Audit Medical Record Tool 2011-2026

What is the aaahc chart audit tool?

The aaahc chart audit tool is designed to assist healthcare organizations in evaluating the quality and compliance of their medical records. This tool helps identify areas for improvement in patient care documentation, ensuring that practices adhere to established standards and regulations. By utilizing this tool, healthcare providers can enhance their operational efficiency and maintain high-quality patient care.

How to use the aaahc chart audit tool

Using the aaahc chart audit tool involves several straightforward steps. First, gather the medical records you wish to audit. Next, follow the structured guidelines provided by the tool to assess each record against the required criteria. This process includes evaluating documentation completeness, accuracy, and compliance with relevant regulations. After completing the audit, compile the findings to identify trends and areas needing improvement.

Key elements of the aaahc chart audit tool

The aaahc chart audit tool includes several key elements that facilitate effective audits. These elements typically consist of:

- Checklist of Standards: A comprehensive list of criteria against which records are evaluated.

- Scoring System: A method to quantify compliance and identify performance gaps.

- Reporting Features: Tools to generate detailed reports summarizing audit findings.

- Action Plans: Recommendations for addressing identified deficiencies and improving documentation practices.

Steps to complete the aaahc chart audit tool

Completing the aaahc chart audit tool involves a systematic approach. Begin by selecting the records for review. Then, utilize the checklist to assess each record thoroughly. Document your findings, paying close attention to areas of non-compliance. Finally, analyze the results to develop actionable insights that can enhance documentation practices and improve patient care.

Legal use of the aaahc chart audit tool

Ensuring the legal use of the aaahc chart audit tool is crucial for maintaining compliance with healthcare regulations. The tool must be used in accordance with the Health Insurance Portability and Accountability Act (HIPAA) to protect patient information. Additionally, organizations should ensure that all audit processes comply with state-specific regulations and guidelines to avoid potential legal issues.

Examples of using the aaahc chart audit tool

Practical examples of using the aaahc chart audit tool can illustrate its effectiveness. For instance, a primary care clinic may use the tool to audit patient charts for adherence to preventive care guidelines. Similarly, a behavioral health facility might employ the tool to ensure that treatment plans are documented accurately and consistently. These examples highlight the versatility of the tool across various healthcare settings.

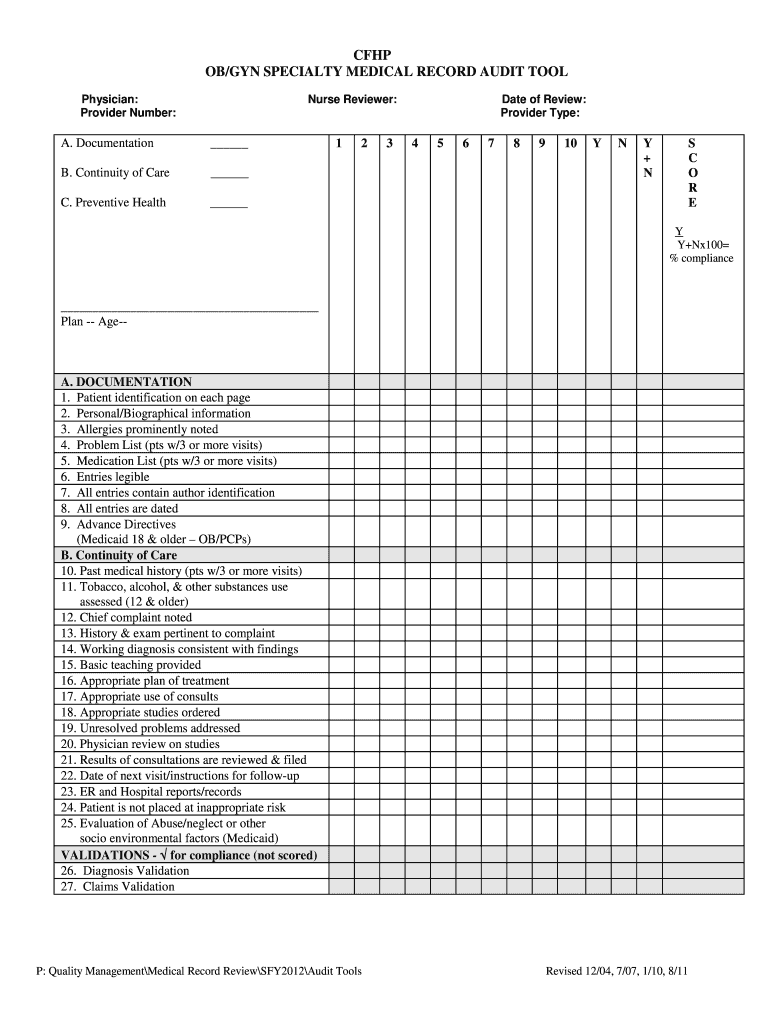

Quick guide on how to complete cfhp obgyn specialty medical record audit tool

The optimal method to locate and approve Audit Medical Record Tool

Across the breadth of a complete organization, ineffective methods pertaining to document approval can take up substantial working hours. Executing paperwork like Audit Medical Record Tool is a fundamental aspect of operational tasks in every sector, which is why the efficiency of each contract’s lifecycle signNowly impacts the overall effectiveness of the enterprise. With airSlate SignNow, authorizing your Audit Medical Record Tool is as straightforward and swift as possible. This platform provides you with the most recent version of nearly any document. Even better, you can sign it instantly without needing to download additional software to your device or print out physical copies.

Steps to acquire and authorize your Audit Medical Record Tool

- Browse our collection by category or use the search bar to locate the document you require.

- Review the document preview by clicking on Learn more to confirm it’s the correct one.

- Select Get form to begin modifying immediately.

- Fill out your document and include any required information utilizing the toolbar.

- Once finished, click the Sign tool to endorse your Audit Medical Record Tool.

- Choose the signature method that suits you best: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to complete editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you possess everything required to manage your documents efficiently. You can search, complete, modify, and even send your Audit Medical Record Tool in one window without complications. Enhance your procedures with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Why, after all that time and money was spent computerizing medical records, do we all have to fill out these forms that already have the information requested?

Because the office doesn’t know all of your info is up to date. Have you moved? Did you see another doctor who changed a medication? Did you go to the naturopath and you’re now taking an herbal supplement? Has your knee been hurting and you’ve been taking tylenol every day for the last month? Did you go to the ED 6 months ago while you were visiting relatives out of town because you had an allergic reaction to something? All of those things may impact your treatment plan and we don’t always remember to tell the doctor because it’s “old” news to us

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the cfhp obgyn specialty medical record audit tool

How to create an eSignature for your Cfhp Obgyn Specialty Medical Record Audit Tool online

How to generate an eSignature for the Cfhp Obgyn Specialty Medical Record Audit Tool in Chrome

How to make an electronic signature for putting it on the Cfhp Obgyn Specialty Medical Record Audit Tool in Gmail

How to generate an electronic signature for the Cfhp Obgyn Specialty Medical Record Audit Tool from your smartphone

How to make an electronic signature for the Cfhp Obgyn Specialty Medical Record Audit Tool on iOS devices

How to create an electronic signature for the Cfhp Obgyn Specialty Medical Record Audit Tool on Android OS

People also ask

-

What is the aaahc chart audit tool and how does it work?

The aaahc chart audit tool is designed to streamline the auditing process for healthcare organizations. It allows users to review, analyze, and improve their charting practices efficiently. By leveraging this tool, you can enhance compliance and ensure accuracy in documentation.

-

How can the aaahc chart audit tool benefit my organization?

Using the aaahc chart audit tool can signNowly improve your organization's efficiency in managing audits. It helps identify areas for improvement in charting practices, enhances compliance with regulatory standards, and ultimately, reduces the risk of costly errors.

-

Is there a free trial available for the aaahc chart audit tool?

Yes, airSlate SignNow offers a free trial for the aaahc chart audit tool. This allows potential customers to explore its features and benefits without any financial commitment. You can familiarize yourself with the tool's functionalities before deciding on a subscription.

-

What are the pricing options for the aaahc chart audit tool?

The aaahc chart audit tool features flexible pricing plans to cater to varying organizational needs. Prices are designed to be competitive and provide great value for the features offered. For detailed pricing information, it is best to visit the airSlate SignNow website or contact the sales team.

-

Does the aaahc chart audit tool integrate with other software?

Yes, the aaahc chart audit tool seamlessly integrates with various healthcare software systems. This ensures that your auditing processes can be streamlined with existing workflows. Integration enhances data consistency and improves overall operational efficiency.

-

What features are included in the aaahc chart audit tool?

The aaahc chart audit tool includes features such as customizable audit templates, real-time reporting, and insights that help improve documentation practices. These features enhance the auditing experience, making it user-friendly and efficient for healthcare providers.

-

How secure is the aaahc chart audit tool?

AirSlate SignNow prioritizes security, and the aaahc chart audit tool is compliant with industry standards. Measures such as data encryption and user access controls are implemented to safeguard sensitive information. Your data's integrity and confidentiality are of utmost importance.

Get more for Audit Medical Record Tool

- Lausd retirement benefits form

- Pli form fill up

- Witness statement template south africa form

- Fnb funding application form

- Lowes donation request letter form

- Rabbit farming business plan pdf download form

- Skin wellness center of alabama hipaa patient consent form

- Observation of communicative competencecs1doc form

Find out other Audit Medical Record Tool

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free