721av Form

What is the 721av

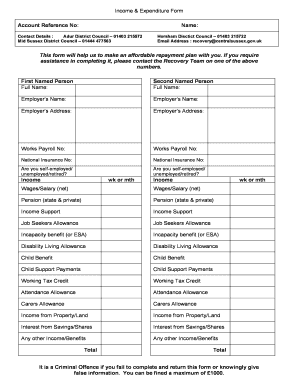

The 721av form is a specific document used primarily for reporting income and expenditures for various financial activities. This form is essential for individuals and businesses to accurately declare their financial status and ensure compliance with tax regulations. It is particularly relevant for those engaged in activities that require detailed financial reporting, such as self-employment or business operations.

How to use the 721av

Using the 721av form involves several straightforward steps. First, gather all necessary financial documents, including receipts, invoices, and bank statements. Next, accurately fill out the form, ensuring that all income and expenditure entries are clearly documented. It is important to double-check your entries for accuracy to avoid discrepancies. Once completed, the form can be submitted to the appropriate tax authority, either online or via traditional mail, depending on your preference and local regulations.

Steps to complete the 721av

Completing the 721av form requires attention to detail. Here are the main steps:

- Collect all relevant financial records, such as income statements and expense receipts.

- Fill in personal information, including your name, address, and Social Security number.

- Document all sources of income in the designated sections.

- List all expenditures, categorizing them appropriately for clarity.

- Review the entire form for accuracy and completeness before submission.

Legal use of the 721av

The legal use of the 721av form is governed by specific tax laws and regulations. It is crucial to ensure that the information provided is truthful and accurate to avoid legal repercussions. The form serves as an official document that may be reviewed by tax authorities, and any discrepancies could lead to penalties or audits. Therefore, it is advisable to consult with a tax professional if you have questions about compliance or the proper use of the form.

Filing Deadlines / Important Dates

Filing deadlines for the 721av form can vary based on individual circumstances and local regulations. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers in the United States. It is essential to stay informed about any changes to deadlines that may occur annually or due to special circumstances, such as extensions or changes in tax law.

Required Documents

To complete the 721av form accurately, several documents are required. These include:

- Income statements, such as W-2s or 1099s.

- Receipts for all business-related expenditures.

- Bank statements that reflect income and expenditure activities.

- Any additional documentation that supports claims made on the form.

Form Submission Methods (Online / Mail / In-Person)

The 721av form can be submitted through various methods, providing flexibility for users. Options include:

- Online submission through the tax authority's website, which may offer quicker processing times.

- Mailing the completed form to the appropriate tax office, ensuring it is postmarked by the filing deadline.

- In-person submission at designated tax offices, which may be beneficial for those who prefer direct interaction.

Quick guide on how to complete 721av

Prepare 721av effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle 721av on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign 721av seamlessly

- Obtain 721av and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign 721av and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 721av

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 721av and how can it benefit my business?

721av is a powerful eSignature solution designed to streamline document management for businesses. By using 721av, you can quickly send, sign, and manage documents online, reducing the need for paper and improving transaction speed.

-

How much does 721av cost?

721av offers competitive pricing plans that can fit any budget. You can choose from basic plans for small teams to advanced plans for larger enterprises, ensuring you get the best value for your business needs.

-

What features are included in 721av?

721av includes a range of features such as document templates, real-time tracking, and secure cloud storage. Additionally, it provides customizable workflows that enhance efficiency and compliance in document signing.

-

Can I integrate 721av with other software?

Yes, 721av easily integrates with a variety of third-party applications including CRM systems and cloud storage services. This flexibility allows you to streamline your workflows and enhance productivity.

-

Is 721av secure for my sensitive documents?

Absolutely. 721av prioritizes security, offering advanced encryption and compliance with industry regulations. Your documents are safe with us, providing peace of mind while you manage your electronic signatures.

-

How does 721av improve the signing process?

With 721av, the signing process is simplified and accelerated. Users can sign documents from anywhere on any device, which eliminates the delays associated with traditional paper-based methods.

-

What types of businesses can benefit from 721av?

721av is versatile and can benefit a wide range of industries including real estate, healthcare, and finance. Any business that requires document signing can leverage 721av to enhance operational efficiency.

Get more for 721av

- Affidavit and request to contest the validity of a foreign form

- The family court of the state of delaware delaware courts form

- Motion and affidavit for interim relief forms workflow

- Of a motion form

- Rev 218 form

- Rev 1118 form

- History family court delaware courts state of delaware form

- Special invoicing procedure form

Find out other 721av

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form