Nrighthouse 403 B Withdrawal Form

Understanding the Brighthouse Withdrawal Form

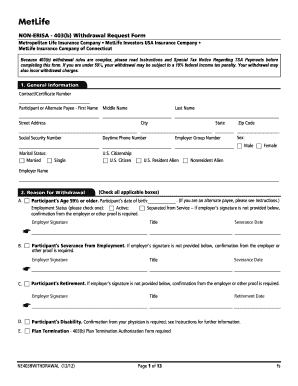

The Brighthouse withdrawal form is a crucial document for individuals looking to withdraw funds from their Brighthouse financial accounts, including variable annuities and non-ERISA 403(b) plans. This form serves as an official request to access accumulated funds, ensuring that the withdrawal process adheres to regulatory standards. Understanding the specific requirements and implications of this form is essential for a smooth withdrawal experience.

Steps to Complete the Brighthouse Withdrawal Form

Completing the Brighthouse withdrawal form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary personal information, including your account number and identification details. Next, carefully fill out the form, providing details about the amount you wish to withdraw and the method of payment. Review the completed form for any errors or omissions before submitting it to avoid delays in processing. It is advisable to keep a copy of the completed form for your records.

Legal Use of the Brighthouse Withdrawal Form

The Brighthouse withdrawal form is legally binding once completed and submitted according to the guidelines set forth by Brighthouse Financial. To ensure the document's legality, it must be signed by the account holder, and in some cases, notarization may be required. Compliance with relevant laws, such as the ESIGN Act, ensures that electronic signatures are recognized and enforceable. Understanding these legal aspects can help prevent potential disputes or issues during the withdrawal process.

Required Documents for the Brighthouse Withdrawal Form

To successfully submit the Brighthouse withdrawal form, several documents may be required. Typically, you will need to provide proof of identity, such as a government-issued ID, and any additional documentation that verifies your account ownership. If the withdrawal involves a non-ERISA 403(b) plan, additional forms or statements may be necessary to comply with specific regulations. Gathering these documents beforehand can streamline the submission process and reduce the likelihood of delays.

Form Submission Methods

The Brighthouse withdrawal form can be submitted through various methods, including online, by mail, or in person. For online submissions, ensure that you have a secure internet connection and follow the instructions provided on the Brighthouse website. If mailing the form, use a reliable postal service and consider tracking the delivery to confirm receipt. In-person submissions may be made at designated Brighthouse locations, allowing for immediate confirmation of the form's acceptance.

Eligibility Criteria for Withdrawal

Eligibility to withdraw funds using the Brighthouse withdrawal form typically depends on the specific terms of your financial product. For instance, certain withdrawal options may be available only after a specified period or under specific conditions, such as reaching a certain age or retirement status. Reviewing your account's terms and conditions can clarify your eligibility and help you understand any potential penalties or restrictions associated with the withdrawal.

Quick guide on how to complete nrighthouse 403 b withdrawal form

Finish Nrighthouse 403 B Withdrawal Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, enabling you to acquire the necessary form and safely keep it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without delays. Handle Nrighthouse 403 B Withdrawal Form on any system with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Nrighthouse 403 B Withdrawal Form without stress

- Find Nrighthouse 403 B Withdrawal Form and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools available from airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Nrighthouse 403 B Withdrawal Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nrighthouse 403 b withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the brighthouse withdrawal form?

The brighthouse withdrawal form is a document needed for requesting withdrawals from your Brighthouse Financial policies. It is essential for policyholders to complete this form to initiate the withdrawal process smoothly. By using the airSlate SignNow platform, you can electronically sign and submit the brighthouse withdrawal form quickly and efficiently.

-

How do I fill out the brighthouse withdrawal form?

To fill out the brighthouse withdrawal form, start by providing your personal information, including your policy number and contact details. Follow the instructions on the form carefully to ensure all required fields are completed. Once you’ve filled it out, you can use airSlate SignNow to eSign and send it securely.

-

Can I track the status of my brighthouse withdrawal form?

Yes, when you use airSlate SignNow to send your brighthouse withdrawal form, you can track its status in real-time. The platform provides notifications on the document's progress, so you know exactly when it has been received and processed. This transparency helps ensure a smoother withdrawal experience.

-

What are the benefits of using airSlate SignNow for the brighthouse withdrawal form?

Using airSlate SignNow to handle your brighthouse withdrawal form offers several benefits, including speed and convenience. The electronic signing process eliminates the need for printing and mailing forms, making withdrawals faster. Additionally, our platform enhances security and keeps your documents organized.

-

Is there a fee for submitting a brighthouse withdrawal form through airSlate SignNow?

airSlate SignNow provides a cost-effective solution for submitting your brighthouse withdrawal form. While there may be fees associated with the processing of withdrawals by Brighthouse Financial, using SignNow itself is generally affordable with various plans to suit your needs. Check our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other applications for managing my brighthouse withdrawal form?

Yes, airSlate SignNow offers integrations with numerous applications that can assist you in managing your brighthouse withdrawal form. Whether you use CRM systems, cloud storage solutions, or document management tools, you can streamline your workflow. This flexibility allows you to enhance efficiency while handling your withdrawal requests.

-

What should I do if my brighthouse withdrawal form is rejected?

If your brighthouse withdrawal form is rejected, carefully review the feedback provided by Brighthouse Financial to determine the reason. Make necessary corrections or adjustments to the form, such as providing missing information. You can then resubmit it using airSlate SignNow, ensuring a smooth process the second time around.

Get more for Nrighthouse 403 B Withdrawal Form

- Sos sellers responsibilities selling a vehicle state of michigan form

- Sellersdo hereby bargain and sell to buyers the form

- In the above entitled and numbered cause a judgment was rendered in this court or other united states form

- Notice to landlord retaliatory eviction form

- Notice to landlord insufficient notice of termination of rental agreement form

- State of alabama ma form

- Virtue of a previously executed lease agreement dated 20 hereinafter lease form

- Landlord or authorized agent form

Find out other Nrighthouse 403 B Withdrawal Form

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple