Senior Property Tax Homestead Exemption Short Form Pueblo County Pueblohealthdept

What is the Senior Property Tax Homestead Exemption Short Form Pueblo County Pueblohealthdept

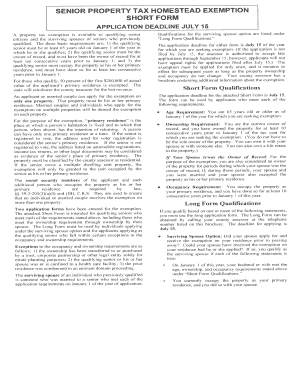

The Senior Property Tax Homestead Exemption Short Form is a document designed for senior citizens residing in Pueblo County, Colorado. This form allows eligible individuals to apply for a property tax exemption on their primary residence, thereby reducing their overall property tax burden. The exemption is intended to provide financial relief to seniors, making it easier for them to maintain their homes and manage living expenses. The form must be completed accurately to ensure eligibility and compliance with local regulations.

How to use the Senior Property Tax Homestead Exemption Short Form Pueblo County Pueblohealthdept

Using the Senior Property Tax Homestead Exemption Short Form involves several straightforward steps. First, gather all necessary information, including personal identification details, property information, and any required supporting documents. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once the form is filled out, it can be submitted either online, by mail, or in person at the appropriate county office. It is important to keep a copy of the submitted form for your records.

Steps to complete the Senior Property Tax Homestead Exemption Short Form Pueblo County Pueblohealthdept

Completing the Senior Property Tax Homestead Exemption Short Form requires attention to detail. Follow these steps:

- Obtain the form from the Pueblo County website or local government office.

- Provide your name, address, and contact information in the designated sections.

- Indicate your age and confirm your eligibility as a senior citizen.

- Include information about your property, such as the address and parcel number.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form through your preferred method.

Eligibility Criteria

To qualify for the Senior Property Tax Homestead Exemption, applicants must meet specific eligibility criteria. Generally, applicants must be at least sixty-five years old and must have owned and occupied the property as their primary residence for at least one year prior to applying. Additionally, the applicant's income may be subject to limits set by the county, which can affect eligibility. It is advisable to review the latest guidelines from Pueblo County to ensure compliance.

Required Documents

When completing the Senior Property Tax Homestead Exemption Short Form, certain documents may be required to support your application. These typically include:

- Proof of age, such as a driver's license or birth certificate.

- Documentation of property ownership, like a deed or property tax statement.

- Income verification, which may include tax returns or pay stubs.

Having these documents ready can streamline the application process and help ensure that your form is processed without delays.

Form Submission Methods

The Senior Property Tax Homestead Exemption Short Form can be submitted through various methods, providing flexibility for applicants. Options typically include:

- Online submission through the Pueblo County website.

- Mailing the completed form to the appropriate county office.

- In-person submission at designated government offices.

Each method may have different processing times, so it is wise to choose the option that best fits your needs.

Quick guide on how to complete senior property tax homestead exemption short form pueblo county pueblohealthdept

Easily Prepare Senior Property Tax Homestead Exemption Short Form Pueblo County Pueblohealthdept on Any Device

Digital document management has gained traction among businesses and individuals. It serves as a suitable environmentally-friendly substitute for traditional printed and signed paperwork, allowing users to access the right form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Handle Senior Property Tax Homestead Exemption Short Form Pueblo County Pueblohealthdept on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

Effortlessly Modify and eSign Senior Property Tax Homestead Exemption Short Form Pueblo County Pueblohealthdept

- Locate Senior Property Tax Homestead Exemption Short Form Pueblo County Pueblohealthdept and click on Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as an ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Senior Property Tax Homestead Exemption Short Form Pueblo County Pueblohealthdept while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the senior property tax homestead exemption short form pueblo county pueblohealthdept

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Senior Property Tax Homestead Exemption Short Form for Pueblo County?

The Senior Property Tax Homestead Exemption Short Form for Pueblo County is a simplified document designed for seniors to apply for property tax exemptions. This form helps eligible residents reduce their property tax burden, providing financial relief. For more details about the application process, visit the Pueblo County Pueblohealthdept website.

-

How can I obtain the Senior Property Tax Homestead Exemption Short Form for Pueblo County?

You can obtain the Senior Property Tax Homestead Exemption Short Form for Pueblo County online from the Pueblohealthdept website or visit their office in person. The form is readily accessible to ensure seniors can easily apply for exemptions they are entitled to. Ensure to have all required documentation ready for a smooth application process.

-

What are the eligibility requirements for the Senior Property Tax Homestead Exemption in Pueblo County?

To qualify for the Senior Property Tax Homestead Exemption in Pueblo County, applicants must be at least 65 years old and meet certain income and residency criteria. The exemption provides vital financial assistance to seniors, reducing the overall property tax burden. Consult the Pueblohealthdept resources for detailed eligibility information.

-

Are there any fees associated with the Senior Property Tax Homestead Exemption Short Form for Pueblo County?

There are typically no fees associated with filing the Senior Property Tax Homestead Exemption Short Form for Pueblo County. It is a free service designed to support seniors in managing their property taxes. Contact the Pueblohealthdept for any updates or potential charges related to additional assistance.

-

How long does it take to process the Senior Property Tax Homestead Exemption Short Form for Pueblo County?

Processing times for the Senior Property Tax Homestead Exemption Short Form for Pueblo County can vary, but typically, applicants should expect a response within a few weeks. Delays can occur during peak submission periods, so timely filing is encouraged. For specific updates, checking directly with the Pueblohealthdept can provide clarity.

-

What are the benefits of applying for the Senior Property Tax Homestead Exemption?

The key benefit of applying for the Senior Property Tax Homestead Exemption is the potential reduction in property taxes for eligible seniors. This exemption can lead to signNow savings, allowing seniors to allocate funds towards other essential needs. Additionally, it promotes financial stability among seniors living in Pueblo County.

-

Can the Senior Property Tax Homestead Exemption Short Form be submitted online?

Yes, residents can submit the Senior Property Tax Homestead Exemption Short Form online through the Pueblohealthdept's official website. This convenient option allows seniors to complete their applications without needing to visit an office. Ensure all required documents are scanned and uploaded for a complete submission.

Get more for Senior Property Tax Homestead Exemption Short Form Pueblo County Pueblohealthdept

- Identity theft after deathattorney general state of colorado form

- Types of identity theft and fraudcolorado bureau of form

- Control number co p086 pkg form

- Control number co p087 pkg form

- Legal forms thanks you for your purchase of a letters of recommendation

- Control number co p092 pkg form

- Control number co p093 pkg form

- Name of principal whose address is street address city form

Find out other Senior Property Tax Homestead Exemption Short Form Pueblo County Pueblohealthdept

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online