Becu Dispute Charge Form

What is the Becu Dispute Charge

The Becu dispute charge refers to the process a cardholder follows when contesting a transaction on their BECU credit card statement. This charge can arise from various situations, such as unauthorized transactions, billing errors, or dissatisfaction with a purchased product or service. Understanding this process is crucial for cardholders to ensure their rights are protected and to facilitate a smooth resolution.

Steps to Complete the Becu Dispute Charge

Completing the Becu dispute charge involves several key steps to ensure that your claim is properly submitted and addressed. Here are the essential steps:

- Review your statement to identify the charge in question.

- Gather any supporting documentation, such as receipts or correspondence related to the transaction.

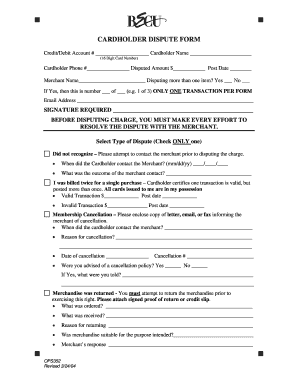

- Complete the BECU Mastercard dispute form, providing all required details, including your account information and the nature of the dispute.

- Submit the completed form through your preferred method: online, by mail, or in person at a BECU branch.

- Monitor your account and email for updates regarding your dispute.

Legal Use of the Becu Dispute Charge

The Becu dispute charge is legally recognized under consumer protection laws, which allow cardholders to dispute unauthorized or erroneous charges. When filing a dispute, it is important to adhere to the guidelines set forth by the Fair Credit Billing Act (FCBA), which provides consumers with the right to dispute charges and outlines the responsibilities of creditors in resolving such disputes.

Required Documents

When filing a Becu dispute charge, certain documents are necessary to support your claim. These may include:

- A completed BECU Mastercard dispute form.

- Copies of any relevant receipts or invoices.

- Correspondence with the merchant, if applicable.

- Your account statement highlighting the disputed charge.

Form Submission Methods

Cardholders have multiple options for submitting their Becu dispute charge. The available methods include:

- Online submission through the BECU website or mobile app.

- Mailing the completed dispute form to the designated BECU address.

- Visiting a local BECU branch to submit the form in person.

Key Elements of the Becu Dispute Charge

Understanding the key elements of the Becu dispute charge is essential for a successful resolution. Important components include:

- The specific details of the transaction being disputed.

- The reason for the dispute, such as fraud or dissatisfaction.

- Timely submission of the dispute, adhering to any deadlines.

- Accurate and complete documentation to support your claim.

Quick guide on how to complete becu dispute charge

Complete Becu Dispute Charge effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the appropriate form and safely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly and seamlessly. Manage Becu Dispute Charge on any device with the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

The easiest way to edit and eSign Becu Dispute Charge without any hassle

- Obtain Becu Dispute Charge and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and eSign Becu Dispute Charge and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the becu dispute charge

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a BECU dispute charge and how can airSlate SignNow help?

A BECU dispute charge refers to the process of disputing unauthorized or incorrect charges made through your BECU account. airSlate SignNow simplifies this process by allowing you to create, sign, and send documents quickly. With its user-friendly interface, you can easily prepare the required forms to initiate your dispute efficiently.

-

Are there any costs associated with using airSlate SignNow for BECU dispute charges?

Using airSlate SignNow has a variety of pricing plans tailored to different needs, including features specifically designed to handle disputes like the BECU dispute charge. There are free trials available, along with flexible subscription options, making it a cost-effective solution for managing your signature and document needs efficiently.

-

What features does airSlate SignNow offer to facilitate the BECU dispute charge process?

airSlate SignNow provides features like document templates, eSigning, and sharing capabilities that streamline the BECU dispute charge process. You can easily upload your dispute documents, track their status, and send reminders to prompt timely responses. This makes managing disputes more organized and hassle-free.

-

How secure is airSlate SignNow when handling sensitive information for BECU dispute charges?

airSlate SignNow prioritizes security, ensuring that all documents related to your BECU dispute charge are encrypted and stored securely. The platform complies with industry standards to protect your sensitive information. You can feel safe knowing your data is protected during the entire dispute process.

-

Can I integrate airSlate SignNow with other applications to manage BECU dispute charges?

Yes, airSlate SignNow offers various integrations with popular tools like Google Drive, Dropbox, and Microsoft Office. This makes managing your BECU dispute charge process even easier, as you can automate workflows and ensure seamless document sharing across different platforms.

-

How can I track the status of my BECU dispute charge documents in airSlate SignNow?

Tracking your BECU dispute charge documents is straightforward with airSlate SignNow. The platform provides real-time notifications and allows you to see when your documents are opened, signed, or completed. This feature keeps you informed throughout the entire dispute process.

-

Is there customer support available if I encounter issues with my BECU dispute charge?

Absolutely! airSlate SignNow offers robust customer support to assist you in resolving any issues related to your BECU dispute charge. You can signNow out through various channels, including email and live chat, ensuring you receive the help you need promptly.

Get more for Becu Dispute Charge

- Ms renewal medical license form

- Physical rehabilitation clinic in baltimorerehab at work form

- Application for registration as a horticulture export treatment facility form

- Assistance animal verification form

- Management of change checklist form

- Triple column technique pdf form

- Rim nordic ski area form

- Usa cycling competitive and non competitive event release form

Find out other Becu Dispute Charge

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online