Reg 1 R Form

What is the Reg 1 R

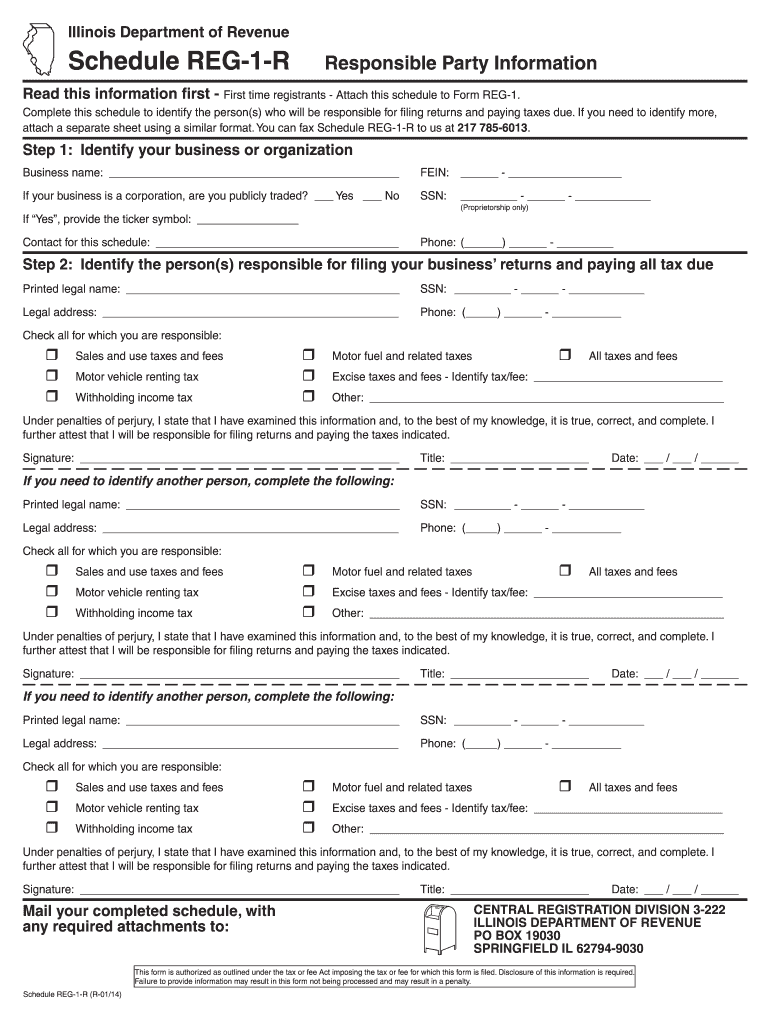

The Reg 1 R is a specific form utilized in the state of Illinois, primarily for tax purposes. It serves as a means for individuals and businesses to report certain financial information to the state government. This form is essential for ensuring compliance with state tax laws and regulations. Understanding its purpose and requirements is crucial for accurate filing and to avoid potential penalties.

Steps to complete the Reg 1 R

Completing the Reg 1 R involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with precise information, ensuring that all fields are completed as required. It is important to double-check the entries for any errors before submission. Once completed, the form can be submitted either online or by mail, depending on the preferences and requirements set by the state.

Legal use of the Reg 1 R

The Reg 1 R must be filled out in accordance with Illinois state laws to be considered legally valid. This includes adhering to guidelines regarding the information provided and ensuring that all signatures are appropriately executed. Utilizing a reliable electronic signature solution can enhance the legitimacy of the document, as it complies with the ESIGN and UETA acts, which govern the use of electronic signatures in the United States.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Reg 1 R to avoid penalties. Typically, the form must be submitted by a specific date each year, often coinciding with the general tax filing deadline. Keeping track of these dates and setting reminders can help ensure timely submission and compliance with state regulations.

Who Issues the Form

The Reg 1 R is issued by the Illinois Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring that individuals and businesses comply with tax laws. For any inquiries or clarifications regarding the form, contacting the Illinois Department of Revenue can provide the necessary guidance and support.

Required Documents

When completing the Reg 1 R, several documents may be required to substantiate the information provided. These typically include income statements, previous tax returns, and any relevant financial records. Having these documents readily available can facilitate a smoother completion process and ensure that all information is accurate and verifiable.

Penalties for Non-Compliance

Failing to properly complete and submit the Reg 1 R can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action from the state. Understanding the consequences of non-compliance highlights the importance of adhering to filing requirements and deadlines to avoid unnecessary complications.

Quick guide on how to complete reg 1 r

Complete Reg 1 R seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Reg 1 R on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Reg 1 R effortlessly

- Acquire Reg 1 R and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Reg 1 R and ensure excellent communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the reg 1 r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is reg 1 r and how does it benefit my business?

Reg 1 r is a crucial aspect of streamlined document processes that airSlate SignNow simplifies. It enhances the efficiency of eSigning and document management, ensuring that businesses can complete transactions quicker. By adopting reg 1 r with airSlate SignNow, you can signNowly reduce turnaround times and improve overall productivity.

-

How much does airSlate SignNow cost while using reg 1 r?

The pricing for airSlate SignNow is competitive and designed to offer value for businesses looking to implement reg 1 r. Various subscription plans cater to different needs, allowing companies to choose the best option based on their document volume and feature requirements. You can explore our pricing page for detailed information on affordable plans.

-

What features does airSlate SignNow offer for reg 1 r?

AirSlate SignNow provides robust features that support reg 1 r, such as customizable templates, in-document collaboration, and advanced security measures. These features help streamline the signing process while ensuring documents remain secure and compliant. The user-friendly interface makes it easy for businesses to adopt reg 1 r seamlessly.

-

Does airSlate SignNow support integrations involving reg 1 r?

Yes, airSlate SignNow offers various integrations that enhance the functionality of reg 1 r. It seamlessly connects with popular platforms like Salesforce, Google Drive, and Microsoft Office, allowing for a cohesive workflow across different applications. Such integrations help companies to maintain efficiency while implementing reg 1 r in their processes.

-

How does airSlate SignNow ensure compliance with reg 1 r?

AirSlate SignNow prioritizes compliance with reg 1 r by adhering to industry standards and legal requirements. The platform includes features like audit trails, secure storage, and encryption to protect sensitive data. This ensures that businesses can confidently use airSlate SignNow for their electronic signing needs without compromising on compliance.

-

Can I customize documents for reg 1 r in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize documents specifically for reg 1 r. With easy-to-use editing tools, you can tailor your documents to meet your business needs, ensuring they align with compliance requirements. Customization enhances the effectiveness of your document management process while using reg 1 r.

-

What support does airSlate SignNow provide for users of reg 1 r?

AirSlate SignNow offers comprehensive support for users implementing reg 1 r. This includes a detailed help center, live chat, and email support to assist with any questions or challenges. Whether you're a new user or looking to maximize the benefits of reg 1 r, our support team is dedicated to your success.

Get more for Reg 1 R

- Permit to acquire form

- Medicare entitlement statement how to get one services billing services rendered prior to and after medicare part timely filing form

- Medical entitlement statement form

- Wwwpcgovpkuploadsarchivesannexure 7 planning commission guidelines on calculating form

- Pd268 form

- Pest control checklist excel format

- Aftercare registration form

- Canada application plan benefit form

Find out other Reg 1 R

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later