Md Tax Exempt Form

What is the Maryland Tax Exempt Form?

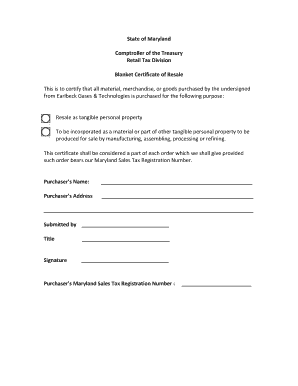

The Maryland tax exempt form, often referred to as the Maryland exemption certificate, is a document used by businesses and organizations to claim exemption from sales tax in the state of Maryland. This form is essential for entities that qualify for tax-exempt status, such as non-profit organizations, government agencies, and certain educational institutions. By submitting this form, eligible entities can purchase goods and services without paying sales tax, thereby reducing their overall operational costs.

How to Use the Maryland Tax Exempt Form

Using the Maryland tax exempt form is straightforward. Once you have obtained the form, fill it out with the required information, including the name of the exempt organization, the type of exemption being claimed, and the signature of an authorized representative. It is important to provide accurate details to avoid complications during transactions. After completing the form, present it to the seller at the time of purchase to ensure that sales tax is not applied to the transaction.

Steps to Complete the Maryland Tax Exempt Form

Completing the Maryland tax exempt form involves several key steps:

- Obtain the Maryland tax exempt form from a reliable source.

- Fill in the organization’s name and address accurately.

- Specify the type of exemption being claimed.

- Include the signature of an authorized representative.

- Double-check all entered information for accuracy.

- Provide the completed form to the seller during the purchase.

Legal Use of the Maryland Tax Exempt Form

The legal use of the Maryland tax exempt form is governed by state laws that define eligibility criteria for tax exemption. It is crucial for organizations to ensure they meet these criteria before using the form. Misuse of the form can lead to penalties, including fines and back taxes owed. Therefore, understanding the legal implications and ensuring compliance with Maryland state regulations is essential for any entity claiming tax exemption.

Key Elements of the Maryland Tax Exempt Form

Key elements of the Maryland tax exempt form include:

- Organization Name: The full legal name of the tax-exempt entity.

- Address: The physical address of the organization.

- Type of Exemption: A clear indication of the exemption status being claimed.

- Authorized Signature: A signature from an individual with the authority to act on behalf of the organization.

- Date: The date the form is completed and signed.

Eligibility Criteria for the Maryland Tax Exempt Form

Eligibility for using the Maryland tax exempt form typically includes non-profit organizations, government entities, and certain educational institutions. To qualify, these organizations must demonstrate that they operate for charitable, educational, or governmental purposes. It is important for entities to review the specific eligibility criteria outlined by the Maryland Comptroller’s office to ensure compliance and avoid potential issues when claiming tax exemption.

Quick guide on how to complete md tax exempt form

Handle Md Tax Exempt Form effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to obtain the correct form and safely archive it online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents swiftly without delays. Manage Md Tax Exempt Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Md Tax Exempt Form with ease

- Locate Md Tax Exempt Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Md Tax Exempt Form and ensure effective communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the md tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland tax exempt form PDF used for?

The Maryland tax exempt form PDF is used by eligible organizations and individuals to claim exemption from state sales tax on qualifying purchases. This ensures that tax-exempt entities can conduct their business without incurring unnecessary expenses. By using this form, you can streamline your purchasing process and ensure compliance with Maryland tax regulations.

-

How can I fill out the Maryland tax exempt form PDF using airSlate SignNow?

You can easily fill out the Maryland tax exempt form PDF using airSlate SignNow's intuitive platform. Simply upload the PDF document, add the necessary fields, and fill in the required information. Once completed, the form can be saved, shared, or signed electronically, making the process hassle-free.

-

Is there a cost associated with using airSlate SignNow for the Maryland tax exempt form PDF?

airSlate SignNow offers a range of pricing plans to fit different business needs, including access to features for managing the Maryland tax exempt form PDF. The platform is designed to be cost-effective, allowing you to choose the plan that best suits your requirements. Check our pricing page for more details on the available subscriptions.

-

Can I use airSlate SignNow on mobile devices for the Maryland tax exempt form PDF?

Yes, airSlate SignNow is fully compatible with mobile devices, enabling you to manage your Maryland tax exempt form PDF on the go. Whether you're using a smartphone or tablet, you can fill out, sign, and send the form directly from your device. This provides flexibility and convenience for busy professionals.

-

What features does airSlate SignNow offer for managing the Maryland tax exempt form PDF?

airSlate SignNow provides several features to enhance the management of the Maryland tax exempt form PDF, including eSignature capabilities, templates, and document tracking. These features help streamline document workflows, ensuring that you can quickly obtain the necessary approvals. Additionally, the platform allows for easy collaboration with team members.

-

How secure is airSlate SignNow when handling the Maryland tax exempt form PDF?

airSlate SignNow prioritizes security and compliance, ensuring that your Maryland tax exempt form PDF and other documents are handled with the utmost care. The platform employs advanced encryption and data protection measures to safeguard your information. You can trust that sensitive data remains confidential and secure.

-

Can I integrate airSlate SignNow with other tools for my Maryland tax exempt form PDF?

Yes, airSlate SignNow offers various integrations with other business tools to enhance your workflow concerning the Maryland tax exempt form PDF. You can connect it with CRM systems, cloud storage platforms, and more, making document management and collaboration seamless across your organization. Check our integration options for details.

Get more for Md Tax Exempt Form

- Non resident pharmacy notification form

- Pharmacy board 4001 w valhalla blvd sioux falls sd drug form

- 4001 w valhalla blvd suite 106 form

- Tennessee conservatorship forms

- Tennessee birth certificate application pdf form

- Ems form

- G5098231preceptor application 00del1025 updated summary health tn form

- Miller am and warren md tennessee department of tngov form

Find out other Md Tax Exempt Form

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template