Va 760es Voucher # 3 Form

What is the VA 760ES Voucher # 3 Form

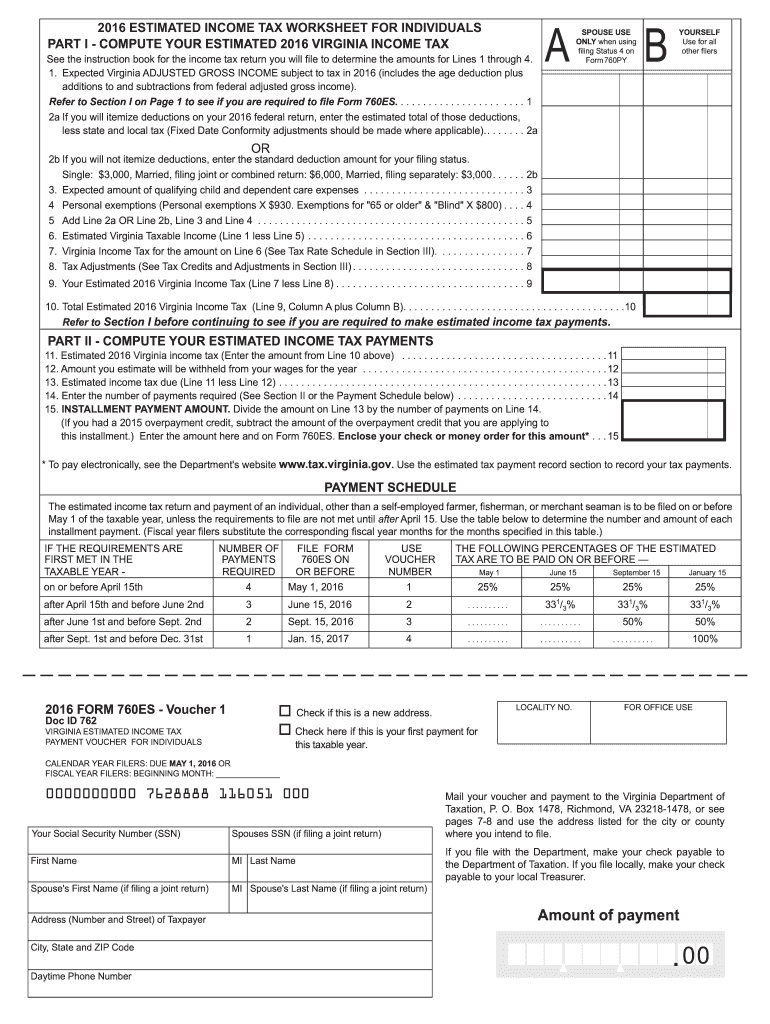

The VA 760ES Voucher # 3 form is a tax payment voucher used by Virginia residents to make estimated tax payments. This form is specifically designed for individuals who expect to owe tax on their income and wish to pay it in advance. The voucher allows taxpayers to submit their payments to the Virginia Department of Taxation, ensuring compliance with state tax laws. It is essential for individuals who are self-employed or have income not subject to withholding.

How to use the VA 760ES Voucher # 3 Form

Using the VA 760ES Voucher # 3 form involves several straightforward steps. First, taxpayers need to fill out the form with their personal information, including name, address, and Social Security number. Next, they must calculate the estimated tax amount owed for the year. Once the form is completed, it can be submitted along with the payment. Taxpayers can choose to pay electronically or by mail, depending on their preference. It is important to retain a copy of the voucher and payment for personal records.

Steps to complete the VA 760ES Voucher # 3 Form

Completing the VA 760ES Voucher # 3 form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the Virginia Department of Taxation's website or through authorized channels.

- Enter your personal information accurately, ensuring that all details match your tax records.

- Calculate your estimated tax liability using the appropriate methods, such as prior year’s tax return or current income projections.

- Indicate the payment amount on the form, ensuring it reflects the estimated tax due.

- Choose your payment method: electronic payment through the state’s system or a check/money order if mailing.

- Submit the completed voucher by the due date to avoid penalties.

Legal use of the VA 760ES Voucher # 3 Form

The VA 760ES Voucher # 3 form is legally binding when filled out correctly and submitted on time. It serves as an official record of payment towards estimated taxes, which is crucial for compliance with Virginia tax laws. To ensure its legal standing, taxpayers must follow the guidelines set forth by the Virginia Department of Taxation and maintain accurate records of their submissions. This form helps prevent underpayment penalties and interest that may accrue if taxes are not paid on time.

Filing Deadlines / Important Dates

Filing deadlines for the VA 760ES Voucher # 3 form are critical for taxpayers to note. Generally, estimated tax payments are due quarterly, with specific dates throughout the year. For instance, payments are typically due on April 15, June 15, September 15, and January 15 of the following year. It is essential to adhere to these deadlines to avoid penalties and ensure that the estimated tax obligations are met in a timely manner.

Required Documents

When preparing to complete the VA 760ES Voucher # 3 form, taxpayers should gather the necessary documents. These may include:

- Previous year’s tax return to help estimate current tax liability.

- Income statements, such as W-2s or 1099s, to accurately report earnings.

- Records of any deductions or credits that may apply to the current tax year.

Having these documents ready will streamline the process of filling out the voucher and ensure accurate calculations of estimated taxes owed.

Quick guide on how to complete va 760es voucher 3 2016 form

Fill out Va 760es Voucher # 3 Form seamlessly on any gadget

Digital document administration has gained traction among businesses and individuals alike. It presents an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it on the web. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents promptly without delays. Manage Va 760es Voucher # 3 Form on any gadget using airSlate SignNow’s Android or iOS applications and simplify any document-driven process today.

How to modify and eSign Va 760es Voucher # 3 Form effortlessly

- Obtain Va 760es Voucher # 3 Form and click Get Form to initiate.

- Make use of the tools available to finalize your document.

- Emphasize key sections of the document or obscure sensitive data using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature utilizing the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Va 760es Voucher # 3 Form and enjoy seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I check if my Groupon voucher code is still valid?

(Image Source: https://www.groupon.com/deals/po...)Log in to your Groupon account.2. Click on the drop down arrow besides your name (as shown in the screenshot)3. Once your click on the drop down arrow, beside your name, you would now click on ‘My Groupons’. (as shown in the screenshot)4. Now you would see the list of Groupons you have and on the left side of every Groupon you would see the expiration date for that particular Groupon.(as shown in the screenshot)Note: Instructions mentioned in this answer would help if you are using the http://www.groupon.com website to check if your Group code is still valid or not.

-

Whose duty is to fill voucher in Indian banks?

Indeed a tricky question …. frustrated bank employee will definitely say it is customer job to fill and find his way to work done…Anyway i dont want to give a direct answer just by saying yes or no… i have few lines to express my views on this and you will realise what i trying to point out…Our own Gandhiji once said about customers in his speech….“A customer is the most important visitor on our premises. He is not dependent on us. We are dependent on him. He is not an interruption of our work. He is the purpose of it. He is not an outsider of our business. He is part of it. We are not doing him a favour by serving him. He is doing us a favour by giving us the opportunity to do so.”So , if customer dont visit my bank then how will i survive. How will i feed my stomach.Yes indeed i have seen in so many banks that staffs refuse to fill the challan of customer. But i sware we never made any practice of not helping any customer. HNI (high networth individuals) seeks personal attention and they never fills their forms becoz they expects special attention as they are providing enough buisiness to branch. So y cant staffs provide the same service to other customers.As a human being staffs go through different moods but that should never get reflected in the banking atmosphere, before joining bank u should learn the art of pretending i.e. u should keep a smile all time while sitting in branch.If you are enough educated and u are capable of getting your forms filled then i suggest to do it by youself rather than asking for staffs help. At the same time if you ask the staff to fill your form then iam sure staff would never refuse to do it.Get your doubts cleared , no resteictions in banks for asking any kind of questions. As i mentioned nowdays nationalised banks are closely monitoring their staffs therefore customer service is upmost priority for any banks.

-

Why do ex-employers refuse to fill out the VA form 21-4192 for a vet?

VA Form 21–4192 is an application for disability benefits and like similar state benefits, it must be filled out by the veteran or by his or her qualified representative. This is a private, sensitive, legal document and every dot or dash in it can be critical, so must be accurate and verifiable.Employers have zero responsibility to fill out this form or furnish information for it, however, Social Security would have all the information required that the Department of Defense did not have. The veteran’s DD-214 is likely required, but does not furnish all the information required on the form.

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

-

How can I get more people to fill out my survey?

Make it compellingQuickly and clearly make these points:Who you are and why you are doing thisHow long it takesWhats in it for me -- why should someone help you by completing the surveyExample: "Please spend 3 minutes helping me make it easier to learn Mathematics. Answer 8 short questions for my eternal gratitude and (optional) credit on my research findings. Thank you SO MUCH for helping."Make it convenientKeep it shortShow up at the right place and time -- when people have the time and inclination to help. For example, when students are planning their schedules. Reward participationOffer gift cards, eBooks, study tips, or some other incentive for helping.Test and refineTest out different offers and even different question wording and ordering to learn which has the best response rate, then send more invitations to the offer with the highest response rate.Reward referralsIf offering a reward, increase it for referrals. Include a custom invite link that tracks referrals.

-

How does amazon afford vouchers for getting survey forms filled?

Gamentio Web Loot :- There is no need to install any app. You just need to Register via Facebook and you’re done. You can redeem your points as a free recharge as well as you can redeem it as amazon gift vouchers and many more you can do!!!How To Register on Gameinto Web Loot and Earn 200 Points? :1.Click on Given Link Here to Get 200 Points on Sign Up :–http://gamentio.com/3dcasinogame...2. Click on Register Now Option.3. Now Click on Sign Up Via Facebook.NOTE : Do not register via Email id or any other way. LOGIN Via FACEBOOK Only.4. Allow Facebook to Share Gameinto on Facebook.5. You will redirect to Your Profile and you will get 200 Points instantly.6. Go To Home Page of Gameinto.7. Get Your Refer Link. Share it with your friends and start earning 500 Points per Refer.8. You earn more points via playing Game on Website and sharing score on facebook also.How To Redeem Points :250 Points = Rs.25 MYGYFTR Recharge Voucher500 Points = Rs.50 MYGYFTR Recharge Voucher500 Points = Rs.50 Amazon Voucher2000 Points = Rs.200 Amazon Voucher5000 Points = Rs.500 Amazon Voucher

Create this form in 5 minutes!

How to create an eSignature for the va 760es voucher 3 2016 form

How to create an electronic signature for your Va 760es Voucher 3 2016 Form online

How to make an eSignature for your Va 760es Voucher 3 2016 Form in Chrome

How to make an electronic signature for putting it on the Va 760es Voucher 3 2016 Form in Gmail

How to generate an eSignature for the Va 760es Voucher 3 2016 Form straight from your smart phone

How to make an electronic signature for the Va 760es Voucher 3 2016 Form on iOS devices

How to make an eSignature for the Va 760es Voucher 3 2016 Form on Android devices

People also ask

-

What is the VA 760ES form and how is it used?

The VA 760ES form is a Virginia Estimated Tax Payment voucher used by individuals to report and pay estimated taxes throughout the year. Understanding how to properly fill out the VA 760ES can help ensure compliance and avoid penalties. Using airSlate SignNow, you can easily eSign and manage your VA 760ES documents from anywhere.

-

How can airSlate SignNow help with submitting the VA 760ES?

airSlate SignNow streamlines the process of submitting your VA 760ES form by allowing you to electronically sign and send your document quickly. With our user-friendly interface, you can complete your tax submissions efficiently and securely, ensuring that your VA 760ES is delivered on time.

-

Is airSlate SignNow cost-effective for managing VA 760ES forms?

Yes, airSlate SignNow offers a cost-effective solution for managing your VA 760ES forms. Our pricing plans are designed to fit various business needs without compromising on features. By choosing airSlate SignNow, you can save time and resources while ensuring that your VA 760ES is processed smoothly and professionally.

-

What features does airSlate SignNow offer for the VA 760ES?

airSlate SignNow provides numerous features to assist with the VA 760ES, including electronic signing, customizable templates, and document tracking. These features enhance efficiency and reduce errors in the tax submission process. Moreover, our platform ensures that all documents, including the VA 760ES, are securely stored and accessible.

-

Can I integrate airSlate SignNow with other software to handle VA 760ES submissions?

Absolutely, airSlate SignNow integrates seamlessly with a variety of software applications to enhance your workflow, including accounting and tax preparation systems. This means you can easily manage your VA 760ES submissions alongside your other financial documents. Our integrations help create a streamlined process, saving you time and effort.

-

What are the benefits of using airSlate SignNow for VA 760ES forms?

Using airSlate SignNow for your VA 760ES forms comes with several benefits, including improved accuracy, faster processing times, and enhanced security. Our electronic signature capability helps ensure your documents are signed quickly. Additionally, our platform provides easy access to your forms whenever needed, making tax season less stressful.

-

How secure is the information shared in the VA 760ES on airSlate SignNow?

Security is a top priority at airSlate SignNow. When sending your VA 760ES forms, your data is protected with advanced encryption and secure storage solutions. This means that your sensitive tax information remains confidential and compliant with industry standards.

Get more for Va 760es Voucher # 3 Form

Find out other Va 760es Voucher # 3 Form

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract