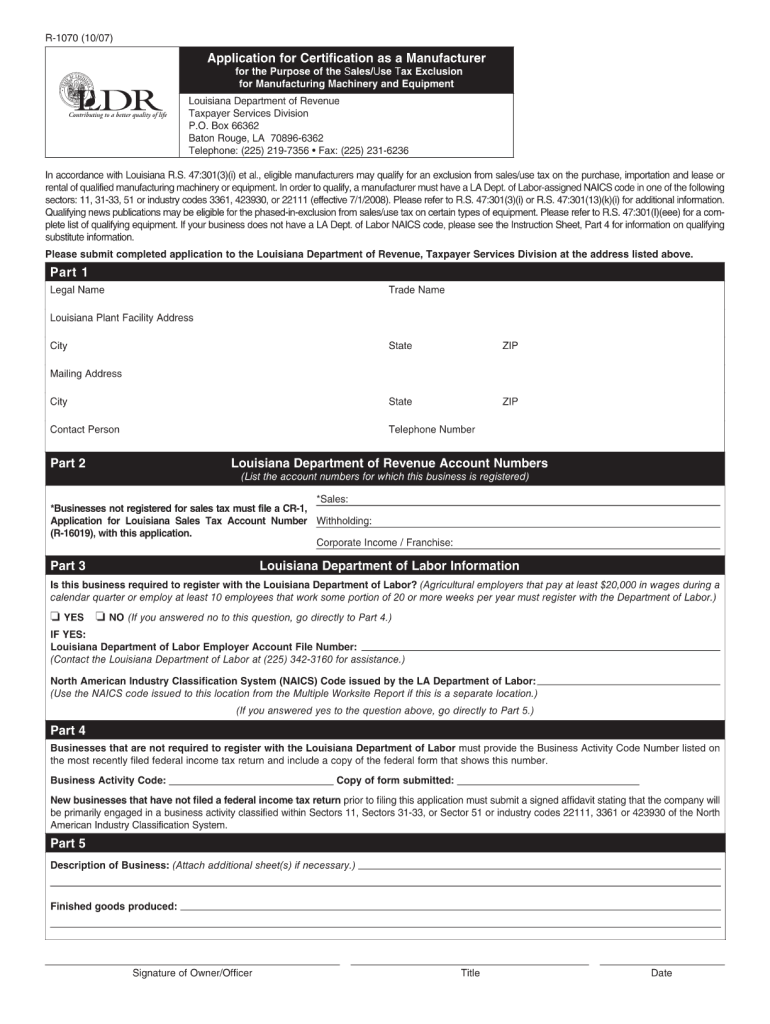

R 1070 Form

What is the R 1070?

The R 1070 form is a tax document utilized in the United States for specific reporting purposes. This form is often associated with various tax obligations and is essential for individuals and businesses to accurately report their financial activities to the Internal Revenue Service (IRS). Understanding the purpose of the R 1070 is crucial for compliance and ensuring that all necessary information is submitted correctly.

How to use the R 1070

Using the R 1070 form involves several steps to ensure proper completion and submission. First, gather all relevant financial documents and information that pertain to your tax situation. Next, fill out the form accurately, providing all required details. It is important to review the completed form for any errors before submission. Finally, submit the form to the appropriate IRS office by the designated deadline, either electronically or via mail, depending on your preference and eligibility.

Steps to complete the R 1070

Completing the R 1070 form requires careful attention to detail. Follow these steps for successful completion:

- Collect necessary financial documents, such as income statements and previous tax returns.

- Access the R 1070 form, either online or through a physical copy.

- Fill in personal information, including name, address, and Social Security number.

- Provide detailed financial information as required by the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, ensuring that all necessary signatures are included.

- Submit the form by the deadline, keeping a copy for your records.

Legal use of the R 1070

The R 1070 form is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal use, it is essential to comply with all relevant laws and guidelines governing tax reporting. This includes maintaining accurate records, filing within the specified deadlines, and ensuring that all information provided is truthful and complete. Non-compliance can lead to penalties and legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the R 1070 form can vary based on individual circumstances, such as whether you are an individual taxpayer or a business entity. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. It is important to stay informed about any changes to deadlines and to plan accordingly to avoid late penalties.

Required Documents

To complete the R 1070 form, certain documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Previous year’s tax returns for reference.

- Any supporting documentation related to deductions or credits claimed.

- Identification documents, such as a driver’s license or Social Security card.

Quick guide on how to complete r 1070

Complete R 1070 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage R 1070 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign R 1070 with ease

- Obtain R 1070 and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign R 1070 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 1070

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1070 form and how is it used?

A 1070 form is a specific document used for various administrative purposes, particularly in business and legal contexts. It typically requires signatures to verify authenticity and completion. Using airSlate SignNow, you can easily send and eSign your 1070 form securely and efficiently.

-

How does airSlate SignNow simplify the signing process for a 1070 form?

airSlate SignNow simplifies the signing process for a 1070 form by providing a user-friendly platform that allows both senders and signers to manage documents seamlessly. You can send reminders, track the status of your 1070 form, and store it securely within the application, thereby enhancing productivity.

-

What pricing options are available for airSlate SignNow in relation to the 1070 form?

AirSlate SignNow offers competitive pricing plans that cater to different business needs, including features specifically tailored for managing documents like the 1070 form. Whether you are a small business or a large enterprise, you can find a plan that aligns with your budget while providing essential signing capabilities.

-

Can I integrate airSlate SignNow with other software when managing 1070 forms?

Yes, airSlate SignNow allows for seamless integration with a variety of third-party applications, enhancing the management of your 1070 form. This includes integration with CRM systems, document management tools, and other workflow applications, ensuring that you can work efficiently across platforms.

-

What are the benefits of using airSlate SignNow for my 1070 form?

Using airSlate SignNow for your 1070 form streamlines the document management process, reduces turnaround time, and enhances compliance with eSignature laws. Additionally, users benefit from improved visibility and tracking of document status, which can signNowly improve organizational efficiency.

-

Is it safe to eSign a 1070 form with airSlate SignNow?

Absolutely! Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the 1070 form. Our platform uses advanced encryption technologies and complies with industry standards to ensure that your signed documents are safe and secure.

-

How quickly can I send and receive a signed 1070 form using airSlate SignNow?

You can send and receive a signed 1070 form almost instantly using airSlate SignNow. The platform is designed for efficiency, allowing signers to complete documents in just a few clicks, thus expediting the entire process from sending to signing.

Get more for R 1070

- Unless the insured designated otherwise you have four options option a alliance account this is an account opened for you by form

- Request for dual va employee and trainee appointment form

- Va form 4637

- Sglv 8286a election form

- 22 0997 vet tec pilot program training provider application form

- Cheyenne vamc demographic form

- Sglv 8714 application for veteransamp39 group life insurance benefits va form

- Ptsd checklist dsm 5 form

Find out other R 1070

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free