Annex B Bir Form

What is the Annex B Bir

The Annex B Bir is a specific form utilized in various administrative and legal contexts. It serves as a crucial document for compliance and reporting purposes. This form is often required by businesses and individuals to provide necessary information to regulatory bodies or for tax-related matters. Understanding the purpose and requirements of the Annex B Bir is essential for ensuring proper completion and submission.

How to use the Annex B Bir

Using the Annex B Bir involves several steps that ensure the form is completed accurately. First, gather all necessary information and documentation required for the form. This may include personal identification details, financial records, or other relevant data. Next, carefully fill out the form, ensuring that all fields are completed as instructed. Review the information for accuracy before submission to avoid delays or compliance issues.

Steps to complete the Annex B Bir

Completing the Annex B Bir involves a systematic approach:

- Review the instructions provided with the form to understand the requirements.

- Collect all necessary documentation and information needed for completion.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for any errors or omissions.

- Submit the form through the designated method, whether online or via mail.

Legal use of the Annex B Bir

The Annex B Bir must be used in accordance with applicable laws and regulations. This includes adhering to deadlines for submission and ensuring that all provided information is truthful and complete. Failure to comply with legal requirements can result in penalties or other consequences. It is advisable to consult legal or tax professionals if there are uncertainties regarding the form's use.

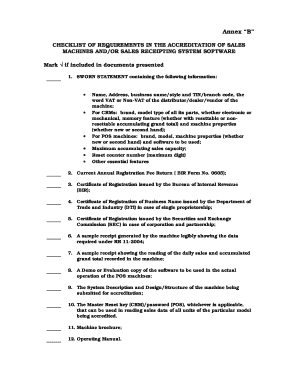

Key elements of the Annex B Bir

Key elements of the Annex B Bir include specific fields that must be filled out, such as identification information, financial details, and any relevant signatures. Each section of the form serves a distinct purpose, contributing to the overall integrity and legality of the document. Understanding these elements is crucial for accurate completion and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Annex B Bir vary depending on the context in which it is used. It is important to be aware of these dates to ensure timely submission. Missing a deadline can lead to penalties or complications in processing. Keeping a calendar of important dates related to the Annex B Bir can help individuals and businesses stay organized and compliant.

Quick guide on how to complete annex b bir

Prepare Annex B Bir easily on any device

Digital document management has surged in popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Annex B Bir on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Annex B Bir effortlessly

- Obtain Annex B Bir and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Annex B Bir to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annex b bir

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is annex b bir in the context of eSigning?

Annex b bir refers to a specific section of document management that outlines requirements for eSignatures. Understanding annex b bir is crucial for compliance when signing and sending documents electronically. airSlate SignNow ensures that your eSignature solutions align with these requirements.

-

How does airSlate SignNow support annex b bir compliance?

airSlate SignNow provides features that help ensure all eSignatures meet the standards outlined in annex b bir. Our platform is designed to guide users through secure signing processes that comply with legal requirements. This compliance ensures that your documents are valid and enforceable.

-

What are the pricing options for using airSlate SignNow with annex b bir support?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including provisions for annex b bir compliance. Each plan includes essential features for managing your document workflow effectively. You can choose a subscription that best fits your business needs and budget.

-

What features does airSlate SignNow offer for annex b bir forms?

Our platform provides various features for handling annex b bir forms, such as custom templates, automated workflows, and secure cloud storage. These tools streamline the signing process and ensure that your documents are compliant and easily accessible. You can also track document status in real-time.

-

Can airSlate SignNow integrate with other systems for annex b bir management?

Yes, airSlate SignNow is equipped with API capabilities that allow for seamless integration with your existing systems to manage annex b bir documentation. This flexibility ensures that your organization's workflow remains uninterrupted while incorporating compliant eSigning solutions. Integrations enhance efficiency and save time.

-

What benefits does airSlate SignNow provide when handling annex b bir eSignatures?

Using airSlate SignNow for annex b bir eSignatures offers numerous benefits, including enhanced security, improved document management, and accelerated turnaround times for signed documents. Our platform is user-friendly, making it easy for team members and clients to sign anything securely and efficiently. This leads to better business relationships and streamlined operations.

-

Is training available for using airSlate SignNow with annex b bir requirements?

Yes, airSlate SignNow offers comprehensive training resources to help you effectively navigate annex b bir requirements. We provide tutorials, webinars, and customer support to ensure you fully utilize our platform. This support empowers users to comply with annex b bir while maximizing the potential of our eSigning solutions.

Get more for Annex B Bir

- Family court custody forms family court delaware courts

- Net income available form

- Form 346

- Form 16cez

- Presenting a motion before the court requires the completion and form

- Recorder of deeds formssussex county

- Motion to modify extend or rescind order of protection from form

- Laws of the government of new castle kent and sussex form

Find out other Annex B Bir

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document