Oklahoma W4 Form

What is the Oklahoma W4?

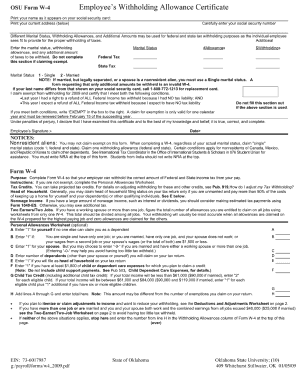

The Oklahoma W4 form, officially known as the Oklahoma State Tax Withholding Form, is a crucial document used by employees in Oklahoma to determine the amount of state income tax to withhold from their paychecks. This form allows individuals to provide their personal information, including filing status and number of allowances, which directly impacts their tax withholdings. Proper completion of the Oklahoma W4 ensures that employees do not overpay or underpay their state taxes throughout the year.

How to use the Oklahoma W4

Using the Oklahoma W4 involves several straightforward steps. First, employees must obtain the form from their employer or download it from the official state resources. After filling in personal details such as name, address, and Social Security number, individuals should indicate their filing status and the number of allowances they wish to claim. This information helps employers calculate the correct amount of state tax to withhold. Once completed, the form should be submitted to the employer, who will then adjust the withholding accordingly.

Steps to complete the Oklahoma W4

Completing the Oklahoma W4 form requires careful attention to detail. Follow these steps:

- Obtain the Oklahoma W4 form from your employer or download it from a reliable source.

- Fill in your personal information, including your full name, address, and Social Security number.

- Select your filing status, which can be single, married, or head of household.

- Determine the number of allowances you wish to claim. More allowances typically result in less tax withheld.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Key elements of the Oklahoma W4

The Oklahoma W4 form includes several key elements that are essential for accurate tax withholding. These elements consist of personal identification details, filing status options, and a section for claiming allowances. The form also provides guidance on how to calculate the number of allowances based on various factors, such as dependents and additional income. Understanding these components is vital for ensuring that the correct amount of state tax is withheld from an employee's paycheck.

Legal use of the Oklahoma W4

The legal use of the Oklahoma W4 is governed by state tax regulations. Employees are required to submit this form to their employers to ensure compliance with state tax laws. The information provided on the form must be accurate, as it directly affects the amount of state income tax withheld from wages. Failing to submit a properly completed Oklahoma W4 can lead to incorrect withholding, resulting in potential tax liabilities or penalties. Employers are also obligated to keep the form on file for record-keeping and compliance purposes.

Form Submission Methods

The Oklahoma W4 can be submitted to employers through various methods. Most commonly, employees will provide a physical copy of the completed form directly to their human resources or payroll department. In some cases, employers may allow electronic submission via secure email or an internal HR system. Regardless of the method, it is important for employees to ensure that their form is submitted promptly to avoid any delays in tax withholding adjustments.

Quick guide on how to complete oklahoma w4

Prepare Oklahoma W4 effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a great eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to produce, modify, and electronically sign your documents promptly without delays. Manage Oklahoma W4 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and electronically sign Oklahoma W4 with ease

- Locate Oklahoma W4 and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Oklahoma W4 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W 4 form in Oklahoma?

The W 4 form in Oklahoma is a tax document used by employees to indicate their tax withholding preferences. By filling out the W 4 Oklahoma correctly, employees ensure that the appropriate amount of state and federal taxes are withheld from their paychecks.

-

How can airSlate SignNow help with W 4 Oklahoma forms?

airSlate SignNow simplifies the process of completing and eSigning W 4 Oklahoma forms. Our platform allows users to easily upload, fill out, and send W 4 forms electronically, ensuring a quick and efficient onboarding for new employees.

-

What are the costs associated with using airSlate SignNow for W 4 Oklahoma?

airSlate SignNow offers various pricing plans to meet the needs of businesses of all sizes. Users can access features related to the W 4 Oklahoma form starting with our affordable monthly subscription, which includes unlimited document signing and sharing.

-

Are there any specific features for handling W 4 Oklahoma forms on airSlate SignNow?

Yes, airSlate SignNow includes features such as customizable templates for W 4 Oklahoma forms, allowing businesses to streamline the data entry process. Additionally, the platform provides automatic reminders for signature requests, ensuring timely completion.

-

What benefits does using airSlate SignNow provide for managing W 4 Oklahoma?

Using airSlate SignNow to manage W 4 Oklahoma forms increases efficiency and reduces paper clutter. With electronic signatures, businesses can save time and money by accelerating the onboarding process for new hires.

-

Can airSlate SignNow integrate with other HR tools to manage W 4 Oklahoma forms?

Absolutely, airSlate SignNow offers seamless integrations with various HR tools and software. This allows businesses to easily export and manage W 4 Oklahoma forms alongside their existing employee management systems.

-

Is airSlate SignNow secure for handling W 4 Oklahoma forms?

Yes, airSlate SignNow is committed to security, employing encryption and compliance measures to protect sensitive information. Using our platform for W 4 Oklahoma forms ensures that your data is safe during the signing process.

Get more for Oklahoma W4

- Csd600 form

- This delegation cannot last more than one year and can be revoked by the parent or form

- Delegation of powers by parent or guardian alaska court system courts alaska form

- Marriage bureau dccourts form

- City of sunrise general employees retirement plan et al v form

- Notice of appearance instructions ca2 uscourts form

- Synca magnification loupes implants and dental materials form

Find out other Oklahoma W4

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive