Self Assessment Company Returnpdf Malawi Revenue Authority Form

What is the Self Assessment Company Returnpdf Malawi Revenue Authority

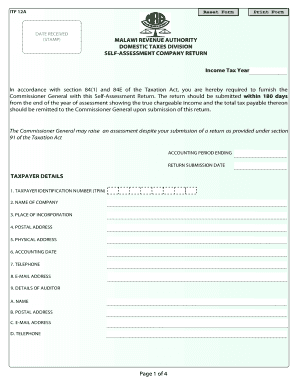

The Self Assessment Company Returnpdf from the Malawi Revenue Authority is a crucial document for businesses operating in Malawi. This form is used by companies to report their income and calculate the tax owed to the government. It serves as a self-assessment tool, allowing businesses to declare their earnings, expenses, and other financial information necessary for tax purposes. Understanding this form is essential for compliance with local tax laws and regulations.

Steps to complete the Self Assessment Company Returnpdf Malawi Revenue Authority

Completing the Self Assessment Company Returnpdf requires careful attention to detail. Here are the key steps to follow:

- Gather all necessary financial documents, including income statements, balance sheets, and expense reports.

- Access the Self Assessment Company Returnpdf form from the Malawi Revenue Authority's official website.

- Fill out the form accurately, ensuring all income and expenses are reported correctly.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, depending on your preference.

Legal use of the Self Assessment Company Returnpdf Malawi Revenue Authority

The Self Assessment Company Returnpdf is legally binding when filled out and submitted correctly. It is essential for businesses to understand the legal implications of the information provided. The form must comply with local tax laws, and any inaccuracies can lead to penalties. Utilizing a reliable digital solution, such as eSigning software, can enhance the legal validity of the document by ensuring secure and compliant submissions.

Required Documents

To complete the Self Assessment Company Returnpdf, several documents are typically required:

- Income statements detailing all revenue sources.

- Expense reports outlining all business-related costs.

- Previous tax returns for reference.

- Any additional documentation that supports claims made on the return.

Form Submission Methods

The Self Assessment Company Returnpdf can be submitted through various methods to accommodate different preferences:

- Online submission via the Malawi Revenue Authority's official platform.

- Mailing a printed copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if preferred.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Self Assessment Company Returnpdf can result in significant penalties. Businesses may face fines, interest on unpaid taxes, or even legal action for persistent non-compliance. It is crucial for companies to understand their obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete self assessment company returnpdf malawi revenue authority

Prepare Self Assessment Company Returnpdf Malawi Revenue Authority seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and safely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Self Assessment Company Returnpdf Malawi Revenue Authority on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Self Assessment Company Returnpdf Malawi Revenue Authority effortlessly

- Obtain Self Assessment Company Returnpdf Malawi Revenue Authority and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature utilizing the Sign tool, which takes mere seconds and holds the same legal authority as a standard wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or disorganized documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Self Assessment Company Returnpdf Malawi Revenue Authority and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the self assessment company returnpdf malawi revenue authority

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Self Assessment Company Returnpdf for Malawi Revenue Authority?

A Self Assessment Company Returnpdf is a document that businesses in Malawi must submit to the Malawi Revenue Authority. This document provides a comprehensive overview of a company's income, expenses, and tax obligations. Submitting this return correctly is crucial for compliance and can help avoid penalties.

-

How can airSlate SignNow help me with my Self Assessment Company Returnpdf?

airSlate SignNow streamlines the process of preparing and submitting your Self Assessment Company Returnpdf to the Malawi Revenue Authority. Our platform allows you to easily fill out forms, securely eSign documents, and send them to the relevant authorities. This simplifies your tax submission process and saves valuable time.

-

What features does airSlate SignNow offer for submitting Self Assessment Company Returnpdf?

airSlate SignNow offers a variety of features designed to assist with your Self Assessment Company Returnpdf. You can utilize customizable templates, electronic signatures, and automatic alerts for submission deadlines. These features ensure that your submissions are accurate and timely.

-

Is airSlate SignNow a cost-effective solution for managing Self Assessment Company Returnpdf?

Yes, airSlate SignNow is a cost-effective solution for managing your Self Assessment Company Returnpdf. Our pricing plans are designed to fit small to large businesses, ensuring you get the best value for your document management needs. Investing in our services can result in signNow savings on time and resources.

-

Can I integrate airSlate SignNow with other tools for managing Self Assessment Company Returnpdf?

Absolutely! airSlate SignNow integrates seamlessly with various applications that can help you manage your Self Assessment Company Returnpdf. This includes accounting software and cloud storage solutions, allowing for a more synchronized and efficient workflow.

-

What are the benefits of using airSlate SignNow for Self Assessment Company Returnpdf?

Using airSlate SignNow for your Self Assessment Company Returnpdf provides multiple benefits, including enhanced security, ease of use, and improved compliance with the Malawi Revenue Authority. The platform simplifies document management, making it easier for businesses to keep records and stay organized.

-

How secure is airSlate SignNow when handling Self Assessment Company Returnpdf?

Security is a top priority for airSlate SignNow when handling your Self Assessment Company Returnpdf. We implement advanced encryption protocols and secure data storage practices to protect your sensitive information. Our compliance with industry standards ensures that your documents are safe and secure.

Get more for Self Assessment Company Returnpdf Malawi Revenue Authority

- Wwwuslegalformscom387101 zero income formzero income form fill and sign printable template online

- Written statement from employer form

- Mi sales tax form 3421

- Schedulewpdf reset form schedule w michigan department

- The purpose of this checklist is to assist ucf employees and departments with the process when an form

- Pi 1464 wisconsin department of public instruction form

- Application agreement policy statement dpi wi doc form

- Alternate sfa agreementwisconsin department of public instruction form

Find out other Self Assessment Company Returnpdf Malawi Revenue Authority

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online

- How To Fax Sign PDF