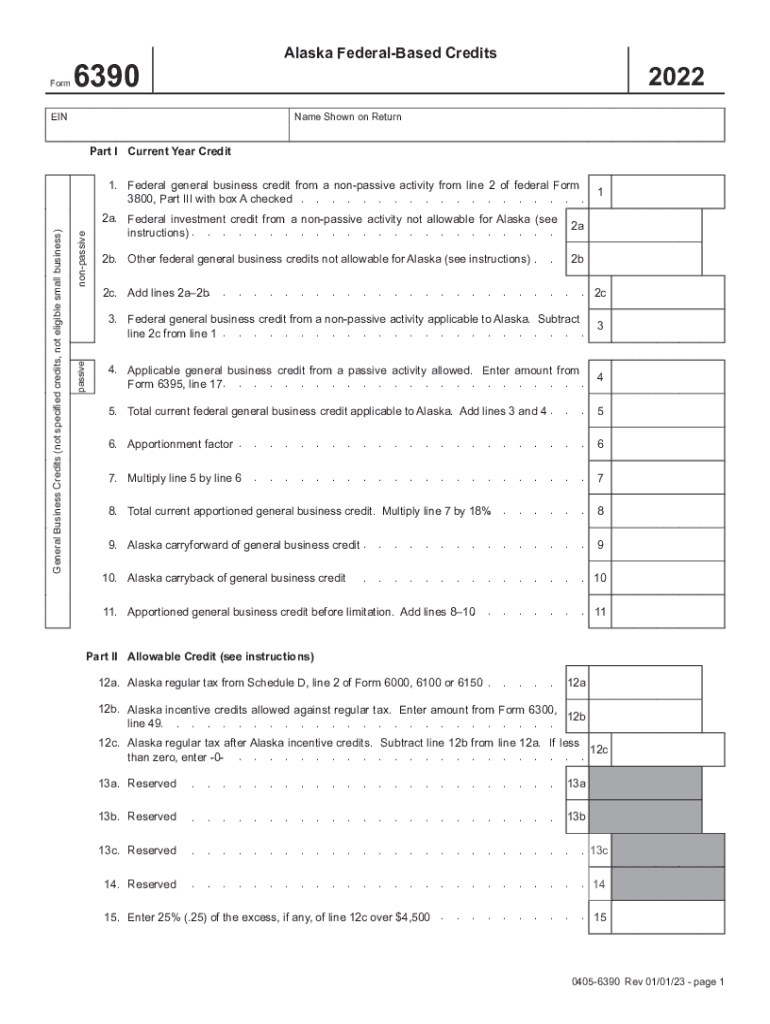

AK DoR 6390 Form 2022

What is the Form 3800?

The Form 3800, also known as the General Business Credit, is a tax form used by businesses in the United States to claim various tax credits. This form consolidates multiple credits into one, allowing businesses to reduce their tax liability effectively. The credits included can range from investment credits to credits for hiring certain employees. Understanding this form is essential for businesses looking to maximize their tax benefits and ensure compliance with IRS regulations.

How to Use the Form 3800

Using Form 3800 involves several steps to ensure accurate completion and submission. First, businesses must gather all necessary supporting documents related to the credits they intend to claim. This may include forms like the W-2 for employees or documentation for specific investments. Next, businesses fill out the form, detailing each credit and the corresponding amounts. After completing the form, it should be attached to the business's tax return, whether filed electronically or by mail. Careful attention to detail is crucial to avoid errors that could lead to delays or penalties.

Steps to Complete the Form 3800

Completing Form 3800 requires a systematic approach to ensure all information is accurate. Here are the steps to follow:

- Gather all necessary documentation for the credits you plan to claim.

- Fill out the top section with your business information, including name and Employer Identification Number (EIN).

- Complete the sections for each credit you are claiming, providing the required calculations and amounts.

- Double-check all entries for accuracy, ensuring that all supporting documents are included.

- Attach Form 3800 to your tax return when filing.

Legal Use of the Form 3800

The legal use of Form 3800 is governed by IRS regulations, which outline the eligibility criteria for each credit included on the form. Businesses must ensure they meet the specific requirements for the credits they are claiming to avoid issues with compliance. Additionally, maintaining accurate records and documentation is essential to substantiate the claims made on the form. Failure to comply with IRS rules can result in penalties or disallowance of credits.

Filing Deadlines / Important Dates

Filing deadlines for Form 3800 typically align with the due dates for business tax returns. For most businesses, this means the form should be filed by April 15 of the following tax year. However, if a business operates on a fiscal year, the deadline may differ. It is crucial for businesses to be aware of these dates to ensure timely submission and avoid penalties for late filings.

Required Documents

When preparing to file Form 3800, businesses must gather several required documents. These may include:

- Supporting documentation for each credit claimed, such as investment records or employee eligibility forms.

- Prior year tax returns, which may provide context for current claims.

- Any correspondence from the IRS regarding previous credits or audits.

Having these documents ready can streamline the filing process and help ensure compliance with IRS regulations.

Quick guide on how to complete ak dor 6390 form

Effortlessly Prepare AK DoR 6390 Form on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage AK DoR 6390 Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and Electronically Sign AK DoR 6390 Form Without Hassle

- Obtain AK DoR 6390 Form and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid files, arduous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign AK DoR 6390 Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ak dor 6390 form

Create this form in 5 minutes!

How to create an eSignature for the ak dor 6390 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alaska Form 6390 federal and how can airSlate SignNow help?

The Alaska Form 6390 federal is a specific document required for certain administrative tasks in Alaska. With airSlate SignNow, businesses can easily send and eSign this form, ensuring compliance while streamlining the process. Our platform simplifies the management of such documents, making it accessible and user-friendly.

-

How much does it cost to use airSlate SignNow for the Alaska Form 6390 federal?

The pricing for using airSlate SignNow varies based on the chosen plan, which includes a range of features suited for handling the Alaska Form 6390 federal. We offer competitive rates designed to fit different business needs. Additionally, a free trial is available, allowing you to explore our features before committing.

-

What features does airSlate SignNow provide for managing the Alaska Form 6390 federal?

airSlate SignNow offers several features including eSigning, document sharing, and real-time tracking specifically for managing the Alaska Form 6390 federal. Our platform also supports secure storage and seamless collaboration, enhancing the efficiency of your document workflows. These tools are designed to optimize the completion of federal forms easily.

-

Can I integrate airSlate SignNow with other applications for the Alaska Form 6390 federal?

Yes, airSlate SignNow allows integration with various third-party applications to facilitate the handling of the Alaska Form 6390 federal. This means you can sync data from other platforms, enhancing your workflow efficiency. Popular integrations include Google Drive, Dropbox, and CRM software.

-

Is airSlate SignNow compliant with federal regulations for the Alaska Form 6390?

Absolutely! airSlate SignNow is designed to comply with federal regulations regarding document signing, including the Alaska Form 6390 federal. Our platform ensures that all eSignature processes are legally binding and adhere to applicable standards, providing peace of mind for users.

-

What are the benefits of using airSlate SignNow for the Alaska Form 6390 federal?

Using airSlate SignNow for the Alaska Form 6390 federal offers numerous benefits, including faster processing times and reduced paper waste. The platform enables easy access to documents from anywhere, facilitating quicker approvals. Moreover, it enhances collaboration between teams ensuring that everyone stays informed.

-

How do I get started with airSlate SignNow for the Alaska Form 6390 federal?

Getting started with airSlate SignNow for the Alaska Form 6390 federal is straightforward. Simply sign up for an account on our website and select your preferred plan. Once registered, you can upload documents, including the Alaska Form 6390 federal, and begin the eSigning process right away.

Get more for AK DoR 6390 Form

Find out other AK DoR 6390 Form

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement