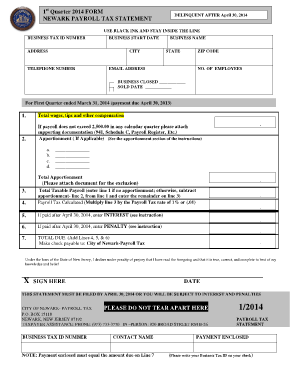

Newark Payroll Tax Statement Form

What is the Newark Payroll Tax Statement?

The Newark Payroll Tax Statement is a crucial document for employers and employees in Newark, New Jersey. It outlines the payroll taxes that are withheld from employees' wages and is essential for compliance with local tax regulations. The statement provides a summary of the total payroll taxes collected, which contribute to the city's revenue and fund various public services. Understanding this document is vital for accurate tax reporting and ensuring that all financial obligations are met.

How to Obtain the Newark Payroll Tax Statement

To obtain the Newark Payroll Tax Statement, employers can access it through the City of Newark's official website or contact the local tax office directly. The statement may also be available through payroll service providers who assist businesses in managing their payroll tax obligations. Employers should ensure they have the necessary identification and business information ready when requesting the statement to facilitate the process.

Steps to Complete the Newark Payroll Tax Statement

Completing the Newark Payroll Tax Statement involves several key steps:

- Gather all relevant payroll records, including employee wages and hours worked.

- Calculate the total payroll taxes withheld for each employee based on the applicable tax rates.

- Fill out the statement accurately, ensuring all figures are correct and reflect the total amounts withheld.

- Review the completed statement for any errors or omissions before submission.

- Submit the statement by the designated deadline, either online or by mail, as per local regulations.

Legal Use of the Newark Payroll Tax Statement

The Newark Payroll Tax Statement serves as a legally binding document that employers must provide to their employees. It is essential for maintaining compliance with local tax laws and regulations. Properly completed statements can protect employers from potential penalties and ensure that employees receive accurate information regarding their tax withholdings. It is important for both parties to retain copies for their records.

Filing Deadlines / Important Dates

Filing deadlines for the Newark Payroll Tax Statement are typically set by the City of Newark's tax authority. Employers should be aware of these deadlines to avoid late submissions, which can result in penalties. Generally, payroll tax statements must be filed quarterly or annually, depending on the size of the business and the amount of payroll tax collected. It is advisable to check the official city website for the most current deadlines and any changes to the filing schedule.

Penalties for Non-Compliance

Failure to comply with the requirements for the Newark Payroll Tax Statement can result in significant penalties for employers. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to stay informed about their tax obligations and ensure timely and accurate submissions to avoid these repercussions. Regular audits and consultations with tax professionals can help maintain compliance.

Quick guide on how to complete newark payroll tax statement

Effortlessly Organize Newark Payroll Tax Statement on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed forms, as you can find the needed document and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Newark Payroll Tax Statement on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to adjust and electronically sign Newark Payroll Tax Statement effortlessly

- Find Newark Payroll Tax Statement and click Get Form to get started.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to secure your updates.

- Select your preferred method of sharing your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device. Adjust and electronically sign Newark Payroll Tax Statement and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the newark payroll tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Newark payroll tax form 2020?

The city of Newark payroll tax form 2020 is a document required by the city for reporting local payroll taxes. Businesses operating in Newark must complete this form to ensure compliance with local tax regulations. It includes details about employee wages, withholdings, and the calculated tax amount.

-

How can airSlate SignNow help with the city of Newark payroll tax form 2020?

airSlate SignNow simplifies the process of completing the city of Newark payroll tax form 2020 by allowing users to easily fill out and eSign the document. With its user-friendly interface, you can ensure that all necessary information is included and submitted on time. This helps businesses stay compliant and avoid penalties.

-

Is there a cost associated with using airSlate SignNow for the city of Newark payroll tax form 2020?

Yes, airSlate SignNow offers various pricing plans to meet the needs of different businesses. While there may be a subscription fee for using the platform, the cost is balanced by the time savings and efficiency gained from using an electronic signing solution for documents like the city of Newark payroll tax form 2020.

-

What features does airSlate SignNow offer for handling tax forms?

airSlate SignNow provides features such as document templates, automated workflows, secure eSignatures, and storage options. These features help ensure that you can efficiently manage the city of Newark payroll tax form 2020 and other related documents with minimal hassle. All tools are designed to enhance productivity and streamline tax compliance.

-

Can I integrate airSlate SignNow with other software for payroll management?

Absolutely! airSlate SignNow offers seamless integrations with various payroll management systems and software, allowing you to automatically handle documents like the city of Newark payroll tax form 2020. This integration helps streamline your processes and ensures that your payroll data is consistently updated.

-

Are there any benefits of using airSlate SignNow for the city of Newark payroll tax form 2020?

Using airSlate SignNow for the city of Newark payroll tax form 2020 brings numerous benefits including expedited document processing, enhanced security, and reduced reliance on paper forms. The electronic signing process is not only eco-friendly but also signNowly cuts down on the time needed to get forms completed and submitted.

-

How secure is airSlate SignNow when handling the city of Newark payroll tax form 2020?

airSlate SignNow prioritizes security and uses advanced encryption and compliance measures to protect your documents, including the city of Newark payroll tax form 2020. Your sensitive payroll information is safeguarded throughout the process, ensuring that only authorized personnel have access.

Get more for Newark Payroll Tax Statement

- Ny statement of the nyc board of health to take action to prevent drug overdose deaths form

- Wa agr 4300b formerly agr form 630 4300b

- Nh appendix b fire alarm inspection and testing form

- Wi saxony apartments parking rental agreement form

- Ny forest hills south owners purchase application form

- Ar mls waiver application form

- Nc gym rental lease agreement city of dunn form

- Md accessory apartment lease montgomery county form

Find out other Newark Payroll Tax Statement

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself