Pa 3 Form PDF

What is the Pa 3 Form PDF

The Pa 3 form, also known as the Pennsylvania Sales Tax Return Form, is a crucial document used by businesses in Pennsylvania to report and remit sales tax collected during a specific period. This form is essential for ensuring compliance with state tax regulations. The Pa 3 form PDF version allows for easy digital access and completion, making it convenient for users to fill out and submit their information electronically.

How to Use the Pa 3 Form PDF

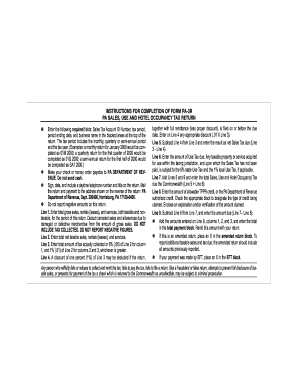

Using the Pa 3 form PDF involves several steps. First, download the form from an official source. Once you have the PDF, open it using a compatible PDF reader. Fill in the required fields, which typically include your business information, sales figures, and the amount of sales tax collected. After completing the form, review it for accuracy to ensure all information is correct before submission.

Steps to Complete the Pa 3 Form PDF

Completing the Pa 3 form PDF requires careful attention to detail. Here are the steps to follow:

- Download the Pa 3 form PDF from a reliable source.

- Open the PDF in a PDF reader that supports form filling.

- Enter your business name, address, and tax identification number.

- Report total sales and the sales tax collected for the reporting period.

- Double-check all entries for accuracy.

- Save the completed form on your device.

Legal Use of the Pa 3 Form PDF

The Pa 3 form PDF is legally binding when completed and submitted according to Pennsylvania state regulations. It must be signed and dated by an authorized individual within the business. Compliance with state tax laws is crucial, as improper filing can lead to penalties or audits. Utilizing a reliable e-signature solution can enhance the legal validity of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Pa 3 form are typically quarterly, with specific due dates depending on the reporting period. Businesses should be aware of these dates to avoid late penalties. It is advisable to check the Pennsylvania Department of Revenue's website for the most current deadlines and any changes that may occur in the filing schedule.

Form Submission Methods (Online / Mail / In-Person)

The Pa 3 form can be submitted through various methods to accommodate different business needs. Options include:

- Online submission through the Pennsylvania Department of Revenue's e-filing system.

- Mailing a printed copy of the completed form to the designated address.

- In-person submission at local revenue offices, if required.

Penalties for Non-Compliance

Failure to file the Pa 3 form by the deadline can result in penalties, including fines and interest on unpaid taxes. Businesses may also face audits if they consistently fail to comply with filing requirements. It is essential to stay informed about compliance obligations to avoid these potential consequences.

Quick guide on how to complete pa 3 form pdf

Effortlessly prepare Pa 3 Form Pdf on any device

Digital document management has become increasingly popular among organizations and individuals. It presents an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Manage Pa 3 Form Pdf on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and eSign Pa 3 Form Pdf with minimal effort

- Find Pa 3 Form Pdf and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify the information and then click on the Done button to finalize your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Pa 3 Form Pdf to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 3 form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PA 3 form?

The PA 3 form is a document used for various business and legal purposes. It is essential for properly managing contracts and agreements. Understanding how to correctly fill out and utilize the PA 3 form can enhance your document workflow.

-

How does airSlate SignNow facilitate signing a PA 3 form?

airSlate SignNow provides a user-friendly platform for electronically signing and sending your PA 3 form. With its intuitive interface, you can quickly prepare, sign, and share forms without the hassle of paperwork. This simplifies the entire signing process for both you and your recipients.

-

What are the pricing options for using airSlate SignNow with a PA 3 form?

airSlate SignNow offers various pricing plans to fit different business needs, including options for individuals and teams. Each plan provides access to essential features for handling documents like the PA 3 form. Choosing the right plan can enhance your document management efficiency.

-

Can I integrate airSlate SignNow with other applications while using a PA 3 form?

Yes, airSlate SignNow supports integration with numerous applications, making it easy to streamline your workflow when handling a PA 3 form. You can connect it to popular tools like Google Drive, Dropbox, and more. This functionality helps centralize your document management process.

-

What are the benefits of using airSlate SignNow for PA 3 form management?

Using airSlate SignNow for your PA 3 form provides several benefits, including increased efficiency and reduced turnaround times. The electronic signing feature allows for immediate responses, minimizing delays. Additionally, the platform offers secure storage options for your documents.

-

Is it secure to sign a PA 3 form electronically with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to ensure that your PA 3 form and other documents are securely stored and signed. You can confidently send and receive sensitive information without sacrificing security.

-

How can I get started with airSlate SignNow for my PA 3 form?

Getting started with airSlate SignNow is easy. Simply sign up for an account, explore the features, and begin uploading your PA 3 form for electronic signatures. The platform provides guided assistance to help you through the initial setup.

Get more for Pa 3 Form Pdf

- Worley brown llc v the mississippi department of form

- Defendants responses and objections to plaintiffs form

- How to make good objections to written discovery form

- Motion for additional time to respond form

- Defendants reponses and objections to plaintiffs first set form

- Agreement of settlement settlement agreement free search form

- Notice of servicefree legal forms

- From the plaintiffs cause of action without form

Find out other Pa 3 Form Pdf

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation