Multi Jurisdiction Tax Exempt Form

What is the Multi Jurisdiction Tax Exempt Form

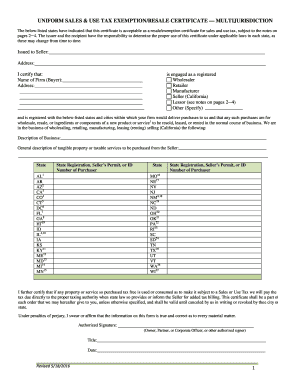

The multi jurisdiction tax exempt form is a specialized document that allows businesses and individuals to claim exemption from certain taxes across multiple jurisdictions. This form is particularly relevant for entities operating in various states or regions, as it helps streamline the tax exemption process. By providing the necessary information and documentation, taxpayers can ensure compliance with local tax regulations while benefiting from applicable exemptions.

How to Use the Multi Jurisdiction Tax Exempt Form

Using the multi jurisdiction tax exempt form involves several steps to ensure accurate completion and submission. First, identify the specific jurisdictions where tax exemption is sought. Next, gather all required documentation, including proof of eligibility and any supporting materials. Once the form is filled out, review it for accuracy before submitting it to the relevant tax authorities. It is essential to keep a copy of the submitted form for your records.

Steps to Complete the Multi Jurisdiction Tax Exempt Form

Completing the multi jurisdiction tax exempt form requires attention to detail. Begin by providing your name, address, and taxpayer identification number. Then, specify the type of tax exemption being claimed and the jurisdictions involved. Include any necessary documentation that supports your claim. After filling in all required fields, double-check for completeness and accuracy. Finally, sign and date the form before submission.

Legal Use of the Multi Jurisdiction Tax Exempt Form

The legal use of the multi jurisdiction tax exempt form is governed by state and federal tax laws. To be considered valid, the form must be completed accurately and submitted to the appropriate tax authorities. Failure to comply with legal requirements can result in penalties or denial of the exemption. It is crucial to understand the specific regulations in each jurisdiction to ensure that the form is used correctly.

Eligibility Criteria

Eligibility for the multi jurisdiction tax exempt form varies by jurisdiction and the type of exemption being claimed. Generally, businesses and individuals must meet specific criteria, such as being registered in the jurisdiction or engaging in activities that qualify for tax exemption. Common examples include non-profit organizations, educational institutions, and certain types of businesses. It is important to review the eligibility requirements for each jurisdiction before applying.

Form Submission Methods

The multi jurisdiction tax exempt form can typically be submitted through various methods, including online, by mail, or in person. Online submissions are often the fastest and most efficient way to file, as they can reduce processing times. If submitting by mail, ensure that the form is sent to the correct address and consider using a trackable mailing service. In-person submissions may be required in some jurisdictions, particularly for complex cases or when additional documentation is needed.

IRS Guidelines

IRS guidelines play a crucial role in the completion and submission of the multi jurisdiction tax exempt form. These guidelines outline the necessary procedures, documentation, and eligibility criteria for tax exemptions. It is essential to consult the IRS website or relevant publications to stay informed about any updates or changes in regulations that may impact the use of the form. Adhering to these guidelines helps ensure compliance and minimizes the risk of penalties.

Quick guide on how to complete multi jurisdiction tax exempt form

Complete Multi Jurisdiction Tax Exempt Form seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle Multi Jurisdiction Tax Exempt Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to update and electronically sign Multi Jurisdiction Tax Exempt Form effortlessly

- Find Multi Jurisdiction Tax Exempt Form and click Get Form to begin.

- Use the tools provided to fill in your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Multi Jurisdiction Tax Exempt Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the multi jurisdiction tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a multi jurisdiction tax exempt form?

A multi jurisdiction tax exempt form is a document that allows organizations to assert their tax-exempt status across different jurisdictions. With airSlate SignNow, you can easily create and manage this form, streamlining the process for businesses that operate in multiple regions. This ensures compliance and helps avoid unnecessary tax expenditures.

-

How can airSlate SignNow help with multi jurisdiction tax exempt forms?

AirSlate SignNow simplifies the creation, sending, and signing of multi jurisdiction tax exempt forms. Its user-friendly interface allows businesses to quickly customize templates, ensuring that all necessary information is captured accurately. Additionally, the platform offers a secure environment for document handling, which is crucial for sensitive tax-related information.

-

Is airSlate SignNow affordable for small businesses needing a multi jurisdiction tax exempt form?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses looking for a multi jurisdiction tax exempt form solution. With various subscription options, users can select a plan that fits their budget while benefiting from powerful features. This ensures that even smaller organizations can manage their tax-exempt documentation efficiently.

-

What features does airSlate SignNow offer for managing multi jurisdiction tax exempt forms?

AirSlate SignNow provides numerous features for managing multi jurisdiction tax exempt forms, including customizable templates, cloud storage, and real-time collaboration. These features allow users to easily create and modify forms, track changes, and ensure all parties have access to the latest documents. This enhances efficiency and reduces the likelihood of errors.

-

Can I integrate airSlate SignNow with other tools for multi jurisdiction tax exempt forms?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, facilitating the management of multi jurisdiction tax exempt forms. This means you can connect your existing workflow tools, such as CRM or accounting software, to streamline processes and enhance overall productivity. Integrations make it easier to keep tax documentation organized and accessible.

-

What benefits does airSlate SignNow provide for eSigning multi jurisdiction tax exempt forms?

Using airSlate SignNow for eSigning multi jurisdiction tax exempt forms offers numerous benefits, including speed, security, and ease of use. Signers can receive and complete documents from any device, eliminating delays and enhancing collaboration. The platform also ensures that signatures are legally binding, providing peace of mind for businesses managing tax-exempt status.

-

Is there a mobile app for managing multi jurisdiction tax exempt forms?

Yes, airSlate SignNow has a mobile app that allows users to manage multi jurisdiction tax exempt forms on the go. This flexibility enables businesses to send, sign, and store important tax documentation anytime, anywhere. The mobile app ensures that all essential features are readily available, allowing users to stay productive while managing their tax obligations.

Get more for Multi Jurisdiction Tax Exempt Form

- Contract labor receipt form

- Private education loan applicant self certification form

- General fax 1 866 650 0003 form

- Construction loan agreement fannie mae form

- Fannie mae form 10 q third quarter 2015

- 10pdf this is a model document for use in fannie mae form

- Prob 48 net worth statement form

- Elements of fiction quiz form

Find out other Multi Jurisdiction Tax Exempt Form

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later