Blank Credit Report Form

Understanding the Blank Credit Report

A blank credit report is a document that outlines an individual's credit history, including details about credit accounts, payment history, and any outstanding debts. This report is essential for consumers who want to review their credit status or prepare for a credit dispute. It provides a comprehensive view of how credit is being managed and can help identify inaccuracies that may affect credit scores.

In the context of myequifacts, the blank credit report serves as a foundational tool for individuals seeking to understand their credit standing and rectify any discrepancies. This report is often used when filing a credit dispute, as it provides the necessary information to support claims regarding inaccuracies in credit reporting.

How to Obtain the Blank Credit Report

To obtain a blank credit report, individuals can request it from major credit reporting agencies like Equifax, Experian, and TransUnion. Each agency allows consumers to access their reports online, by mail, or over the phone. It is advisable to check each agency's website for specific instructions and any potential fees associated with obtaining the report.

Under U.S. law, consumers are entitled to one free credit report per year from each of the three major credit bureaus. This can be a valuable opportunity to review your credit information without incurring costs.

Steps to Complete the Blank Credit Report

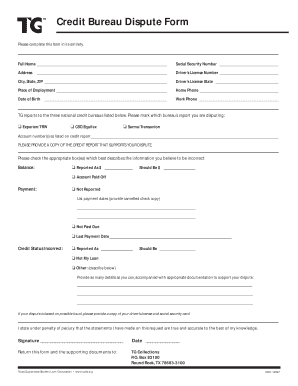

Completing a blank credit report involves several key steps to ensure that all information is accurate and up-to-date. Start by gathering personal information, including your full name, address, Social Security number, and date of birth. This information is crucial for identifying your credit history accurately.

Next, review each section of the report thoroughly. Check for any discrepancies, such as incorrect account balances or unfamiliar accounts. If you find errors, document them clearly, as this will be necessary for any disputes you may file later. Finally, ensure that you keep a copy of your completed report for your records.

Legal Use of the Blank Credit Report

The blank credit report is legally recognized as an important document in the credit dispute process. Under the Fair Credit Reporting Act (FCRA), consumers have the right to dispute inaccuracies in their credit reports. This legal framework ensures that individuals can challenge incorrect information that may negatively impact their credit scores.

When using the blank credit report for legal purposes, it is essential to follow proper procedures for filing disputes with credit reporting agencies. This includes providing supporting documentation and adhering to timelines set by the FCRA to ensure that disputes are resolved in a timely manner.

Key Elements of the Blank Credit Report

A blank credit report typically includes several key elements that provide a comprehensive overview of an individual's credit history. These elements include:

- Personal Information: Name, address, Social Security number, and date of birth.

- Credit Accounts: Details of credit accounts, including account numbers, balances, and payment history.

- Credit Inquiries: A record of who has accessed your credit report and when.

- Public Records: Information about bankruptcies, liens, or judgments.

Understanding these elements is crucial for effectively managing your credit and addressing any inaccuracies that may arise.

Examples of Using the Blank Credit Report

The blank credit report can be utilized in various scenarios, including:

- Preparing for a Loan Application: Reviewing your credit report before applying for a mortgage or auto loan can help identify areas for improvement.

- Disputing Errors: If you notice inaccuracies in your report, you can use it to file a dispute with the credit reporting agency.

- Monitoring Your Credit Over Time: Regularly reviewing your blank credit report can help you track changes in your credit status and detect potential fraud.

These examples highlight the importance of the blank credit report in maintaining a healthy credit profile and ensuring accurate reporting.

Quick guide on how to complete blank credit report 100060961

Effortlessly Prepare Blank Credit Report on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without hassles. Handle Blank Credit Report on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

Steps to Edit and Electronically Sign Blank Credit Report with Ease

- Find Blank Credit Report and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important portions of the documents or obscure sensitive data using tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method of sending the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Blank Credit Report to ensure excellent communication at every step of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank credit report 100060961

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is myequifacts and how does it work with airSlate SignNow?

Myequifacts is an innovative tool that streamlines the management of your essential documents. By integrating with airSlate SignNow, it allows businesses to send and eSign documents efficiently, ensuring that everything is organized and easily accessible. This synergy enhances your workflow, making document handling easier and more productive.

-

What features does airSlate SignNow offer for myequifacts users?

AirSlate SignNow provides a plethora of features for myequifacts users, including customizable templates, secure cloud storage, and automated reminders for signing. These functionalities are designed to optimize your document management, reduce turnaround times, and ensure that your agreements are finalized sooner. Additionally, you can track the status of your documents in real-time.

-

How can myequifacts improve my document workflow?

Using myequifacts with airSlate SignNow can signNowly improve your document workflow by eliminating manual processes. The platform offers seamless collaboration options that allow multiple stakeholders to review and sign documents effortlessly. This not only saves time but also reduces the likelihood of errors or miscommunication.

-

What are the pricing plans for using airSlate SignNow with myequifacts?

AirSlate SignNow offers competitive pricing plans that cater to different business sizes and needs, making it a cost-effective solution for myequifacts users. Whether you are a small business or a large enterprise, there are multiple tiered options available to suit your budget. Additionally, all plans come with features that enhance document handling and eSigning.

-

Are there integrations available for myequifacts with airSlate SignNow?

Yes, airSlate SignNow provides various integrations that work smoothly with myequifacts. You can connect with popular applications such as Google Drive, Dropbox, and Salesforce, enabling you to streamline your document processes further. These integrations help in centralizing your document management ecosystem.

-

Is airSlate SignNow secure for storing myequifacts documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, including those related to myequifacts. The platform utilizes advanced encryption and secure server technology to protect your data from unauthorized access. Moreover, all electronic signatures are legally binding, giving you peace of mind when managing your important documents.

-

What benefits can myequifacts users expect from adopting airSlate SignNow?

Myequifacts users can expect numerous benefits from adopting airSlate SignNow, including enhanced efficiency, reduced paperwork, and improved compliance. The ability to send and eSign documents electronically accelerates the signing process, leading to faster business transactions. Furthermore, the user-friendly interface simplifies document management for all team members.

Get more for Blank Credit Report

- Nebraska department of motor vehicles driver and vehicle form

- Specialty plate relinquishment form nebraska dmv

- 452 a irp carriers only loststolen or destroyed license plate report replacement application form

- Texas department of public safety 5805 n lamar blvd austin form

- Out of state or out of country packet texas department of public form

- De964 test online form

- Dl 77 texas hardship driver license card application form

- Content form 1644891

Find out other Blank Credit Report

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online