Pa Rev 276 Online Form

What is the Pa Rev 276 Online

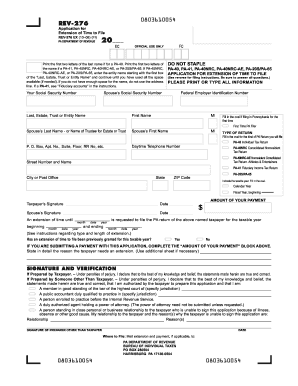

The Pa Rev 276 online form is a document used in Pennsylvania for various administrative purposes, including tax-related matters. This form allows individuals and businesses to submit necessary information electronically, streamlining the process of compliance with state regulations. The online version of the Pa Rev 276 ensures that users can fill it out conveniently from any location, reducing the need for physical paperwork.

How to Use the Pa Rev 276 Online

Using the Pa Rev 276 online involves several straightforward steps. First, access the form through a secure digital platform that supports electronic signatures. Once you have the form open, fill in the required fields with accurate information. After completing the form, review all entries for accuracy. Finally, sign the document electronically to ensure its validity. This process not only saves time but also enhances the security of your submission.

Steps to Complete the Pa Rev 276 Online

Completing the Pa Rev 276 online requires careful attention to detail. Follow these steps for a smooth experience:

- Access the Pa Rev 276 form through a trusted electronic platform.

- Fill in your personal or business information as required.

- Review the information for accuracy and completeness.

- Sign the form electronically to authenticate your submission.

- Submit the completed form to the appropriate state department.

By adhering to these steps, you can ensure that your form is filled out correctly and submitted on time.

Legal Use of the Pa Rev 276 Online

The legal use of the Pa Rev 276 online is supported by various regulations that govern electronic signatures and document submissions. The form is considered legally binding when completed and signed electronically, provided it meets specific criteria outlined by state laws. Compliance with these regulations ensures that your submission is recognized by authorities, protecting your rights and interests.

Key Elements of the Pa Rev 276 Online

Understanding the key elements of the Pa Rev 276 is essential for proper completion. Important components include:

- Identification Information: Personal or business details that verify your identity.

- Signature Section: An area designated for your electronic signature.

- Submission Instructions: Guidelines on how to submit the completed form.

- Compliance Statements: Declarations that affirm adherence to relevant laws.

Focusing on these elements will help ensure that your form is completed accurately and efficiently.

Form Submission Methods

The Pa Rev 276 can be submitted through various methods, including:

- Online Submission: The most efficient method, allowing for immediate processing.

- Mail: Sending a physical copy to the designated state office.

- In-Person: Delivering the form directly to a state office, if necessary.

Choosing the right submission method can impact the processing time and confirmation of your form's receipt.

Quick guide on how to complete pa rev 276 online

Complete Pa Rev 276 Online effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without any delays. Manage Pa Rev 276 Online on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and electronically sign Pa Rev 276 Online without any fuss

- Obtain Pa Rev 276 Online and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Pa Rev 276 Online and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa rev 276 online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa form rev 276 and its purpose?

The pa form rev 276 is an essential document used for tax-related processes in Pennsylvania. It serves as a means to report certain financial details to the state. Understanding how to effectively use this form can signNowly streamline your tax filing process.

-

How can airSlate SignNow help me with the pa form rev 276?

airSlate SignNow provides a user-friendly platform for electronically signing and sending the pa form rev 276. With our solution, you can ensure that your form is completed accurately and submitted on time, reducing the risk of errors.

-

What features does airSlate SignNow offer for handling the pa form rev 276?

Our platform offers features like eSignatures, document workflows, and templates tailored for the pa form rev 276. These tools enhance your document management process, making it easier to create, send, and track forms efficiently.

-

Is there a cost associated with using airSlate SignNow for the pa form rev 276?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when handling documents like the pa form rev 276. Our competitive pricing ensures you get a cost-effective solution without compromising on features.

-

Can I integrate airSlate SignNow with other software for managing the pa form rev 276?

Absolutely! airSlate SignNow integrates seamlessly with a variety of third-party applications. This means you can manage the pa form rev 276 alongside other essential business tools, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for the pa form rev 276?

Using airSlate SignNow for the pa form rev 276 provides benefits such as improved efficiency, time savings, and reduced paperwork. Our platform ensures that your documents are securely stored and easily accessible, simplifying the filing process.

-

How secure is airSlate SignNow for filing the pa form rev 276?

Security is a top priority for airSlate SignNow. Our platform uses advanced encryption and compliance measures to protect your documents, including the pa form rev 276, ensuring that your sensitive information remains confidential.

Get more for Pa Rev 276 Online

- 447 ncpdf south carolina department of motor vehicles form

- Purchasers statement of tax exemption form

- Sut 1 dmv form

- Vehicle certificate of ownership title application form

- Penndot photo identification card application for change form

- Cg 719s form

- Answer all items type or print in black ink form

- Agency clearance officer us customs and border protection form

Find out other Pa Rev 276 Online

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement