Oregon Wine Board Tax Report 2011-2026

What is the Oregon Wine Board Tax Report

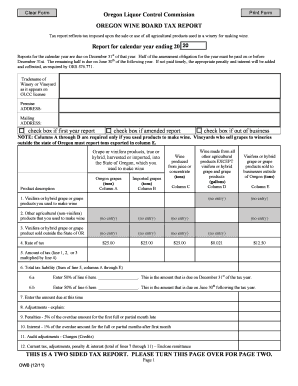

The Oregon Wine Board Tax Report is a specific tax document required for wineries operating in Oregon. This report helps the state track wine production and sales, ensuring compliance with state tax regulations. It is essential for wineries to accurately report their production volumes, sales figures, and any applicable taxes owed. This form is part of a broader regulatory framework that supports the state's wine industry while ensuring that businesses contribute to local and state revenues.

Steps to complete the Oregon Wine Board Tax Report

Completing the Oregon Wine Board Tax Report involves several key steps. First, gather all necessary data, including production and sales figures for the reporting period. Next, access the official form, which is available online or through the Oregon Wine Board. Fill out the form with accurate information, ensuring that all figures align with your records. After completing the form, review it for accuracy and completeness before submitting it. Finally, retain a copy for your records, as it may be needed for future reference or audits.

How to obtain the Oregon Wine Board Tax Report

The Oregon Wine Board Tax Report can be obtained through the Oregon Wine Board's official website. The form is typically available for download in a PDF format, which can be filled out digitally or printed for manual completion. Additionally, wineries may contact the Oregon Wine Board directly for assistance in accessing the form or for any questions regarding the reporting process.

Legal use of the Oregon Wine Board Tax Report

To ensure the legal validity of the Oregon Wine Board Tax Report, it must be completed accurately and submitted on time. Compliance with state regulations is crucial, as any discrepancies may lead to penalties or audits. The report serves as an official document that can be used in legal contexts, such as tax assessments or disputes. Therefore, wineries should maintain thorough records and ensure that all information provided in the report is truthful and complete.

Filing Deadlines / Important Dates

Wineries must be aware of the filing deadlines for the Oregon Wine Board Tax Report to avoid late penalties. Typically, the report is due quarterly, with specific dates set by the Oregon Wine Board. It is important for businesses to mark these dates on their calendars and prepare their reports in advance to ensure timely submission. Missing a deadline can result in financial penalties and affect the winery's standing with state authorities.

Required Documents

When preparing to complete the Oregon Wine Board Tax Report, wineries should gather several required documents. This includes production records, sales receipts, and any relevant tax documents. Accurate bookkeeping is essential, as these records will support the figures reported on the tax form. Having all necessary documentation ready will streamline the completion process and help ensure compliance with state regulations.

Quick guide on how to complete oregon wine board tax report

Complete Oregon Wine Board Tax Report effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as a highly efficient environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Manage Oregon Wine Board Tax Report on any device with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to adjust and eSign Oregon Wine Board Tax Report effortlessly

- Find Oregon Wine Board Tax Report and click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize important sections of the documents or redact sensitive details using tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Edit and eSign Oregon Wine Board Tax Report and ensure efficient communication throughout every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon wine board tax report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Wine Board tax report?

The Oregon Wine Board tax report is a document that outlines the tax obligations for wine businesses operating in Oregon. This report helps wineries ensure they are compliant with state regulations and manage their tax liabilities effectively.

-

How can airSlate SignNow assist with Oregon Wine Board tax reports?

airSlate SignNow streamlines the process of creating and signing the Oregon Wine Board tax report. With our platform, businesses can easily fill out the necessary forms, obtain signatures, and store documents securely.

-

Is airSlate SignNow cost-effective for generating Oregon Wine Board tax reports?

Yes, airSlate SignNow offers affordable pricing plans that provide excellent value for businesses needing to manage their Oregon Wine Board tax report. Our solution helps save time and reduces errors, which can ultimately lower costs associated with tax preparation.

-

What features does airSlate SignNow provide for handling tax reports?

airSlate SignNow includes features such as customizable templates, electronic signatures, and secure cloud storage, ensuring that generating your Oregon Wine Board tax report is efficient and reliable. Our platform is designed to simplify complex processes.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow integrates with various accounting and tax management software. This allows for seamless data transfer when preparing your Oregon Wine Board tax report, enhancing overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for the Oregon Wine Board tax report?

Utilizing airSlate SignNow to handle your Oregon Wine Board tax report provides several benefits, including faster processing times, improved accuracy, and easy access to important documentation. This ensures you stay compliant while saving valuable time.

-

Is it easy to use airSlate SignNow for someone unfamiliar with tax documents?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible for individuals unfamiliar with tax documents. Our intuitive interface guides users through the process of completing and signing the Oregon Wine Board tax report with ease.

Get more for Oregon Wine Board Tax Report

Find out other Oregon Wine Board Tax Report

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT