104ptc Form

What is the 104ptc

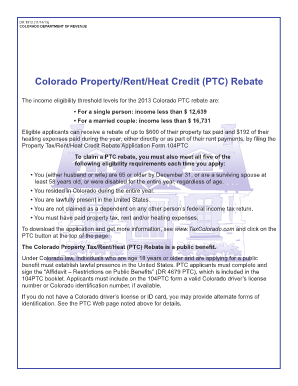

The 104ptc is a specific form used in Colorado for claiming the Property Tax/Rent/Heat Credit (PTC) rebate. This rebate assists eligible residents with property tax or rent payments, providing financial relief to those who qualify. The form is designed for individuals who have paid property taxes or rent during the tax year and meet specific income and residency requirements. Understanding the purpose and eligibility criteria of the 104ptc is crucial for residents seeking to benefit from this program.

Eligibility Criteria

To qualify for the 104ptc rebate, applicants must meet several key criteria:

- Be a resident of Colorado for the entire tax year.

- Have an income that does not exceed the specified limits set by the state.

- Have paid property taxes or rent on a primary residence.

- Be at least 65 years old, or be a disabled individual, or have dependent children under the age of 17.

It is essential for applicants to review these criteria thoroughly to ensure their eligibility before completing the form.

Steps to complete the 104ptc

Completing the 104ptc involves several straightforward steps to ensure accuracy and compliance:

- Gather necessary documents, including proof of income, property tax statements, or rental agreements.

- Fill out the 104ptc form with accurate personal and financial information.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail to the appropriate state agency.

Following these steps can help streamline the process and increase the likelihood of a successful rebate claim.

Required Documents

When applying for the 104ptc, applicants must provide several supporting documents to verify their eligibility:

- A copy of the property tax statement or rental agreement.

- Proof of income, such as W-2 forms or tax returns.

- Identification documents, such as a driver's license or state ID.

Having these documents ready can expedite the application process and ensure compliance with state requirements.

Form Submission Methods

The 104ptc can be submitted through various methods to accommodate different preferences:

- Online submission via the state’s official website, which allows for quick processing.

- Mailing a hard copy of the completed form to the designated address provided on the form.

- In-person submission at local government offices, where assistance may be available.

Choosing the appropriate submission method can enhance the efficiency of the application process.

Legal use of the 104ptc

The 104ptc form is legally binding when completed and submitted according to state regulations. To ensure its validity, applicants must provide accurate information and comply with all eligibility criteria outlined by the Colorado Department of Revenue. The form must be signed and dated, affirming that the information provided is true and correct. Adhering to these legal requirements safeguards against potential penalties or issues during the review process.

Quick guide on how to complete 104ptc

Effortlessly Prepare 104ptc on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Handle 104ptc on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign 104ptc with Ease

- Obtain 104ptc and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important areas of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for providing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors necessitating the reprinting of new document copies. airSlate SignNow streamlines all your document management needs within a few clicks from any device you choose. Edit and electronically sign 104ptc and ensure flawless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 104ptc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PTC104 form and why is it important?

The PTC104 form is a crucial document used for various tax-related purposes. It allows businesses and individuals to report certain transactions accurately. Understanding the significance of the PTC104 form can help ensure compliance and avoid potential penalties.

-

How can airSlate SignNow help with the PTC104 form?

airSlate SignNow simplifies the process of filling out the PTC104 form by providing an intuitive e-signature solution. Users can easily create, send, and sign this form electronically, ensuring that it is completed accurately and returned promptly. Moreover, automating this process saves time and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing the PTC104 form?

With airSlate SignNow, users have access to customizable templates, secure storage, and real-time tracking for the PTC104 form. Users can collaborate with team members seamlessly, and the platform supports multi-party signatures, making the process efficient and hassle-free. These features ensure that the PTC104 form is handled professionally.

-

Is airSlate SignNow a cost-effective solution for handling the PTC104 form?

Yes, airSlate SignNow offers a range of pricing plans tailored to different business needs, making it a cost-effective solution for processing the PTC104 form. By reducing paper usage and streamlining the signing process, businesses can save on operational costs as well. The efficiency gained can lead to signNow time and cost savings in the long run.

-

Can I use airSlate SignNow for other forms besides the PTC104 form?

Absolutely! airSlate SignNow is versatile and can be used for a variety of documents, including contracts, agreements, and other tax forms like the PTC104 form. This flexibility allows businesses to centralize their document management, making it easier to maintain consistency and compliance across all paperwork.

-

What integrations does airSlate SignNow offer for managing the PTC104 form?

airSlate SignNow integrates seamlessly with popular business tools such as Microsoft Office, Salesforce, and Google Workspace. These integrations facilitate easy access to the PTC104 form within your existing workflows, enhancing productivity and collaboration among teams. Users can manage their documents more effectively through these integrations.

-

How secure is airSlate SignNow when handling the PTC104 form?

Security is a top priority for airSlate SignNow. The platform employs robust encryption protocols to protect all data, including the PTC104 form, during transmission and storage. Additionally, airSlate SignNow complies with industry-standard regulations to ensure that sensitive information remains confidential.

Get more for 104ptc

- Cmn for hospital bed form

- Authorization for free attendance at a widely form

- Free attendance at widely attended gathering wag or speaking engagement attach copy of event agenda and copy of invitation form

- Cdc checklist form

- Motion for temporary orders idaho form

- Texas court petition county form

- Massachusetts criminal record request form

- Step 1 for parties with common minor children packet saccourt ca form

Find out other 104ptc

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation