by the fifteenth day of the third month following the end of the trust's tax year. For trusts with a calendar year-end, this means the form is due by March 15. It is essential for trustees to mark these deadlines to avoid late filing penalties and ensure timely reporting of the trust's income.

Form Submission Methods (Online / Mail / In-Person)

The T4013 form can be submitted through various methods, providing flexibility for trustees. Options include:

- Online submission through the IRS e-file system, which offers a secure and efficient way to file.

- Mailing the completed form to the appropriate IRS address, ensuring it is postmarked by the filing deadline.

- In-person submission at designated IRS offices, although this method may require an appointment.

Choosing the right submission method can help streamline the filing process and ensure compliance with tax regulations.

Quick guide on how to complete t4013

Complete T4013 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Manage T4013 on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign T4013 effortlessly

- Locate T4013 and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign T4013 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t4013

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is t4013 in the context of airSlate SignNow?

The term t4013 refers to a specific aspect of our document signing solution at airSlate SignNow. It allows users to streamline their electronic signature processes, making it easier to manage and complete transactions. Understanding t4013 can help you leverage our platform effectively.

-

How much does airSlate SignNow cost for using t4013 features?

Pricing for airSlate SignNow, particularly for features related to t4013, varies based on the subscription plan you choose. We offer multiple pricing tiers, allowing businesses to select the option that best suits their needs and budget. You can explore our pricing plans on our website for detailed information.

-

What key features does t4013 offer?

The t4013 feature set at airSlate SignNow includes customizable workflows, advanced security measures, and integration capabilities with popular applications. These features are designed to improve efficiency in document management and signing. By utilizing t4013, users can enhance their overall productivity.

-

How can t4013 benefit my business?

Incorporating the t4013 features from airSlate SignNow can signNowly benefit your business by reducing paperwork, speeding up signing processes, and improving accuracy. This cost-effective solution allows for seamless management of electronic documents, which can lead to better customer satisfaction and faster transactions. Ultimately, t4013 empowers your team to focus on more strategic tasks.

-

Can I integrate t4013 with other software?

Yes, airSlate SignNow's t4013 features are designed to integrate smoothly with various software solutions such as CRMs, project management tools, and more. This flexibility allows you to centralize your workflow and enhance collaboration within your team. Our integration capabilities extend the functionality of t4013 to meet your business needs.

-

Is it easy to use the t4013 features?

Absolutely! airSlate SignNow's t4013 features are user-friendly, ensuring that both tech-savvy and non-tech users can navigate the platform with ease. The intuitive interface provides guided steps for sending and signing documents, making the transition to electronic signatures straightforward. Training resources are also available to help users maximize the t4013 functionality.

-

Is eSigning with t4013 secure?

Yes, security is a top priority for airSlate SignNow, especially for t4013 features. We employ industry-leading encryption, multi-factor authentication, and compliance with data protection regulations to ensure your documents are safe. Users can confidently utilize t4013 for all their eSigning needs without compromising security.

Get more for T4013

- How to stop a foreclosure with mediationnolo form

- Summons to be served in utah englishspanish summons to be served in utah englishspanish form

- Browse all court forms california courts

- Gv 710 notice of hearing on request to renew judicial council forms

- Civil forms gun restraining orders california courts cagov

- I50 insurance claim form income

- Gv 109 notice of court hearing california courts cagov form

- Request for hearing denied application for counsel or waiver of fees juvenile form

Find out other T4013

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure