T183 Form

What is the T183 Form

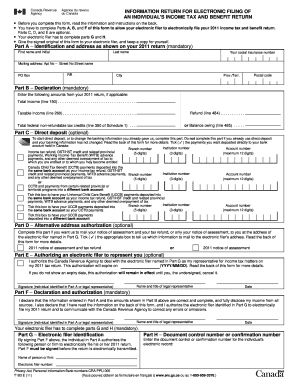

The T183 form, also known as the T183 signature form, is a crucial document used in the Canadian tax system. It is specifically designed for individuals who wish to authorize a third party, such as a tax professional, to file their income tax return electronically on their behalf. This form ensures that the taxpayer's consent is obtained, allowing the designated representative to access and submit sensitive information securely.

How to use the T183 Form

To use the T183 form effectively, taxpayers need to complete it accurately and submit it to the Canada Revenue Agency (CRA) along with their electronic tax return. The form requires personal information, including the taxpayer's name, address, and Social Insurance Number (SIN). Additionally, the taxpayer must provide details about the representative, including their name and contact information. Once completed, both the taxpayer and the representative must sign the form to validate the authorization.

Steps to complete the T183 Form

Completing the T183 form involves several key steps:

- Gather necessary personal information, including your SIN and contact details.

- Provide the representative's information, ensuring accuracy in their name and contact details.

- Review the completed form for any errors or omissions.

- Sign the form to validate your consent.

- Submit the form electronically alongside your tax return.

Legal use of the T183 Form

The T183 form is legally binding, provided it is completed and signed correctly. It complies with the requirements set forth by the CRA for electronic filing. The form protects both the taxpayer and the representative by ensuring that the authorization is documented and verifiable. Using the T183 form helps prevent unauthorized access to sensitive tax information, thereby enhancing the security of the filing process.

Key elements of the T183 Form

Several key elements must be included in the T183 form for it to be valid:

- Taxpayer Information: Full name, address, and SIN.

- Representative Information: Name and contact details of the individual authorized to file.

- Signatures: Both the taxpayer and the representative must sign the form.

- Consent Statement: A declaration affirming that the taxpayer authorizes the representative to file on their behalf.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the T183 form. Typically, the form must be submitted by the tax filing deadline, which is usually April 30 for most individual taxpayers. However, if the taxpayer or their spouse/common-law partner is self-employed, the deadline extends to June 15. Ensuring timely submission of the T183 form is crucial to avoid penalties and ensure compliance with CRA regulations.

Quick guide on how to complete t183 form

Prepare T183 Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, alter, and eSign your documents quickly and without delays. Manage T183 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest method to modify and eSign T183 Form with ease

- Obtain T183 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements with just a few clicks from any device you prefer. Adjust and eSign T183 Form and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t183 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t183 form and why is it important?

The t183 form is a crucial document used in the context of tax preparation in Canada. It serves as a declaration that the taxpayer authorizes their representative to file tax returns on their behalf. Understanding the t183 form is essential for ensuring compliance with tax regulations.

-

How can airSlate SignNow help with the t183 form?

airSlate SignNow simplifies the process of completing and eSigning the t183 form. Our platform allows users to easily upload, fill out, and send the t183 form securely. This enhances the efficiency of tax filing processes for both individuals and tax professionals.

-

What are the pricing options for using airSlate SignNow for the t183 form?

airSlate SignNow offers various pricing plans designed to accommodate different needs. Whether you're an individual or a business, our plans are cost-effective, enabling you to access the features needed for managing documents like the t183 form. Visit our pricing page for detailed options.

-

Is it easy to integrate airSlate SignNow with existing systems for the t183 form?

Yes, airSlate SignNow easily integrates with various platforms and applications, making it convenient to manage the t183 form alongside your existing systems. This seamless integration helps streamline workflows and improves overall document management efficiency.

-

What are the benefits of using airSlate SignNow for signing the t183 form?

Using airSlate SignNow to sign the t183 form offers numerous benefits including enhanced security, reduced processing time, and improved organization. Our solution ensures that your documents are signed quickly and stored securely, ensuring peace of mind during tax season.

-

Can I access the t183 form on mobile using airSlate SignNow?

Absolutely! airSlate SignNow is accessible on both desktop and mobile devices, allowing you to manage the t183 form from anywhere. Our mobile app ensures that you can eSign documents on-the-go, making tax preparation more convenient.

-

Are there any limits on the number of t183 forms I can send or sign using airSlate SignNow?

No, airSlate SignNow does not impose strict limits on the number of t183 forms you can send or sign. Depending on your chosen plan, you can manage as many documents as needed, ensuring you have the flexibility to handle all your tax filing requirements.

Get more for T183 Form

- Client intake form hypnosis and past life regression therapy

- Alg ii hauptantrag antrag auf leistungen zur sicherung des lebensunterhalts nach dem zweiten buch sozialgesetzbuch sgb ii form

- Cigna vision claim form

- Lominger competencies excel form

- Pharmacy transfer request form

- Prijava injenica bitnih za oporezivanje excel form

- Business license application bcoloradobgov colorado form

- Gid 110 al form

Find out other T183 Form

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free