Wage Garnishment Worksheet Excel Form

What is the Wage Garnishment Worksheet Excel

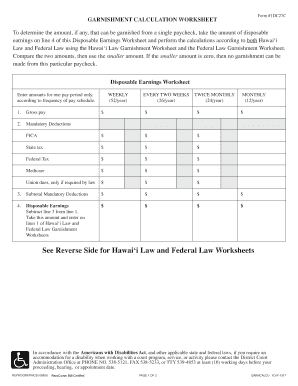

The Wage Garnishment Worksheet Excel is a specialized tool designed to assist individuals and employers in calculating the appropriate amount of wages to be garnished from an employee's paycheck. This worksheet helps ensure compliance with federal and state laws governing wage garnishments. It typically includes fields for entering employee income, allowable deductions, and the percentage of disposable earnings that can be garnished based on legal guidelines.

How to Use the Wage Garnishment Worksheet Excel

Using the Wage Garnishment Worksheet Excel involves several straightforward steps. First, download the worksheet from a reliable source. Open the file in Excel and input the necessary data, such as the employee's gross income and any deductions. The worksheet will automatically calculate the disposable earnings and determine the maximum allowable garnishment amount. Review the results to ensure accuracy before finalizing the garnishment process.

Steps to Complete the Wage Garnishment Worksheet Excel

Completing the Wage Garnishment Worksheet Excel requires careful attention to detail. Follow these steps:

- Enter the employee's gross wages for the pay period.

- List any mandatory deductions, such as taxes and health insurance premiums.

- Calculate disposable income by subtracting deductions from gross wages.

- Apply the appropriate garnishment percentage based on state laws.

- Review the calculated garnishment amount for accuracy.

Legal Use of the Wage Garnishment Worksheet Excel

The legal use of the Wage Garnishment Worksheet Excel is crucial for ensuring compliance with applicable laws. Employers must adhere to both federal and state regulations when determining garnishment amounts. The worksheet serves as a record of calculations and can be presented in court if necessary. It is important to keep the worksheet updated to reflect any changes in income or legal requirements.

State-Specific Rules for the Wage Garnishment Worksheet Excel

Different states have unique rules regarding wage garnishments, which can affect how the Wage Garnishment Worksheet Excel is completed. For example, some states may have lower or higher garnishment limits, or specific exemptions that must be considered. It is essential to consult state-specific guidelines to ensure compliance and avoid potential legal issues.

Examples of Using the Wage Garnishment Worksheet Excel

Examples of using the Wage Garnishment Worksheet Excel can provide clarity on its application. For instance, if an employee earns $1,000 per week and has $200 in deductions, the disposable income would be $800. If the state allows a garnishment of 25% of disposable income, the garnishment amount would be $200. This example illustrates how the worksheet simplifies the calculation process.

Quick guide on how to complete wage garnishment worksheet excel

Effortlessly prepare Wage Garnishment Worksheet Excel on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly and without delays. Manage Wage Garnishment Worksheet Excel on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Wage Garnishment Worksheet Excel with ease

- Locate Wage Garnishment Worksheet Excel and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to share your form, through email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, lengthy form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Modify and electronically sign Wage Garnishment Worksheet Excel to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage garnishment worksheet excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a wage garnishment worksheet?

A wage garnishment worksheet is a document that helps calculate the amount of an employee's wages that can be legally withheld to pay debts. It simplifies the process of determining the garnishment amount based on disposable earnings, ensuring compliance with state and federal laws.

-

How can airSlate SignNow help with wage garnishment worksheets?

airSlate SignNow provides a user-friendly platform to create, share, and eSign wage garnishment worksheets securely. This tool streamlines the process, enabling businesses to manage and store these essential documents easily while maintaining compliance with applicable regulations.

-

Is airSlate SignNow cost-effective for creating wage garnishment worksheets?

Yes, airSlate SignNow offers a cost-effective solution for generating wage garnishment worksheets. With affordable pricing plans tailored for businesses of all sizes, users can create and manage important documents without stretching their budgets.

-

What are the key features of the wage garnishment worksheet template in airSlate SignNow?

Our wage garnishment worksheet template includes customizable fields, automated calculations, and eSign capabilities. These features ensure accuracy, save time, and facilitate quick execution of documents, making it easier for businesses to handle garnishments efficiently.

-

Can I integrate airSlate SignNow with other software for wage garnishment management?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, such as HR software and accounting systems. This allows users to manage wage garnishment worksheets and related processes in one centralized location, optimizing efficiency and reducing manual errors.

-

What benefits does using a wage garnishment worksheet provide to businesses?

Using a wage garnishment worksheet helps businesses calculate the correct garnishment amounts, ensuring compliance with legal requirements. This proactive approach minimizes headaches associated with wage garnishments and protects companies from potential legal repercussions.

-

Is it easy to share a wage garnishment worksheet with employees?

Absolutely! With airSlate SignNow, sharing wage garnishment worksheets with employees is effortless. You can send electronic copies for eSigning, which simplifies communication and keeps all parties informed while maintaining a secure and compliant process.

Get more for Wage Garnishment Worksheet Excel

- North texas soccer must approve a guest player release form when

- Guest player release form instructions nebulawsimgcom

- Client agreement 2014rtf form

- Senior release permission form

- Annexure 2a form download

- Sure start maternity grant online form

- Launceston art society inc art exhibition entry form artlas org

- Local television station model disaster recovery plan incident form

Find out other Wage Garnishment Worksheet Excel

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document