How to Complete Sars Cra01 Form

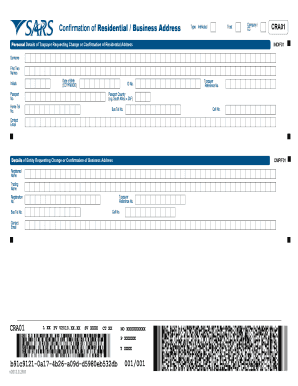

What is the CRA01 Form?

The CRA01 form is a crucial document used for tax purposes in the United States. It is primarily utilized by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). Understanding the purpose of the CRA01 form is essential for compliance with tax regulations and ensuring accurate reporting of income, deductions, and credits. This form serves as a means to communicate vital financial data, which can affect tax liabilities and potential refunds.

Steps to Complete the CRA01 Form

Completing the CRA01 form involves several key steps to ensure accuracy and compliance. Follow these guidelines for a smooth process:

- Gather Required Information: Collect all necessary financial documents, including income statements, expense receipts, and previous tax returns.

- Fill Out Personal Information: Enter your name, address, and Social Security number accurately at the top of the form.

- Report Income: List all sources of income, including wages, dividends, and interest, ensuring that the amounts are correct.

- Claim Deductions: Identify eligible deductions you can claim, such as business expenses or educational costs.

- Review and Sign: Double-check all entries for accuracy, then sign and date the form to validate it.

Legal Use of the CRA01 Form

The CRA01 form holds legal significance as it is used to report financial information to the IRS. Proper completion and submission of this form ensure compliance with federal tax laws. It is essential to understand that inaccuracies or omissions can lead to penalties or audits. Therefore, using the CRA01 form correctly is vital for maintaining legal standing and avoiding potential legal repercussions.

Examples of Using the CRA01 Form

There are various scenarios in which individuals and businesses may need to utilize the CRA01 form. For instance:

- A self-employed individual may use the CRA01 form to report income earned from freelance work.

- A small business owner could complete the CRA01 form to document revenue and expenses for the fiscal year.

- Students may need to file the CRA01 form to report income from part-time jobs while claiming educational deductions.

Filing Deadlines / Important Dates

Staying aware of filing deadlines for the CRA01 form is crucial to avoid penalties. Typically, the form must be submitted by April 15 of the following tax year. If you require additional time, you may file for an extension, but it is essential to submit any tax owed by the original deadline to avoid interest and penalties.

Form Submission Methods

The CRA01 form can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many users prefer to file electronically through tax software, which often simplifies the process and provides immediate confirmation.

- Mail: Alternatively, you can print the completed form and send it to the IRS via postal service. Ensure you use the correct address based on your location.

- In-Person: Some individuals may choose to deliver their forms directly to local IRS offices for personal assistance.

Quick guide on how to complete how to complete sars cra01 form

Effortlessly Complete How To Complete Sars Cra01 Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle How To Complete Sars Cra01 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign How To Complete Sars Cra01 Form with Ease

- Locate How To Complete Sars Cra01 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to share your form, by email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign How To Complete Sars Cra01 Form and guarantee exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to complete sars cra01 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the best way to fill in cra01?

To effectively fill in cra01, start by gathering all necessary financial documents and information. airSlate SignNow provides step-by-step guidance to streamline the process, ensuring you understand each section. This will help you accurately complete the form and submit it without errors.

-

How can airSlate SignNow assist me in filling out forms like cra01?

airSlate SignNow simplifies the process of filling out forms such as cra01 by offering intuitive templates and easy-to-use features. You can collaborate with others, track changes, and electronically sign documents, making the entire process smoother and faster.

-

Is there a cost associated with using airSlate SignNow for filling out cra01?

Yes, airSlate SignNow offers affordable plans that vary based on features and team size. You can choose a package that fits your budget and gain access to tools that help you efficiently fill in cra01 and other documents.

-

What features make airSlate SignNow ideal for filling in cra01?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure eSigning. These tools are designed to enhance your experience when filling in cra01, ensuring accuracy and efficiency throughout the process.

-

Are there any integrations available for airSlate SignNow when filling out cra01?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Workspace and Microsoft Office. This allows you to easily import data and documents needed for filling in cra01, streamlining your workflow.

-

Can I save my progress while filling in cra01 using airSlate SignNow?

Absolutely! With airSlate SignNow, you can save your progress at any time while filling in cra01, allowing you to return and complete your form later. This flexibility helps ensure you have enough time to provide accurate information.

-

What benefits do I gain from using airSlate SignNow for filling in cra01 compared to traditional methods?

Using airSlate SignNow to fill in cra01 eliminates the hassle of paper forms and manual signatures. You gain efficiency, security, and a user-friendly interface that simplifies the entire process, making it more convenient and less time-consuming.

Get more for How To Complete Sars Cra01 Form

- Federal us income tax return for homeowners associations form

- 3903 form 3903 moving expenses department of the treasury

- W2g form 2021

- Fillioimportant notice how to apply for the energyfillable important notice how to apply for the energy state form

- 2021 form 5500 ez annual return of a one participant ownerspartners and their spouses retirement plan or a foreign plan

- Wwwirsgovpubirs pdf2020 instructions for form 943 internal revenue service

- Fillable online instructions for form 8379 rev november

- Form 1042pdf 1042 annual withholding tax return for us

Find out other How To Complete Sars Cra01 Form

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile