Instructions 1120 F Form

What is the Instructions 1120 F Form

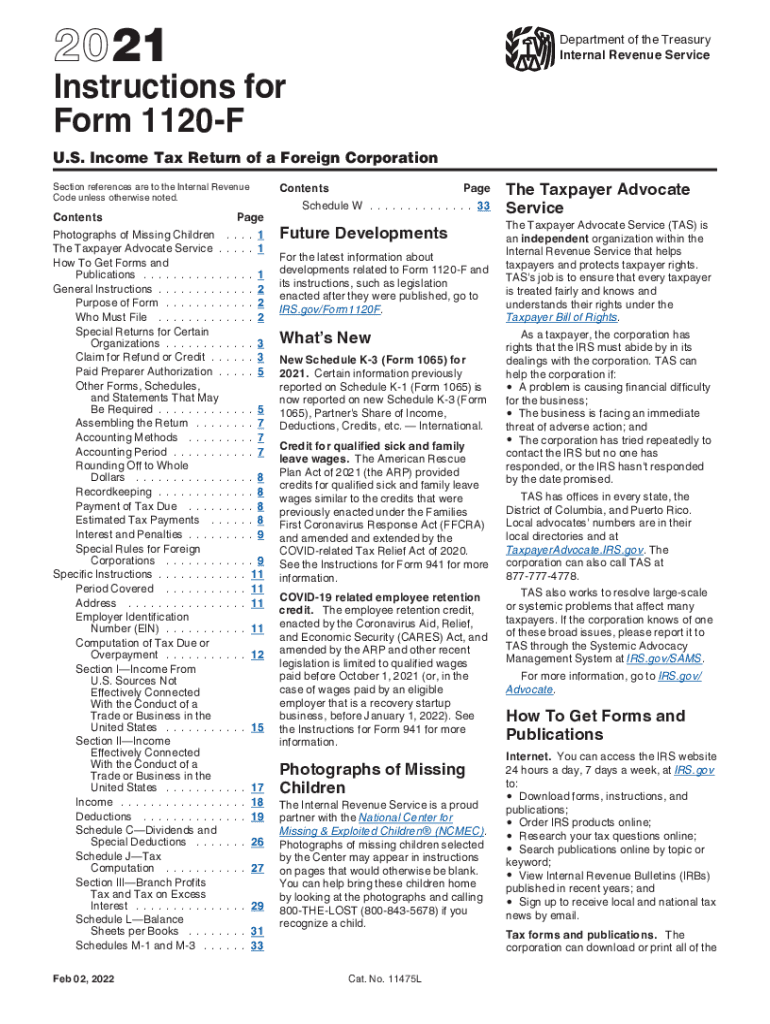

The Instructions 1120 F form is a crucial document used by foreign corporations to report their income, gains, losses, deductions, and credits. This form is specifically designed for entities that are not based in the United States but have income sourced within the country. It serves as a means for the Internal Revenue Service (IRS) to assess the tax obligations of these foreign corporations. Understanding the form's requirements is essential for compliance with U.S. tax laws.

Steps to complete the Instructions 1120 F Form

Completing the Instructions 1120 F form involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the form accurately, ensuring all income from U.S. sources is reported.

- Calculate any deductions and credits applicable to the corporation.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS by the specified deadline.

IRS Guidelines

The IRS provides specific guidelines for completing the Instructions 1120 F form. These guidelines detail the information required, the format for reporting income, and the necessary calculations for deductions and credits. It is important to follow these guidelines closely to avoid errors that could lead to penalties or audits. The IRS also updates these guidelines periodically, so staying informed about any changes is essential for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions 1120 F form are critical for compliance. Generally, the form must be filed on or before the 15th day of the sixth month after the end of the corporation's tax year. For corporations operating on a calendar year, this typically means the deadline is June 15. Extensions may be available, but they must be requested in advance. Missing the deadline can result in penalties and interest on any unpaid taxes.

Required Documents

To complete the Instructions 1120 F form, certain documents are required. These include:

- Income statements detailing U.S. sourced income.

- Balance sheets for the reporting period.

- Documentation supporting any deductions or credits claimed.

- Records of any prior tax filings, if applicable.

Legal use of the Instructions 1120 F Form

The Instructions 1120 F form must be used in accordance with U.S. tax laws. It is legally binding and must be completed accurately to ensure compliance with the IRS. Failure to use the form correctly can lead to legal repercussions, including fines and penalties. Foreign corporations are advised to consult with tax professionals to ensure that they meet all legal requirements when filing this form.

Form Submission Methods (Online / Mail / In-Person)

The Instructions 1120 F form can be submitted through various methods. Corporations can file electronically using the IRS e-file system, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address, depending on the corporation's location. In-person submissions are generally not common for this form, but consulting with a tax professional may provide additional options for submission.

Quick guide on how to complete instructions 1120 f form

Complete Instructions 1120 F Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Instructions 1120 F Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Instructions 1120 F Form with ease

- Locate Instructions 1120 F Form and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Instructions 1120 F Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the instructions 1120f for using airSlate SignNow?

The instructions 1120f for using airSlate SignNow guide you through the process of eSigning documents efficiently. To start, simply create an account, upload your documents, and select the recipients for signing. Following these instructions ensures a smooth and successful eSigning experience.

-

How does airSlate SignNow help with the filing of instructions 1120f?

airSlate SignNow simplifies the filing of instructions 1120f by allowing you to easily collect signatures from clients or stakeholders. The platform provides customizable templates, making it easier to fill out and submit necessary forms. This streamlines the process and reduces the likelihood of errors.

-

What are the pricing plans for airSlate SignNow related to instructions 1120f?

Pricing plans for airSlate SignNow are designed to be cost-effective, starting with a free trial for new users. After the trial, you can choose from various subscription levels that fit your budget and needs, allowing seamless handling of tasks related to instructions 1120f without breaking the bank.

-

Can I integrate airSlate SignNow with other software for instructions 1120f?

Yes, airSlate SignNow offers a variety of integrations with popular software systems. This allows users managing instructions 1120f to connect their existing platforms, such as CRM and document management tools, enhancing workflow efficiency. Integrations help centralize your processes for better document management.

-

What features does airSlate SignNow offer for managing instructions 1120f?

AirSlate SignNow boasts several features for managing instructions 1120f, including customizable templates, audit trails, and mobile compatibility. These features ensure that all documents are handled securely and that users can track the signing process in real time. The intuitive interface makes it easy to navigate and manage paperwork.

-

How does airSlate SignNow enhance the security of instructions 1120f?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive instructions 1120f. The platform uses advanced encryption to protect data in transit and at rest. Additionally, features like two-factor authentication ensure that only authorized individuals can access and sign important documents.

-

Are there any benefits to using airSlate SignNow for instructions 1120f?

Using airSlate SignNow for instructions 1120f offers numerous benefits including time savings and increased accuracy. The ease of eSigning documents helps reduce delays in approvals and filing procedures. Furthermore, the platform’s user-friendly design ensures that users can complete necessary steps without extensive training.

Get more for Instructions 1120 F Form

Find out other Instructions 1120 F Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT