Form W4p South Carolina

What is the Form W-4P South Carolina

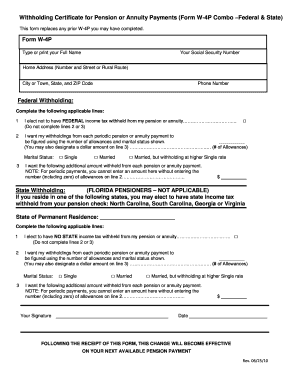

The Form W-4P South Carolina is a tax form used by individuals to request federal income tax withholding from certain types of payments, including pensions and annuities. This form is essential for ensuring that the correct amount of tax is withheld from your income, helping to avoid underpayment or overpayment of taxes throughout the year. It is specifically tailored for residents of South Carolina, aligning with state tax regulations.

How to use the Form W-4P South Carolina

To use the Form W-4P South Carolina, you need to fill it out accurately to reflect your financial situation. This involves providing personal information, such as your name, address, and Social Security number. You will also indicate the amount of tax you wish to have withheld from your payments. After completing the form, submit it to the payer of your income, such as your pension plan administrator or annuity provider, to ensure the correct withholding takes place.

Steps to complete the Form W-4P South Carolina

Completing the Form W-4P South Carolina involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can affect your tax withholding.

- Specify the amount of federal income tax you want withheld from your payments.

- Review the form for accuracy before signing and dating it.

- Submit the completed form to the appropriate payer.

Legal use of the Form W-4P South Carolina

The legal use of the Form W-4P South Carolina is governed by federal and state tax laws. It is crucial that the form is filled out correctly and submitted to the right entity to ensure compliance with tax regulations. This form serves as a legal document that dictates how much tax is withheld from your payments, and any discrepancies can lead to penalties or additional tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-4P South Carolina typically coincide with the payment schedule of your pension or annuity. It is advisable to submit the form well in advance of the payment date to ensure that the correct withholding is applied. Additionally, staying informed about any changes in tax laws or deadlines is important for compliance and effective tax planning.

Who Issues the Form

The Form W-4P South Carolina is typically issued by the payer of your pension or annuity. This could be a retirement plan administrator, an insurance company, or any other entity responsible for disbursing your payments. It is important to request this form from the appropriate source if it is not readily available.

Penalties for Non-Compliance

Failure to submit the Form W-4P South Carolina or inaccuracies in the form can lead to penalties from the IRS. If too little tax is withheld, you may face underpayment penalties and interest charges when you file your tax return. Conversely, overwithholding can result in a delayed refund, affecting your cash flow. Ensuring accuracy and timely submission of this form is essential to avoid such penalties.

Quick guide on how to complete form w4p south carolina

Create Form W4p South Carolina effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to design, modify, and electronically sign your documents swiftly without interruptions. Handle Form W4p South Carolina on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Form W4p South Carolina with ease

- Locate Form W4p South Carolina and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form W4p South Carolina to guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w4p south carolina

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SC W4 form?

The SC W4 form is a South Carolina Employee's Withholding Allowance Certificate used to determine the amount of state tax withheld from your paycheck. Completing the SC W4 accurately ensures that your withholding aligns with your financial situation, helping you avoid tax surprises at year-end.

-

How can airSlate SignNow help with the SC W4 form?

airSlate SignNow streamlines the process of signing and submitting the SC W4 form electronically. With our solution, businesses can easily send the SC W4 form to employees for eSigning, ensuring a quick and efficient onboarding process without the hassle of paper.

-

Is airSlate SignNow a cost-effective solution for managing SC W4 forms?

Yes, airSlate SignNow offers competitive pricing plans that make eSigning SC W4 forms an affordable option for businesses of all sizes. Our pricing structure is designed to provide great value, allowing you to manage your documents without incurring high costs.

-

What features does airSlate SignNow offer for SC W4 form management?

airSlate SignNow provides features such as customizable templates, secure document storage, and automated reminders for SC W4 form submissions. These tools enhance the signing experience and ensure compliance with state requirements.

-

Can I integrate airSlate SignNow with other tools for SC W4 processing?

Yes, airSlate SignNow supports integrations with various business applications, enabling seamless management of the SC W4 forms along with your existing workflows. This ensures that you can keep all your processes interconnected and efficient.

-

How secure is the SC W4 form signing process with airSlate SignNow?

The SC W4 form signing process with airSlate SignNow is highly secure. We utilize advanced encryption and authentication methods to ensure that all sensitive information is protected, giving you peace of mind when handling important documents.

-

What are the benefits of using airSlate SignNow for SC W4 forms?

Using airSlate SignNow for your SC W4 forms provides numerous benefits, including increased efficiency, reduced paper usage, and faster processing times. It simplifies the entire signing and submission process, allowing you to focus on your core business activities.

Get more for Form W4p South Carolina

- Free montana bill of sale templates pdf ampamp docxformswift

- Request for waiver of faculty qualifications form

- Free nebraska general bill of sale form pdfword

- Comprehensive planning forms clark county nv

- See submittal requirements form for more information

- Gre 54 420 form

- Iro contact update formpdf

- Premium tax summary form ins 4001 ohio department of

Find out other Form W4p South Carolina

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now