Form Ct 592

What is the Form CT 592

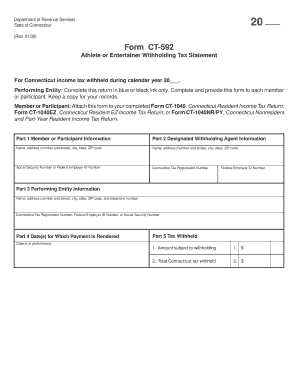

The Form CT 592 is a tax document used in the state of Connecticut. It is primarily utilized for reporting and withholding income tax for non-resident individuals and entities that receive income from Connecticut sources. This form helps ensure that the appropriate amount of tax is withheld from payments made to non-residents, aligning with state tax laws. Understanding the specific purpose of the form is crucial for compliance and accurate reporting.

How to use the Form CT 592

Using the Form CT 592 involves several key steps. First, gather all necessary information regarding the non-resident payee, including their name, address, and taxpayer identification number. Next, accurately report the income being paid and calculate the withholding amount based on the applicable tax rates. After completing the form, it must be submitted to the Connecticut Department of Revenue Services along with the withheld tax payment. Proper use of this form ensures compliance with state tax regulations.

Steps to complete the Form CT 592

Completing the Form CT 592 requires attention to detail. Here are the essential steps:

- Begin by entering the payer's information, including name and address.

- Provide the non-resident payee's details, ensuring accuracy in their identification.

- Report the total income paid to the non-resident.

- Calculate the withholding tax based on the income reported.

- Sign and date the form to certify that the information is correct.

Following these steps will help ensure that the form is filled out correctly and submitted on time.

Legal use of the Form CT 592

The Form CT 592 is legally binding when filled out and submitted according to Connecticut tax laws. It serves as a formal record of income paid to non-residents and the corresponding tax withheld. Compliance with the legal requirements surrounding this form is essential to avoid penalties and ensure that tax obligations are met. Utilizing a reliable eSignature solution can further enhance the legal validity of the completed form.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 592 are crucial for compliance. Typically, the form must be submitted along with the withheld tax payment by the 15th day of the month following the payment to the non-resident. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or updates in state tax policy.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 592 can be submitted through various methods, ensuring flexibility for users. It can be filed online through the Connecticut Department of Revenue Services website, allowing for quick processing. Alternatively, the form can be mailed to the appropriate state office or submitted in person at designated locations. Choosing the right submission method can help streamline the process and ensure timely compliance.

Quick guide on how to complete form ct 592

Effortlessly Prepare Form Ct 592 on Any Device

The management of documents online has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the required form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form Ct 592 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Form Ct 592 with Ease

- Find Form Ct 592 and click on Get Form to initiate the process.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign Form Ct 592 and guarantee seamless communication at any stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 592

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 592 and why is it important?

Form CT 592 is a tax document utilized in Connecticut for reporting income and withholding for certain pass-through entities. Understanding how to accurately complete Form CT 592 is crucial for compliance with state tax laws and avoiding potential penalties.

-

How can airSlate SignNow help with completing Form CT 592?

airSlate SignNow streamlines the process of filling out Form CT 592 by providing customizable templates and eSignature capabilities. This allows businesses to prepare, sign, and send documents securely and efficiently without physical paperwork.

-

Is there a cost associated with using airSlate SignNow for Form CT 592?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. These plans provide access to features that make handling Form CT 592 and other documents both cost-effective and user-friendly.

-

What features does airSlate SignNow offer for managing Form CT 592?

With airSlate SignNow, users can benefit from features like customizable templates, automated workflows, secure sharing, and tracking. These features signNowly simplify the management of Form CT 592 and enhance productivity.

-

Can I integrate airSlate SignNow with other applications for handling Form CT 592?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and others. This allows for more efficient document management and easier access to Form CT 592 as part of your overall workflow.

-

How secure is airSlate SignNow when dealing with Form CT 592?

Security is a top priority for airSlate SignNow, which utilizes advanced encryption methods and secure servers to protect sensitive information. When managing Form CT 592, users can trust that their data is kept confidential and secure.

-

Is it easy to collaborate with others on Form CT 592 using airSlate SignNow?

Absolutely! airSlate SignNow allows for real-time collaboration on Form CT 592, enabling multiple users to review and sign documents simultaneously. This feature greatly enhances communication and speeds up the overall process.

Get more for Form Ct 592

- Complaint custody 569042778 form

- 2021 first time homebuyer credit form

- Notary application form rhode island department of state

- Application notary form

- Safetyservice organization special license plate application form

- Tdhca complaint form

- What to expect from the complaint process form

- Minnesota civil cover sheet form

Find out other Form Ct 592

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe