8862 Form

What is the 8862 Form

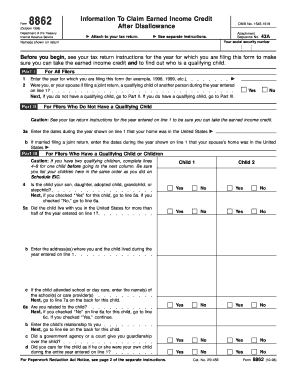

The 8862 form, officially known as the "Information to Claim Certain Credits After Disallowance," is a tax form used by individuals in the United States who wish to claim certain tax credits after previously being denied. This form is primarily associated with the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). If you have had your eligibility for these credits disallowed in prior years, you must complete and submit the 8862 form to demonstrate that you now meet the necessary requirements to claim these credits again.

How to use the 8862 Form

Using the 8862 form involves several steps to ensure that you accurately report your eligibility for tax credits. First, gather all relevant documentation that supports your claim, such as income statements and proof of dependents. Next, fill out the form by providing your personal information, including your Social Security number and details about your dependents. It is essential to answer all questions truthfully and completely, as inaccuracies can lead to further disallowance or penalties. After completing the form, review it carefully for errors before submitting it with your tax return.

Steps to complete the 8862 Form

Completing the 8862 form requires careful attention to detail. Follow these steps for accurate submission:

- Obtain the latest version of the 8862 form from the IRS website or through tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide information about your dependents, including their names and Social Security numbers.

- Answer questions regarding your eligibility for the credits you are claiming.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the 8862 Form

The 8862 form must be used in compliance with IRS regulations. It serves as a legal declaration of your eligibility to claim certain tax credits. When submitting the form, ensure that all information is accurate and complete, as providing false information can lead to penalties, including fines or disallowance of credits. Additionally, the form must be submitted with your tax return for the year you intend to claim the credits.

Eligibility Criteria

To be eligible to use the 8862 form, you must have previously been disallowed from claiming certain credits, such as the EITC or CTC. You must also demonstrate that your situation has changed since the disallowance. This may include changes in income, filing status, or the number of dependents. It is crucial to review the specific eligibility criteria outlined by the IRS to ensure that you qualify before submitting the form.

Form Submission Methods (Online / Mail / In-Person)

The 8862 form can be submitted in several ways, depending on how you file your tax return. If you are using tax preparation software, you can typically submit the form electronically along with your return. If you choose to file by mail, include the completed 8862 form with your tax return documents. In-person submissions are generally not accepted for this form, as it is primarily processed through electronic or mail channels.

Quick guide on how to complete 8862 form

Complete 8862 Form effortlessly on any device

Digital document handling has become favored among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right template and securely store it online. airSlate SignNow provides all the resources you need to create, alter, and electronically sign your documents swiftly without delays. Manage 8862 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to alter and electronically sign 8862 Form with ease

- Locate 8862 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from your selected device. Alter and electronically sign 8862 Form to guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8862 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8862?

Form 8862 is the IRS form used to claim the Earned Income Tax Credit (EITC) after your EITC was disallowed in a prior year. Knowing what is Form 8862 is essential for taxpayers who wish to reclaim this important credit. It must be filed with your tax return, and you'll need to provide adequate information proving your eligibility.

-

Who needs to submit Form 8862?

Taxpayers who have previously been denied the Earned Income Tax Credit must submit Form 8862. It's crucial for anyone looking to reclaim their EITC after their claim was disallowed. Understanding who needs to submit this form is vital to ensure you meet the IRS requirements.

-

What information is required on Form 8862?

Form 8862 requires your personal information, tax filing status, and details about your qualifying children. Understanding what information is needed on Form 8862 helps streamline the process and reduces the chances of errors. Make sure all data is accurate to avoid delays in processing your return.

-

How does Form 8862 affect my tax refund?

Filing Form 8862 can potentially lead to a larger tax refund if you qualify for the Earned Income Tax Credit. Understanding how Form 8862 affects your refund ensures you are aware of financial benefits you may be eligible for. Properly completing this form can maximize your refund during tax season.

-

Is there a deadline for filing Form 8862?

Form 8862 must be filed along with your tax return by the regular tax filing deadline, which is typically April 15. It's important to know the deadline for filing Form 8862 to avoid penalties. Missing the deadline could result in a loss of credits or a reduced refund.

-

Can I eFile Form 8862 with my tax return?

Yes, you can eFile Form 8862 as part of your tax return using most tax software. Knowing that you can eFile Form 8862 simplifies the submission process, making it quicker and more efficient. Make sure to follow the specific instructions from your eFile provider for accurate submission.

-

What happens if I don’t file Form 8862 when required?

If you are required to file Form 8862 and do not, you may lose your eligibility for the Earned Income Tax Credit. It's crucial to understand the consequences of not filing Form 8862 when necessary, as this can result in lower tax refunds or penalties. Staying compliant with IRS regulations is important for all taxpayers.

Get more for 8862 Form

- And two individuals whose form

- La rev stat94811 rs 94811notice of a contract with form

- Allergies if known form

- And hereinafter referred to form

- Address is hereinafter referred to as vendors do hereby grant bargain sell form

- Louisiana contract completion form fill online printable fillable

- Louisiana 2nd circuit demotes importance of lessors notice form

- Property herein conveyed together with all rights of prescription whether acquisitive or liberative to form

Find out other 8862 Form

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple