W7 Instructions Form

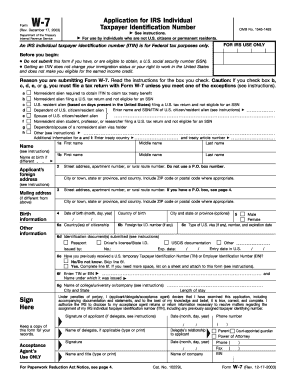

What are the W-7 Instructions?

The W-7 instructions provide essential guidance for individuals seeking to apply for an Individual Taxpayer Identification Number (ITIN) through Form W-7. This form is primarily used by non-resident aliens, their spouses, and dependents who need an ITIN for tax purposes. The instructions detail the eligibility criteria, required documentation, and the application process necessary to obtain an ITIN. Understanding these instructions is crucial for ensuring compliance with IRS regulations and facilitating accurate tax reporting.

Steps to Complete the W-7 Instructions

Completing the W-7 form involves several key steps. First, individuals must determine their eligibility for an ITIN. Next, they need to gather the necessary supporting documents, such as a valid passport or other identification. Once the documents are ready, fill out the W-7 form accurately, ensuring all information matches the supporting documents. After completing the form, review it for any errors or omissions. Finally, submit the W-7 form along with the required documents to the IRS either by mail or through an authorized acceptance agent.

Required Documents for the W-7 Instructions

To successfully complete the W-7 application, specific documents must be submitted. These include:

- A completed Form W-7.

- Proof of identity and foreign status, which can be established through documents such as a passport, national identification card, or birth certificate.

- Any additional documentation that supports the reason for needing an ITIN, such as a tax return.

It is essential to ensure that all documents are current and valid to avoid delays in processing.

Legal Use of the W-7 Instructions

The W-7 instructions are legally binding as they provide the framework for applying for an ITIN. Compliance with these instructions ensures that applicants meet IRS requirements, which can help avoid penalties or issues with tax filings. Understanding the legal implications of the W-7 form is vital for non-resident aliens and their dependents, as it affects their ability to fulfill tax obligations in the United States.

Filing Deadlines for the W-7 Instructions

Filing deadlines for the W-7 form are crucial for individuals needing an ITIN to file their taxes. Generally, the W-7 should be submitted along with the federal tax return by the tax filing deadline, which is typically April 15. However, if an extension is filed, the W-7 can be submitted with the extended return. It is important to be aware of these deadlines to ensure timely processing and avoid potential penalties.

Form Submission Methods for the W-7 Instructions

The W-7 form can be submitted through various methods to accommodate different preferences. Applicants may choose to:

- Mail the completed form and required documents directly to the IRS.

- Visit an IRS Taxpayer Assistance Center for in-person submission.

- Utilize an authorized acceptance agent who can assist with the application process.

Each method has its own processing times and requirements, so selecting the most suitable option is essential for a smooth application experience.

Quick guide on how to complete w7 instructions

Complete W7 Instructions effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage W7 Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and electronically sign W7 Instructions with ease

- Locate W7 Instructions and click on Get Form to begin.

- Make use of the tools available to fill out your document.

- Highlight essential sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign W7 Instructions to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w7 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the w7 instructions for eSigning documents?

The w7 instruction for eSigning documents refers to the process of electronically signing using airSlate SignNow. It simplifies the signing process by allowing users to complete and send documents easily, ensuring that all necessary information is filled out correctly before submission.

-

How much does airSlate SignNow cost for w7 instruction users?

Pricing for airSlate SignNow varies depending on the subscription plan chosen. Our substantial cost-effective solution allows users to efficiently manage document signing, including w7 instructions, while providing various features tailored to different business needs.

-

What features does airSlate SignNow offer specifically for w7 instructions?

AirSlate SignNow provides a range of features designed to enhance the w7 instruction process, including customizable templates, real-time tracking of document status, and robust security measures. These tools empower users to streamline their documentation workflow efficiently.

-

Can I integrate airSlate SignNow with other applications for w7 instruction?

Yes, airSlate SignNow allows integration with various applications to facilitate the w7 instruction process. Whether you're using CRM systems or cloud storage services, these integrations ensure that your document workflow remains seamless and efficient.

-

How does airSlate SignNow ensure compliance with w7 instructions?

AirSlate SignNow is designed to comply with industry standards, ensuring that all w7 instructions are followed accurately. Our platform includes features like audit trails and secure storage, which safeguard the integrity and legality of your electronic signatures.

-

What benefits can I expect from using airSlate SignNow for w7 instructions?

Using airSlate SignNow for w7 instructions offers numerous benefits such as increased efficiency, cost savings, and enhanced accuracy in document handling. With our user-friendly interface, businesses can reduce the time spent on paperwork and focus on core activities.

-

Is there a trial period available for w7 instruction on airSlate SignNow?

Yes, airSlate SignNow offers a free trial period that allows users to explore all the features including those related to w7 instructions. This trial enables prospective customers to experience the platform's functionality before making a financial commitment.

Get more for W7 Instructions

- Money tree payday loan form

- General paediatric consultation clinic referral form print

- Welcome to placer dermatology and skin care center form

- Direct transfer from grow financial federal credit union growfinancial form

- Diabetes form

- Mailing address if different from address form

- Schedule appointment request form

- La jolla gastroenterology medical group patient forms la

Find out other W7 Instructions

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form