Home Heating Credit Form 2021-2026

What is the Home Heating Credit Form

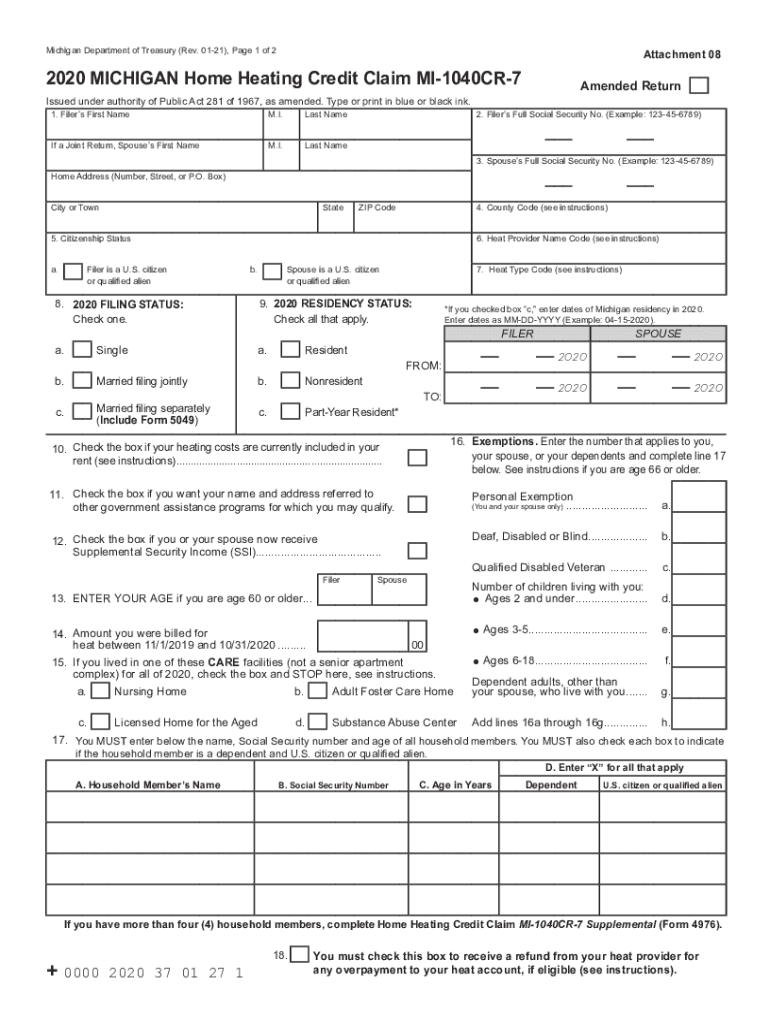

The Home Heating Credit Form is a financial assistance application designed to help eligible households in the United States manage their heating costs. This form allows individuals to request a credit against their heating expenses, which can significantly ease the financial burden during colder months. The credit is typically available to low-income households, seniors, and individuals with disabilities, ensuring that those who need support the most can access it. The form is often referred to by its official designation, such as the MI-1040CR-7 in Michigan, and is crucial for those seeking assistance with their heating bills.

How to Obtain the Home Heating Credit Form

To obtain the Home Heating Credit Form, individuals can visit their state’s Department of Revenue or equivalent agency website. Most states provide downloadable versions of the form, including the MI-1040CR-7 for Michigan residents. Additionally, individuals may request a physical copy by contacting their local agency directly. Some community organizations and non-profits also offer assistance in obtaining and completing the form, ensuring that those in need have access to the necessary resources.

Steps to Complete the Home Heating Credit Form

Completing the Home Heating Credit Form involves several key steps:

- Gather necessary documentation, including proof of income, heating bills, and identification.

- Fill out the form accurately, providing all required personal and household information.

- Double-check the information for accuracy to avoid delays in processing.

- Sign and date the form to validate your application.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal Use of the Home Heating Credit Form

The Home Heating Credit Form is legally recognized as a valid application for financial assistance, provided it is completed and submitted according to state regulations. To ensure compliance, applicants must adhere to the specific guidelines outlined by their state’s Department of Revenue. This includes providing accurate information and submitting the form within the designated filing period. Failure to comply with these legal requirements may result in denial of the credit.

Eligibility Criteria

Eligibility for the Home Heating Credit varies by state but generally includes factors such as income level, household size, and heating costs. Typically, low-income households, seniors, and individuals with disabilities are prioritized. Applicants must provide documentation that verifies their income and heating expenses to demonstrate their eligibility. It is essential to review state-specific guidelines to understand the exact criteria and ensure that all requirements are met.

Form Submission Methods

The Home Heating Credit Form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state’s official website.

- Mailing a physical copy to the designated agency.

- In-person submission at local government offices or designated community organizations.

Each method has its advantages, and applicants should choose the one that best suits their needs and circumstances.

Quick guide on how to complete home heating credit form

Effortlessly Prepare Home Heating Credit Form on Any Device

Managing documents online has gained popularity among organizations and individuals alike. It presents an optimal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the appropriate form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Home Heating Credit Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Home Heating Credit Form with ease

- Locate Home Heating Credit Form and click on Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive details using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Home Heating Credit Form and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct home heating credit form

Create this form in 5 minutes!

How to create an eSignature for the home heating credit form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a home heating credit and who qualifies for it?

What is a home heating credit? It is a financial assistance program designed to help eligible individuals and families offset their heating costs during the colder months. Typically, low-income households that spend a signNow portion of their income on heating may qualify for this credit.

-

How do I apply for a home heating credit?

To apply for a home heating credit, you need to fill out an application form that is usually available through your state's energy office or local utility company. Be prepared to provide proof of income, heating expenses, and identification. Once you submit the application, the review process may take several weeks.

-

What are the benefits of receiving a home heating credit?

The primary benefit of receiving a home heating credit is reduced financial burden during the winter months, making it easier to pay for essential heating costs. Additionally, this assistance can help families stay warm and healthy, minimizing the risk of home heating emergencies.

-

Is the home heating credit available in all states?

Yes, what is a home heating credit is available in all states, but the specifics can vary. Each state administers its program with varying eligibility requirements, application processes, and benefit amounts. It's advisable to check your local government's resources for accurate information.

-

How much can I expect to receive from a home heating credit?

The amount received from a home heating credit can vary signNowly based on several factors, including income, household size, and local heating costs. Typically, the credit can range from a few hundred to several thousand dollars, helping ease your financial burden during the winter.

-

Can I receive a home heating credit if I use alternative heating sources?

Yes, you can still qualify for a home heating credit even if you use alternative heating sources such as wood, propane, or natural gas. What is a home heating credit aims to assist all households that incur heating expenses, regardless of the type of heating fuel they use.

-

Are there any deadlines for applying for a home heating credit?

Each state sets its own deadlines for applying for a home heating credit. It is essential to check the specific dates provided by your state to ensure you submit your application on time and do not miss out on potential assistance during the winter months.

Get more for Home Heating Credit Form

Find out other Home Heating Credit Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors