Tennessee Hotel Tax Exempt Form

What is the Tennessee Hotel Tax Exempt Form

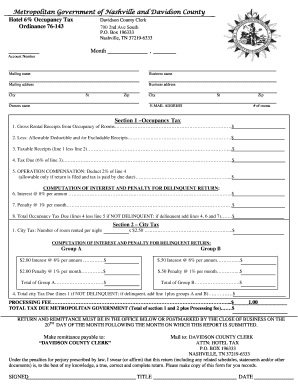

The Tennessee hotel tax exempt form is a document that allows eligible individuals or organizations to claim exemption from hotel occupancy taxes in Tennessee. This form is essential for government employees, military personnel, and certain non-profit organizations traveling for official business. By submitting this form, travelers can avoid paying the state’s lodging tax, which can significantly reduce their travel expenses.

How to use the Tennessee Hotel Tax Exempt Form

Using the Tennessee hotel tax exempt form involves several straightforward steps. First, ensure you meet the eligibility criteria, which typically include being a government employee or part of an exempt organization. Next, download the form from a reliable source. Fill in the required information accurately, including the name of the traveler, the purpose of travel, and the name of the hotel. After completing the form, present it to the hotel upon check-in to receive the tax exemption.

Steps to complete the Tennessee Hotel Tax Exempt Form

Completing the Tennessee hotel tax exempt form requires careful attention to detail. Follow these steps:

- Download the form from a trusted source.

- Fill in your personal information, including your name and contact details.

- Specify the purpose of your travel, ensuring it aligns with the exemption criteria.

- Provide the hotel’s name and address where you will be staying.

- Sign and date the form to certify its accuracy.

Legal use of the Tennessee Hotel Tax Exempt Form

The legal use of the Tennessee hotel tax exempt form is governed by state tax laws. To be valid, the form must be filled out completely and accurately. It is crucial to use this form only for legitimate business purposes, as misuse can lead to penalties. The form serves as proof that the individual or organization qualifies for the tax exemption, ensuring compliance with state regulations.

Eligibility Criteria

Eligibility for using the Tennessee hotel tax exempt form typically includes government employees, military personnel, and certain non-profit organizations. To qualify, the travel must be for official business purposes. It is essential to check the specific guidelines provided by the state to ensure that all criteria are met before submitting the form.

Required Documents

When using the Tennessee hotel tax exempt form, certain documents may be required to support the exemption claim. These documents can include:

- A valid government-issued ID for government employees.

- Military identification for active duty personnel.

- Proof of non-profit status for eligible organizations.

- Any additional documentation that verifies the purpose of travel.

Form Submission Methods

The Tennessee hotel tax exempt form can typically be submitted in various ways, depending on the hotel's policies. Common submission methods include:

- Presenting the completed form in person at check-in.

- Submitting the form via email if the hotel allows electronic submission.

- Mailing the form to the hotel in advance, if required.

Quick guide on how to complete tennessee hotel tax exempt form

Complete Tennessee Hotel Tax Exempt Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to easily access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Handle Tennessee Hotel Tax Exempt Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign Tennessee Hotel Tax Exempt Form with ease

- Obtain Tennessee Hotel Tax Exempt Form and click Get Form to begin.

- Utilize the provided tools to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information carefully, then click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and eSign Tennessee Hotel Tax Exempt Form and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tennessee hotel tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tennessee hotel tax exempt form?

The Tennessee hotel tax exempt form is a document that allows qualifying organizations to be exempt from hotel occupancy taxes in Tennessee. This form must be completed and presented to the hotel at the time of check-in to ensure that tax is not charged. It's important for organizations to understand the eligibility criteria for tax exemption in Tennessee.

-

How do I complete the Tennessee hotel tax exempt form?

To complete the Tennessee hotel tax exempt form, you need to provide your organization’s tax ID number, along with relevant details such as the purpose of the trip and the dates of your stay. Ensure that all required fields are filled out accurately to avoid any issues with the hotel. After completing the form, you should sign and present it directly to the hotel.

-

Are there any fees associated with using the Tennessee hotel tax exempt form?

There are no direct fees associated with obtaining or using the Tennessee hotel tax exempt form itself. However, hotels may have their policies regarding tax exemption, and it's advisable to check if any associated fees apply. Always confirm with the hotel beforehand to understand their requirements.

-

Which types of organizations can use the Tennessee hotel tax exempt form?

The Tennessee hotel tax exempt form can be utilized by certain organizations such as government agencies, non-profit organizations, and educational institutions. These organizations must meet specific criteria outlined by the state of Tennessee to qualify for tax exemption when booking hotels.

-

What benefits does the Tennessee hotel tax exempt form provide?

Using the Tennessee hotel tax exempt form allows eligible organizations to save on hotel costs by avoiding state and local occupancy taxes. This can lead to signNow savings, especially for individuals traveling for business, educational, or governmental purposes. It's an important tool for budget-conscious travelers in Tennessee.

-

How can airSlate SignNow help with the Tennessee hotel tax exempt form?

airSlate SignNow streamlines the process of managing and signing the Tennessee hotel tax exempt form electronically. With easy-to-use features, users can quickly complete, send, and store these important documents, ensuring compliance and efficiency in hotel bookings. Integration with other systems enhances workflow and accessibility.

-

Can the Tennessee hotel tax exempt form be signed electronically?

Yes, the Tennessee hotel tax exempt form can be signed electronically through platforms like airSlate SignNow. This allows organizations to expedite the form completion process and maintain a digital record for their tax-exempt stays. Electronic signing is secure and legal in Tennessee, making it a convenient choice.

Get more for Tennessee Hotel Tax Exempt Form

- Control number co p021 pkg form

- How to form a colorado partnershiplegalzoom

- Ampquotliving will form

- Colorado medical orders for scope of treatment most form

- The uniform anatomical gift act the donate life colorado

- Colorado legal forms kit legal business forms from

- Control number co p027 pkg form

- This template is consistent with rules adopted by the colorado state board of health at 6 ccr 1015 2 form

Find out other Tennessee Hotel Tax Exempt Form

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form