1099g Maryland Form

What is the 1099g Maryland

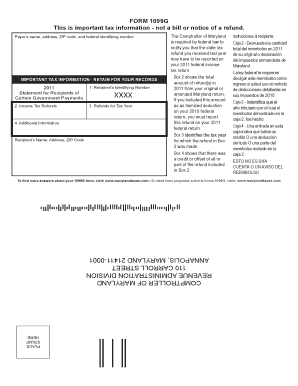

The 1099g form in Maryland is a tax document used to report certain types of income received by individuals and businesses. This includes unemployment compensation, state tax refunds, and other government payments. The form is essential for taxpayers to accurately report their income to the Internal Revenue Service (IRS) and ensure compliance with state tax regulations. Understanding the purpose of the 1099g is crucial for proper tax filing and avoiding potential penalties.

How to obtain the 1099g Maryland

To obtain the 1099g form in Maryland, taxpayers can access it online through the Maryland Comptroller's website. Alternatively, individuals may receive the form by mail if they have previously reported income that necessitates a 1099g. It is important to check the mailing address on file with the state to ensure timely receipt. If you did not receive your 1099g, you can contact the Comptroller's office for assistance in obtaining a copy.

Steps to complete the 1099g Maryland

Completing the 1099g form in Maryland involves several key steps:

- Gather necessary information, including your Social Security number, the amount of income received, and any relevant tax identification numbers.

- Access the 1099g form online or use a printed version.

- Fill in your personal information at the top of the form, ensuring accuracy to avoid processing delays.

- Report the income amounts in the appropriate boxes, including any state tax refunds or unemployment compensation.

- Review the completed form for accuracy, ensuring all information is correct.

- Submit the form either electronically through a secure platform or by mailing it to the appropriate tax authority.

Legal use of the 1099g Maryland

The 1099g form in Maryland is legally binding when completed correctly and submitted on time. Compliance with federal and state tax laws is essential to avoid penalties. The form must be filed accurately to reflect the income received, as discrepancies can lead to audits or additional tax liabilities. Utilizing a reliable eSignature platform can enhance the legal standing of the document, ensuring that it meets all necessary electronic signature requirements.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the 1099g form in Maryland:

- Online Submission: Taxpayers can complete and submit the form electronically through the Maryland Comptroller's website, which offers a secure and efficient process.

- Mail Submission: Completed forms can be printed and sent via postal service to the designated address provided by the Comptroller's office.

- In-Person Submission: Individuals may also choose to deliver their forms in person at local Comptroller offices, where staff can assist with the filing process.

Who Issues the Form

The 1099g form in Maryland is issued by the Comptroller of Maryland. This office is responsible for managing state tax collection and ensuring compliance with tax laws. Taxpayers can rely on the Comptroller's office for accurate information regarding the issuance of 1099g forms, including any updates or changes to reporting requirements. It is advisable to stay informed about any communications from the Comptroller regarding the form to ensure timely and accurate filing.

Quick guide on how to complete 1099g maryland

Complete 1099g Maryland effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without any holdups. Handle 1099g Maryland on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to alter and eSign 1099g Maryland with ease

- Obtain 1099g Maryland and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Select pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign 1099g Maryland to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099g maryland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Maryland 1099G form?

The Maryland 1099G form is a state tax document that reports the total taxable income received from the state, such as unemployment benefits or other government payments. It's important for taxpayers to understand their Maryland 1099G forms for accurate filing and to avoid any penalties.

-

How can I access my Maryland 1099G form?

You can access your Maryland 1099G form online through the Maryland State Comptroller's website or directly via your employer or the agency that issued the payment. It’s essential to keep your information updated to receive your Maryland 1099G in a timely manner.

-

Is there a fee to obtain a Maryland 1099G form?

There is no fee for obtaining your Maryland 1099G form from the state; it is available for free online. However, if you need assistance or additional services related to your form, there may be associated costs depending on the service you choose.

-

How do I eSign my Maryland 1099G form with airSlate SignNow?

With airSlate SignNow, you can easily eSign your Maryland 1099G form by uploading the document and inviting others to sign electronically. The platform provides a secure and efficient way to handle document signing, ensuring you meet submission deadlines effortlessly.

-

What features does airSlate SignNow offer for managing Maryland 1099G forms?

airSlate SignNow offers features like customizable templates, automated reminders, and real-time tracking, making the management of Maryland 1099G forms seamless. You can also integrate it with other applications to streamline your workflow further.

-

Can I utilize airSlate SignNow for multiple Maryland 1099G forms?

Yes, airSlate SignNow allows you to manage and send multiple Maryland 1099G forms efficiently. You can create bulk invites and track the status of each document, which is particularly beneficial during tax season.

-

What are the benefits of using airSlate SignNow for my Maryland 1099G forms?

Using airSlate SignNow for your Maryland 1099G forms simplifies the signing process, reduces paper waste, and saves time. The platform’s user-friendly interface ensures that both senders and recipients can complete forms quickly and securely.

Get more for 1099g Maryland

- Student business services ttuhsc texas tech university form

- Motor vehicle record consent form students villanova university

- Veterans sheet form

- Form wc 117h state of michigan

- Asu diploma form

- International exchange student application for admission form

- Master of social work bowling green state university form

- Ivy tech view unofficial transcript form

Find out other 1099g Maryland

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF