Form 05 904

What is the Form 05 904

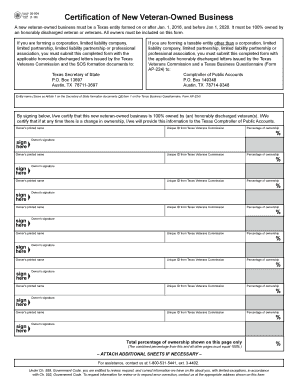

The Form 05 904 is a legal document used in Texas, primarily for the purpose of documenting specific transactions or agreements. This form is often utilized in various legal and business contexts, ensuring that all parties involved have a clear record of their commitments. Understanding the purpose and requirements of the Form 05 904 is essential for individuals and businesses operating within Texas.

How to use the Form 05 904

Using the Form 05 904 involves several key steps to ensure that it is filled out correctly and submitted appropriately. First, gather all necessary information related to the transaction or agreement. This includes the names and contact information of all parties involved, as well as any relevant details about the agreement itself. Next, carefully complete the form, ensuring that all sections are filled out accurately. Once completed, the form can be signed by all parties, either in person or electronically, depending on the circumstances.

Steps to complete the Form 05 904

Completing the Form 05 904 requires attention to detail. Follow these steps for a smooth process:

- Read the form thoroughly to understand its requirements.

- Collect all necessary information, including names, addresses, and specific details related to the agreement.

- Fill out the form completely, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Obtain signatures from all parties involved, ensuring that the signing process complies with legal requirements.

- Submit the form as required, either electronically or via mail.

Legal use of the Form 05 904

The legal use of the Form 05 904 is governed by state regulations, which dictate how and when this form can be utilized. It is important to ensure that the form is executed in compliance with Texas law to maintain its validity. Proper use includes obtaining necessary signatures and adhering to any specific filing requirements. Failure to comply with these legal standards may result in the form being deemed invalid.

Key elements of the Form 05 904

Several key elements must be included in the Form 05 904 for it to be considered complete and legally binding. These elements typically include:

- The names and addresses of all parties involved.

- A clear description of the agreement or transaction.

- Signatures of all parties, along with the date of signing.

- Any additional information required by Texas law.

Form Submission Methods

The Form 05 904 can be submitted through various methods, depending on the requirements set forth by the relevant authorities. Common submission methods include:

- Online submission through designated platforms.

- Mailing the completed form to the appropriate office.

- In-person submission at local government offices or designated locations.

Quick guide on how to complete form 05 904

Complete Form 05 904 easily on any device

Digital document management has become widely adopted by organizations and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delay. Manage Form 05 904 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Form 05 904 effortlessly

- Locate Form 05 904 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Form 05 904 to guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 05 904

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 05 904?

Form 05 904 is a document that businesses can use to streamline their workflow processes. With airSlate SignNow, you can easily fill out and eSign form 05 904, ensuring that all required information is accurately captured.

-

How can airSlate SignNow help with completing form 05 904?

airSlate SignNow offers an intuitive platform for filling and signing form 05 904 electronically. Our easy-to-use interface allows users to complete the document efficiently, reducing errors and improving compliance.

-

What are the pricing options for using airSlate SignNow for form 05 904?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes. You can choose a plan that suits your needs for managing form 05 904, with options for monthly subscriptions or discounted annual payments.

-

Can I integrate airSlate SignNow with other applications for managing form 05 904?

Yes, airSlate SignNow offers various integrations with popular applications, enhancing your ability to manage form 05 904 within your existing workflows. You can easily connect with tools like Google Drive, Dropbox, and CRM systems to simplify document management.

-

What are the benefits of using airSlate SignNow for form 05 904?

Using airSlate SignNow for form 05 904 brings numerous benefits, such as improved efficiency and reduced turnaround times. The platform not only facilitates quick electronic signatures but also ensures your documents are securely stored and easily retrievable.

-

Is there a mobile app for signing form 05 904 with airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that allows users to fill out and eSign form 05 904 from anywhere. This flexibility ensures that you can manage your documents on the go, making it easy to stay productive and responsive.

-

How secure is the eSigning process for form 05 904 with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including form 05 904. Our platform employs advanced encryption and authentication protocols to protect sensitive information, ensuring that your signed documents remain confidential.

Get more for Form 05 904

- Model joint venture agreement checklist american bar association form

- Amended restated and consolidated deed of trust mortgage form

- Franchise agreementsoffering circular form

- Code of laws title 27 chapter 7 form and execution of

- Right of way easement cherokee county electric cooperative form

- Basic conveyancing rules for mineral deeds and assignments of oil form

- Advance directives university of utah health form

- Holders claim for reimbursement state controllers office form

Find out other Form 05 904

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document