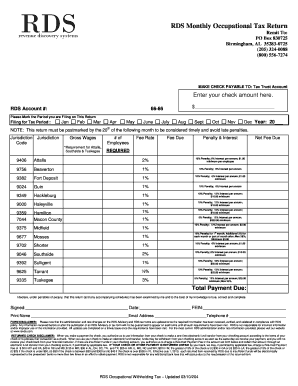

Occupational Withholding Tax Form

What is the Occupational Withholding Tax Form

The Occupational Withholding Tax Form is a crucial document used by employers to report and remit taxes withheld from employees' wages for local or state income tax purposes. This form ensures that the correct amount of tax is collected and submitted to the appropriate tax authority. Each jurisdiction may have specific requirements regarding the form's content and submission process, making it essential for employers to understand their local regulations.

How to use the Occupational Withholding Tax Form

Using the Occupational Withholding Tax Form involves several steps to ensure accurate reporting and compliance with tax regulations. Employers should first gather necessary employee information, including Social Security numbers and wage details. After completing the form with the relevant data, employers can submit it electronically or via mail, depending on their local tax authority's guidelines. Ensuring that the form is filled out correctly helps avoid penalties and ensures timely tax remittance.

Steps to complete the Occupational Withholding Tax Form

Completing the Occupational Withholding Tax Form requires careful attention to detail. Here are the general steps involved:

- Gather employee information, including names, addresses, and Social Security numbers.

- Calculate the total wages paid to each employee during the reporting period.

- Determine the amount of tax to withhold based on local or state tax rates.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

Legal use of the Occupational Withholding Tax Form

The Occupational Withholding Tax Form is legally binding when completed and submitted according to the applicable tax laws. Employers must comply with local and state regulations regarding the collection and remittance of withheld taxes. Failure to use the form correctly can result in penalties, interest on unpaid taxes, and potential legal issues. It is essential for businesses to stay informed about changes in tax laws that may affect their obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Occupational Withholding Tax Form can vary by state and locality. Generally, employers are required to submit the form quarterly or annually, depending on their withholding amounts. It is crucial for employers to keep track of these deadlines to avoid late fees and penalties. Staying organized with a calendar of important dates related to tax filings can help ensure compliance.

Examples of using the Occupational Withholding Tax Form

Employers in various industries utilize the Occupational Withholding Tax Form to manage their tax obligations effectively. For instance, a retail business may use the form to report taxes withheld from employees' paychecks on a monthly basis. Similarly, a construction company may need to submit the form quarterly due to the nature of its workforce. These examples highlight the form's adaptability across different sectors while emphasizing the importance of compliance with local tax laws.

Quick guide on how to complete occupational withholding tax form

Complete Occupational Withholding Tax Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can access the correct format and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly and without issues. Manage Occupational Withholding Tax Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The simplest way to modify and eSign Occupational Withholding Tax Form with ease

- Find Occupational Withholding Tax Form and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive details with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Modify and eSign Occupational Withholding Tax Form while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the occupational withholding tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Occupational Withholding Tax Form?

An Occupational Withholding Tax Form is a document used by employers to report the taxes withheld from employees' earnings based on their work location. It's crucial for compliance with local tax regulations. Using airSlate SignNow, you can easily create, send, and sign these forms digitally, streamlining your payroll processes.

-

How does airSlate SignNow simplify the Occupational Withholding Tax Form process?

airSlate SignNow offers a user-friendly platform that allows you to generate and manage Occupational Withholding Tax Forms efficiently. You can easily customize templates, add necessary fields, and send documents for eSignature. This reduces the time spent on paperwork and enhances accuracy in tax reporting.

-

What are the pricing options for using airSlate SignNow for Occupational Withholding Tax Forms?

airSlate SignNow provides flexible pricing plans to accommodate businesses of all sizes. You can choose a plan based on the number of users and features required for managing Occupational Withholding Tax Forms. Each plan includes essential functionalities like document tracking and reminder settings that enhance your workflow.

-

Can I integrate airSlate SignNow with other software for Occupational Withholding Tax Forms?

Yes, airSlate SignNow seamlessly integrates with various business applications, allowing you to enhance your workflow related to Occupational Withholding Tax Forms. Integrating with accounting or payroll software ensures that your tax documentation is synchronized, accurate, and easy to manage.

-

What benefits does airSlate SignNow offer for Occupational Withholding Tax Form management?

Using airSlate SignNow for Occupational Withholding Tax Forms provides numerous benefits, including enhanced efficiency, reduced human error, and improved compliance. The platform ensures all documents are securely stored and easily retrievable, providing peace of mind for businesses during tax season.

-

Is airSlate SignNow secure for handling Occupational Withholding Tax Forms?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance protocols to protect your Occupational Withholding Tax Forms. Your data is safe, giving you the confidence to manage sensitive information without concern.

-

How can airSlate SignNow help with collaboration on Occupational Withholding Tax Forms?

airSlate SignNow enhances collaboration by allowing multiple stakeholders to access and contribute to Occupational Withholding Tax Forms in real-time. You can easily share documents with team members or tax professionals, ensuring everyone involved has the latest information for accurate tax processing.

Get more for Occupational Withholding Tax Form

- F 05022 form

- Wisconsin form f44243

- State of wisconsin electrician renewal form

- State of wisconsin death certificate application form

- P 3111 waukesha county waukeshacounty form

- Wisconsin marriage certificate application waukesha county waukeshacounty form

- Wv ss188a form

- Electronic funds transfer authorization form for

Find out other Occupational Withholding Tax Form

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free