Form 60 Epv

What is the Form 60 Epv

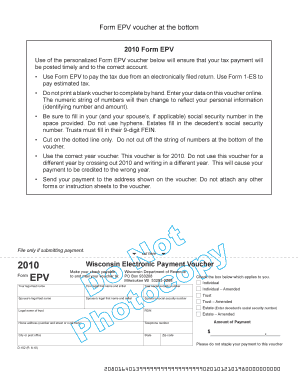

The Form 60 Epv is a specific document used in the United States for various legal and tax-related purposes. It serves as a declaration or statement that may be required by certain agencies or institutions. This form is essential for individuals who need to provide specific information regarding their financial status or other relevant details. Understanding the purpose and requirements of the Form 60 Epv is crucial for ensuring compliance with applicable regulations.

How to use the Form 60 Epv

Using the Form 60 Epv involves several key steps to ensure that it is filled out correctly and submitted in a timely manner. First, gather all necessary information and documentation that may be required to complete the form. This may include personal identification details, financial records, or other pertinent information. Next, carefully fill out each section of the form, ensuring accuracy and clarity. Once completed, review the form for any errors before submission to the relevant authority.

Steps to complete the Form 60 Epv

Completing the Form 60 Epv requires attention to detail. Follow these steps for a successful submission:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documents and information needed for completion.

- Fill out the form accurately, ensuring all sections are completed.

- Double-check for any mistakes or missing information.

- Sign and date the form as required.

- Submit the completed form to the appropriate agency or institution.

Legal use of the Form 60 Epv

The legal use of the Form 60 Epv is governed by specific regulations that vary by state and purpose. It is important to ensure that the form is used in accordance with these regulations to avoid any potential legal issues. The form may be required for various legal proceedings or financial transactions, and its proper use can help establish compliance with relevant laws.

Key elements of the Form 60 Epv

Several key elements must be included in the Form 60 Epv to ensure its validity. These elements typically include:

- Personal identification information of the individual completing the form.

- Details regarding the purpose of the form and any relevant financial information.

- Signature of the individual, confirming the accuracy of the information provided.

- Date of completion to establish a timeline for submission.

Required Documents

When completing the Form 60 Epv, certain documents may be required to support the information provided. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Financial statements or records relevant to the information being declared.

- Any additional documentation specified in the instructions for the form.

Quick guide on how to complete form 60 epv

Complete Form 60 Epv effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and safely store it in the cloud. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle Form 60 Epv on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Form 60 Epv with ease

- Find Form 60 Epv and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight key sections of your documents or redact sensitive information with tools that airSlate SignNow offers particularly for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Edit and eSign Form 60 Epv and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 60 epv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 60 format used for?

The form 60 format is utilized for providing information to tax authorities in India regarding financial transactions that require disclosure. It helps individuals and entities ensure compliance with income tax regulations. Using the form 60 format accurately can prevent legal issues and streamline documentation processes.

-

How does airSlate SignNow support the form 60 format?

airSlate SignNow offers features that simplify the creation and signing of documents in the form 60 format. Users can easily customize templates, insert necessary fields, and securely send the document for eSignature. Our platform ensures that your documents adhere to legal standards, making the process efficient.

-

Is there a cost associated with using the form 60 format on airSlate SignNow?

Yes, while airSlate SignNow provides a cost-effective solution, accessing features related to form 60 format may depend on the chosen subscription plan. Users can select a plan that suits their business size and needs. We recommend checking our pricing page for detailed information on costs associated with specific features.

-

What are the benefits of using airSlate SignNow for the form 60 format?

Using airSlate SignNow for the form 60 format provides numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security. The platform allows users to send, sign, and manage documents seamlessly, thereby saving time and improving productivity. Additionally, the ability to collaborate in real-time ensures secure and accurate documentation.

-

Does airSlate SignNow integrate with other software for managing the form 60 format?

Yes, airSlate SignNow offers integrations with various applications, enabling users to streamline their workflow when handling the form 60 format. By connecting with software like CRM systems and cloud storage services, users can easily manage documents without switching between platforms. Explore our integration options to maximize efficiency.

-

Who can use the form 60 format with airSlate SignNow?

Any individual or business needing to submit a form 60 format to comply with tax regulations can use airSlate SignNow. This includes professionals, entrepreneurs, and corporations seeking reliable eSigning solutions. Our platform caters to a diverse audience, ensuring everyone can efficiently manage their documentation.

-

How secure is the form 60 format documentation on airSlate SignNow?

Security is a top priority at airSlate SignNow. Documents, including those in the form 60 format, are protected with advanced encryption protocols and secure access controls. We also keep an audit trail of all document interactions, ensuring your information remains confidential and secure throughout the signing process.

Get more for Form 60 Epv

Find out other Form 60 Epv

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure