Wage Tax Refund Petition Form

What is the Wage Tax Refund Petition Form

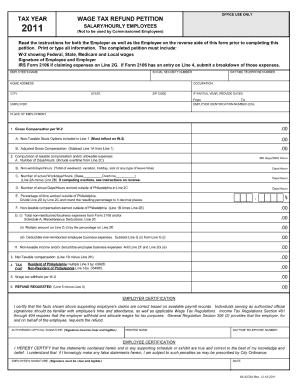

The Wage Tax Refund Petition Form is a document that allows taxpayers to request a refund of wage taxes that may have been overpaid. This form is essential for individuals who believe they have paid more in wage taxes than they owe, whether due to withholding errors or changes in their employment status. It is typically used by employees who have had wages withheld for local or state taxes and need to reclaim those funds. Understanding this form is crucial for ensuring that taxpayers can accurately address their tax situations and recover any overpaid amounts.

How to use the Wage Tax Refund Petition Form

Using the Wage Tax Refund Petition Form involves several key steps. First, gather all necessary documentation, including your W-2 forms and any relevant pay stubs that detail the taxes withheld. Next, accurately fill out the form with your personal information, including your name, address, and Social Security number. Ensure that you specify the amount you believe you are owed and provide a clear explanation for your refund request. After completing the form, review it carefully for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Wage Tax Refund Petition Form

Completing the Wage Tax Refund Petition Form requires careful attention to detail. Follow these steps:

- Collect all relevant tax documents, including W-2s and pay stubs.

- Provide your personal information, including your full name, address, and Social Security number.

- Indicate the amount of wage tax you are claiming as a refund.

- Include a brief explanation of why you are requesting the refund.

- Review the completed form for accuracy and completeness.

- Submit the form according to the instructions provided, either online or via mail.

Required Documents

To successfully file the Wage Tax Refund Petition Form, certain documents are typically required. These include:

- Your W-2 forms from the relevant tax year, which detail your earnings and tax withholdings.

- Any pay stubs that show the amount of wage tax withheld.

- Proof of residency, if applicable, to support your claim for a refund based on local tax regulations.

- Any previous correspondence with tax authorities regarding your wage tax withholdings.

Form Submission Methods

The Wage Tax Refund Petition Form can be submitted through various methods, depending on the requirements of your local tax authority. Common submission methods include:

- Online submission through the tax authority's official website, if available.

- Mailing a hard copy of the completed form to the designated tax office.

- In-person submission at local tax offices, where you can receive immediate assistance.

Legal use of the Wage Tax Refund Petition Form

The Wage Tax Refund Petition Form must be used in compliance with local and federal tax laws. It is important to ensure that the information provided is accurate and truthful, as submitting false information can lead to penalties. Taxpayers should be aware of the specific regulations governing wage tax refunds in their state or locality, as these can vary significantly. Proper use of this form helps protect taxpayer rights and ensures that any claims for refunds are processed legally and efficiently.

Quick guide on how to complete wage tax refund petition form

Prepare Wage Tax Refund Petition Form effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers a viable eco-friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Manage Wage Tax Refund Petition Form across any platform with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to modify and eSign Wage Tax Refund Petition Form without hassle

- Locate Wage Tax Refund Petition Form and hit Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark signNow parts of the documents or obscure confidential information using tools that airSlate SignNow specifically provides for that purpose.

- Craft your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your PC.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Wage Tax Refund Petition Form and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage tax refund petition form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Wage Tax Refund Petition Form?

A Wage Tax Refund Petition Form is a document used to request a refund on wage taxes that were improperly withheld. By utilizing this form, individuals can ensure they're reclaiming any excess funds that may be owed to them. Completing this form accurately is essential for a smooth refund process.

-

How can airSlate SignNow help with the Wage Tax Refund Petition Form?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Wage Tax Refund Petition Form. Our solution streamlines the process, allowing you to fill out your form correctly and securely send it to the necessary authorities. This helps prevent processing delays and ensures that your refund is received promptly.

-

Is there a cost associated with using the Wage Tax Refund Petition Form on airSlate SignNow?

While airSlate SignNow offers a variety of pricing plans, there’s generally a cost for utilizing advanced features when submitting the Wage Tax Refund Petition Form. However, our platform is designed to be cost-effective, ensuring that businesses and individuals can access essential services without breaking the bank. Check our pricing page for temporary offers and more details.

-

What are the key features of using airSlate SignNow for the Wage Tax Refund Petition Form?

Key features include eSignature capabilities, document templates, and cloud storage for completed forms. With airSlate SignNow, you can also track the status of your Wage Tax Refund Petition Form, ensuring that you are always updated on its progress. Additionally, we offer notification alerts for when your documents are signed or viewed.

-

Are there integrations available for managing the Wage Tax Refund Petition Form?

Yes, airSlate SignNow offers seamless integrations with various applications including CRM systems, cloud storage services, and accounting software. This means you can easily incorporate the Wage Tax Refund Petition Form into your existing workflow. By linking tools you already use, you can simplify the process of managing your documents.

-

What benefits does signing the Wage Tax Refund Petition Form digitally offer?

Signing the Wage Tax Refund Petition Form digitally with airSlate SignNow enhances convenience and security, eliminating the need for physical paperwork. Digital signatures are legally binding and provide a faster way to process your refund requests. This method also reduces the likelihood of errors, ensuring a smoother submission process.

-

How secure is my information when using the Wage Tax Refund Petition Form on airSlate SignNow?

Security is a top priority for airSlate SignNow. When you submit your Wage Tax Refund Petition Form, your information is encrypted and securely stored, protecting it from unauthorized access. We adhere to strict compliance standards, ensuring that your sensitive data remains confidential throughout the process.

Get more for Wage Tax Refund Petition Form

- Printable grooming forms

- Fd foc4033 a motion to transfer your case to another michigan 3rdcc form

- General change endorsement federal emergency management fema form

- Declaration of section 214 status www1 honolulu form

- Honorarium letter for pastor form

- Dwc12 form

- Blue card fire scene size up cheat sheet form

- Waiver of subrogation form

Find out other Wage Tax Refund Petition Form

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online