Income Tax and Benefit Return T1 GENERAL All in One Index Form

Understanding the T1 General Income Tax and Benefit Return

The T1 General form is a crucial document for individuals in the United States who need to report their income and calculate their tax obligations. This form is utilized for personal income tax returns and includes various sections that address different types of income, deductions, and credits. Understanding the components of the T1 General form is essential for accurate filing and compliance with tax regulations.

Steps to Complete the T1 General Form

Completing the T1 General form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including income statements, receipts for deductions, and any relevant tax credits. Next, fill out the form methodically, starting with personal information, followed by income details, deductions, and credits. It is advisable to double-check each entry for accuracy before submission. Finally, choose your submission method—whether online, by mail, or in person—and ensure that you meet all filing deadlines.

Required Documents for the T1 General Form

To successfully complete the T1 General form, specific documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Receipts for deductible expenses

- Records of tax credits claimed

- Any prior year tax returns for reference

Having these documents organized will streamline the filing process and help ensure that all income and deductions are accurately reported.

Legal Use of the T1 General Form

The T1 General form is legally recognized for reporting income and calculating taxes owed to the government. It is essential to complete this form accurately to avoid penalties and ensure compliance with tax laws. E-signatures are accepted for electronic submissions, provided that they meet the legal standards set by the IRS and state regulations. Using a reliable e-signature service can enhance the security and validity of your submission.

Filing Deadlines for the T1 General Form

Timely filing of the T1 General form is crucial to avoid late fees and penalties. The standard deadline for submission is typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines or extensions that may occur, especially in response to unforeseen circumstances.

Examples of Using the T1 General Form

The T1 General form can be utilized in various scenarios, including:

- Individuals reporting wages from employment

- Self-employed individuals calculating their business income

- Students claiming education-related tax credits

- Retirees reporting pension income

Each of these scenarios may require specific documentation and considerations, making it important to understand how the T1 General form applies to your unique situation.

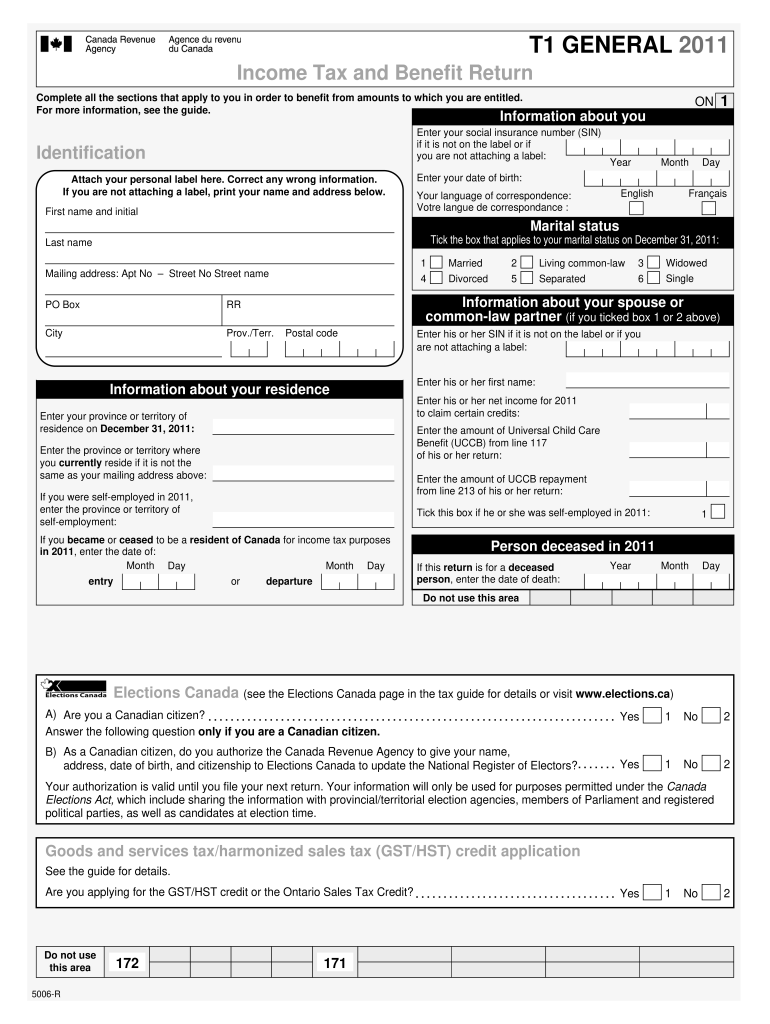

Quick guide on how to complete income tax and benefit return t1 general 2011 all in one index

Complete Income Tax And Benefit Return T1 GENERAL All In One Index effortlessly on any device

Managing documents online has gained popularity among enterprises and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, enabling you to obtain the correct form and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Income Tax And Benefit Return T1 GENERAL All In One Index on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Income Tax And Benefit Return T1 GENERAL All In One Index with ease

- Obtain Income Tax And Benefit Return T1 GENERAL All In One Index and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and eSign Income Tax And Benefit Return T1 GENERAL All In One Index while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

What ITR form should one fill to file his income tax returns in India for AY 2018-19 if he is a salaried employee and he also owns a sole proprietorship firm?

ITR 3 or 4 will be applicable.Accounting for the firm should be properly done and financial statements should be adequately prepared for the purpose of recording it in the ITR. Any TDS deducted on the incomes should also be properly captured in the ITR.Best regards,Aditiaditi.bhardwaj@outlook.com

-

If I am living in UK with T2 General visa and work as a contractor for a US company with W-8BEN form filled out, do I still need to pay income tax to the UK government?

Yes.Every country in the world taxes people who live there. The US (which claims global jurisdiction over its citizens) taxes you because you are a citizen, the UK (which accepts that its jurisdiction stops at its own border, like every other country except the US) taxes you because you are present and earning money.But you don’t pay tax twice.The UK gets the first bite of the cherry - you’re living there, so you should pay towards public services. If you’re resident, you are taxed like the British taxpayers alongside whom you work, except if you have US investment or rental income that you don’t transfer or remit to the UK, special rules for ‘non-domiciled’ visitors may mean there’s no UK tax on this non-UK income (this is a complex area - take proper advice).You then report all your income to Uncle Sam too. The IRS lets you exclude a certain amount of foreign earned income for US tax purposes (up to $103,900 for 2018). If, even with the exclusion, you still owe US income taxes on your UK compensation, you should be able to claim a credit for UK taxes paid that reduces your US tax liability.Again, this is a complex area - take proper advice.It’s actually even more complex, because social security taxes operate under different rules. You should pay in only the UK or the US, but which country’s rules apply depends on the exact circumstances and how they fit with the US-UK bilateral social security treaty.Take advice (I hope that is clear by now!).

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the income tax and benefit return t1 general 2011 all in one index

How to create an eSignature for the Income Tax And Benefit Return T1 General 2011 All In One Index in the online mode

How to generate an eSignature for the Income Tax And Benefit Return T1 General 2011 All In One Index in Google Chrome

How to generate an electronic signature for putting it on the Income Tax And Benefit Return T1 General 2011 All In One Index in Gmail

How to create an eSignature for the Income Tax And Benefit Return T1 General 2011 All In One Index from your mobile device

How to generate an eSignature for the Income Tax And Benefit Return T1 General 2011 All In One Index on iOS

How to create an eSignature for the Income Tax And Benefit Return T1 General 2011 All In One Index on Android OS

People also ask

-

What is a t1 document template?

A t1 document template is a customizable file designed for specific projects or purposes, allowing users to streamline document creation. With airSlate SignNow, you can easily create, edit, and manage your t1 document templates to enhance your workflow. This capability ensures efficiency and minimizes repetitive tasks.

-

How can I create a t1 document template using airSlate SignNow?

Creating a t1 document template in airSlate SignNow is straightforward. Simply log in to your account, navigate to the templates section, and select 'Create New Template.' You can then customize the template with your designs and fields, ensuring it fits your specific requirements.

-

What features are included with the t1 document template in airSlate SignNow?

The t1 document template in airSlate SignNow includes features such as drag-and-drop editing, reusable fields, and collaboration tools. These features ensure that your documents are personalized and that multiple stakeholders can contribute efficiently. Additionally, eSignature capabilities simplify the signing process for all parties.

-

Is airSlate SignNow's t1 document template solution cost-effective?

Yes, airSlate SignNow offers a cost-effective solution for t1 document templates, empowering businesses to save on time and resources. The pricing plans are designed to fit various budgets, ensuring you can access essential features without overspending. This affordability, combined with its robust capabilities, maximizes your return on investment.

-

Can I integrate the t1 document template with other apps?

Absolutely! airSlate SignNow supports various integrations with applications such as Salesforce, Google Drive, and Microsoft Office, allowing you to use the t1 document template seamlessly across platforms. This facilitates better workflow and document management while enhancing productivity across your organization.

-

What benefits do I gain by using a t1 document template?

Using a t1 document template simplifies document creation and reduces errors in the signing process. It enables consistent branding and messaging across documents, enhancing professionalism. Additionally, it saves time, allowing employees to focus on more critical tasks while ensuring compliance and accuracy.

-

Are there any templates available for specific industries?

Yes, airSlate SignNow provides a variety of pre-built t1 document templates tailored for different industries, including real estate, healthcare, and finance. These templates are designed to meet industry-specific needs and compliance standards, making it easier for you to adapt them to your business.

Get more for Income Tax And Benefit Return T1 GENERAL All In One Index

Find out other Income Tax And Benefit Return T1 GENERAL All In One Index

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy